BuckToothMoron

Gold Member

- Apr 3, 2016

- 9,895

- 1,898

- 290

A con tool response. How surprising, coming from a con tool.

To rational people, we simply need to change the laws to be sure they do pay.

Why should they pay US taxes on foreign profits? Do you have a rational reason?

If they want to do business here, and sell in this country, they need to pay their fair share.

Some, but not what they should pay. Not the percentage I pay, and others pay. Thing is, cons like you will believe, say, and do whatever the bat shit crazy con web sites, fox, and the talking points tell you to. The rest of us do not like to be told what to believe, say and do. Progressives and liberals actually demand that they think for themselves. So, you are doing a great job of carrying the con flag. How it will work out, we shall see. Perhaps, like you, we will all be owned completely by the conservative. bosses for whom you carry water.

Some, but not what they should pay.

US companies pay US taxes on US profits.

A con tool response. How surprising, coming from a con tool.

So, did you think that the money made by transfers and operations moved overseas are not US profits?

Not the percentage I pay, and others pay.

No kidding. They pay a higher percentage than you do.

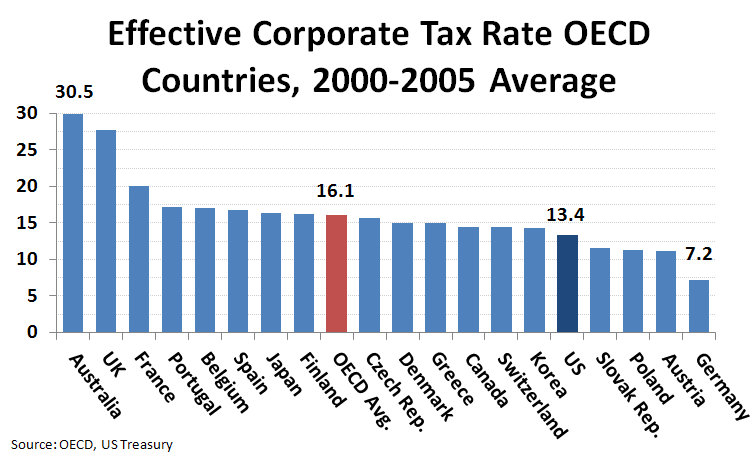

They pay a lower percentage than I. A number paid None. The average for corporations was around 12%.

They pay a lower percentage than I.

What percentage do you pay?

Really, me boy, you did not really think I would tell you with no conditions. I would if you want to publish your taxes. Because as a con tool, I could not believe what you sy. Cons lie typically. OK? You publish, then I publish.

The average for corporations was around 12%.

Sounds like liberal math. IE wrong

A con tool response. How surprising, coming from a con tool.

But I did forget to include the word profitable.

What rate did you think profitable us companies paid, me boy?

Oh, and I know that you are just a con, and cons are often ignorant, but producing a tax rate is not Math, me boy. Just trying to help educate you.

Please,provide your source/link which shows corporations pay an average of 12%. And while you are at it, ask yourself why would so many companies perform inversions out of the US if the corporate tax rates were so favorable here. Doesn't really make sense. Here is reality-

- The United States has the third highest general top marginal corporate income tax rate in the world at 39 percent, which is the same as Puerto Rico and is exceeded only by Chad and the United Arab Emirates.

- The worldwide average top corporate income tax rate (accounting for 173 countries and tax jurisdictions) is 22.9 percent, 29.8 percent weighted by GDP.

- By region, Europe has the lowest average corporate tax rate at 18.7 percent (26.1 percent weighted by GDP). Africa has the highest simple average at 28.77 percent.

- Larger, more industrialized countries tend to have higher corporate income tax rates than developing countries.

- The worldwide average corporate tax rate has declined since 2003 from 30 percent to 22.9 percent.

- Every region in the world has seen a decline in its average corporate tax rate in the past twelve years.

- Corporate Income Tax Rates around the World, 2015