Faun

Diamond Member

- Nov 14, 2011

- 124,353

- 80,987

- 2,635

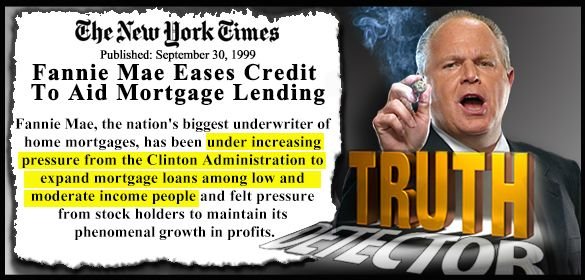

There was also S. 1508, H.R.2575 and S. 1656.If you are talking about HR 1461 or S 190 (I noticed you didn't cite the bill number and neither did your source) both bills were blocked by in committee the GOP who controlled ALL committees, so you are just covering your first lie with another lie, so typical of the lying scum Right.Oct 6, 2008 · That bill, which the Democrats stopped from passing, would have prohibited the GSEs from speculating on the mortgage-based securities they

In 2005 Oxley tried again and this time got a reform bill through the House. Democrats unanimously supported HR 1461 in the Financial Services Committee. A majority of Democrats supported it on the floor, though Congressman Frank and others voted against it because of unrelated restrictions it placed on the Affordable Housing Trust Fund. The bill passed the House, but the Bush administration and Senate Republicans opposed the Oxley bill. Senate Democrats offered the House‐passed Oxley bill in that chamber, but Senate Republicans, who held the majority, lacked the votes to pass the bill. They took no action on any bill.

On September 14, 2006, members of the House Financial Services Committee who had supported GSE reform, including Congressman Frank, sent a letter to then‐Senate Banking Committee Chairman

Richard Shelby urging the Senate to work with them to get a pill passed into law. The letter stated:

Accounting violations by the GSEs have brought to light the fact that current GSE regulators lack

many of the supervisory and enforcement powers bank regulators can wield. We must remedy

this situation by consolidating GSE regulation and providing the tools needed to oversee these

large, complex financial institutions. Both H.R. 1461 and S. 190 create a strong independent

agency to ensure the GSEs operate in a safe and sound manner and comply with their statutory

missions.

However, as Oxley told the Financial Times in September 2008, the White House gave House

Republicans “the one‐finger salute.”

Statement of Administration Policy: H.R. 1461 - Federal Housing Finance Reform Act of 2005 | The American Presidency Project

H.R. 1461 fails to include key elements that are essential to protect the safety and soundness of the housing finance system and the broader financial system at large. As a result, the Administration opposes the bill.

Democrats didn't block a single one of those bills ... they didn't have to -- Republican leadership in the Senate blocked every one of them.