Faun

Diamond Member

- Nov 14, 2011

- 124,353

- 80,987

- 2,635

He wasn’t?? He was the only president on record besides Herbert Hoover of Great Depression infamy to leave office with fewer private sector jobs than when he started.Wrong

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

He wasn’t?? He was the only president on record besides Herbert Hoover of Great Depression infamy to leave office with fewer private sector jobs than when he started.Wrong

LOLOL"George W. Bush was governor of Texas. George W. Bush had nothing to do with any of this."RUSH: I'm gonna tell you something else here, folks. I think on this whole, whatever you call it -- the Great Recession, the housing crisis, and Trump (throw Trump in there)... I have a suspicion that a bunch of Democrats are gonna be hearing things for the first time, and they're not going to know how to deal with it. Such is the safety of the cocoon that has been built by them, for them. I can't think of an example off the top of my head, but there are numerous ones that we pointed out just in recent months.

We'd be watching a cable news show, and some subject like the housing crisis will come up -- or something where it's automatically assumed it's George W. Bush's fault -- that the left and the media have successfully woven deep tentacles of deceit throughout, so that everybody thinks... Including Democrats, everybody thinks that whatever it is we're talking about is directly attributable to Bush, and all of a sudden somebody comes on saying, "No, no, no, no, no! That's Bill Clinton."

They starting pointing out that that's Bill Clinton, and you can see these Democrats. The physical looks on their faces and their instinct is, "That's crazy!" But they don't quite know what to do with it because they've never heard that version of the story. It happens to CNN anchors all the time. It happens to a lot of Drive-By news agencies. Like Chris Cuomo will hear a version of the story that's just gobbledygook to him; he doesn't get it. I think this housing bubble thing, the subprime mortgage crisis is a classic. Now, I'll explain what I mean here in just a second.

But first, Elizabeth Warren and Hillary Clinton are out there ripping Trump because he admits that he wants the market to go low so he can buy in and turn a profit as the market rebounds, 'cause who doesn't? They're trying to portray Trump as a heartless, mean guy that doesn't care about people's suffering and doesn't care about people hurting. The problem with that is... You know, this is a classic. They make this allegation because it's the same allegation they make about every Republican or every conservative: Heartless, cold, mean-spirited.

They don't even wait for a Republican to open his mouth. They just level the charge. Because nobody ever calls them on it. So they're doing it now. They're gonna get a sound bite from Trump in 2006 where he's waiting for the bubble to crash, then profit from it, and they say, "A-ha! A-ha! See? He's mean-spirited, cold-hearted, cruel, doesn't care about suffering." And they launch with the attack. What they fail to do is listen to what Trump is saying on the campaign trail, and I will guarantee you that everybody supporting Donald Trump is convinced he cares about them.

Everybody supporting Donald Trump is convinced he's looking out for 'em. Everybody supporting Donald Trump is convinced that, finally, their concerns are going to be addressed and dealt with. That's why Trump has the support that he does. But here comes Hillary Clinton and here comes Elizabeth Warren and whoever else they throw out there making the generic charge that Trump -- because he's a Republican and a businessman -- has no heart, has no soul, has no compassion.

But it isn't going to work because the exact reason Trump has support is because the people supporting him think that he has all of that and more, because they think he's looking out for 'em, that finally there is somebody representing their interests, when they don't think they've had anybody representing their interests in years. So the charge that the Democrats usually get away with making is going to backfire. Again, it boils down to, they are not used to a Republican firing back at them and doing two things: Defending himself and then obliterating them in the process.

They're used to getting away with the charge. The charge becomes proof. The charge becomes fact. Allegations that Romney, George W. Bush did something? They sit there and take it and move on. Every other Republican, there's no response to it. Trump hears it, fires back -- and in the process, insults them. So the third reply is what they're up to, and they've never been there. They're never had to get into this with the third reply. Some of the folks have like Lanny Davis, but Hillary hasn't. So they end up befuddled and all they've got are these playbook, textbook allegations.

"Republicans = racist, sexist, bigot, homophobe! Republicans = cold-hearted, mean-spirited, cruel, heartless!" Whatever. They say it about every Republican without concern for whether it's true or not. They never listen to what Republicans say. In Trump, they've got somebody who has support precisely because he is all of that. So here's Elizabeth Warren, and she's out there ripping into Trump -- along with Hillary -- for the usual reasons. And if the candidate were any of the other Republicans in the field, except maybe for Cruz (water under the bridge now), she could be confident that all of the hypocrisy that she's engaged in in her life will never be mentioned.

And if it is, the media won't give it any attention and therefore nobody hears it. So Hillary, Elizabeth Warren, every liberal Democrat under the sun is used to getting away with defamatory allegations. But with Trump, it's gonna be reacted to. Elizabeth Warren is a huge hypocrite when it comes to the housing bubble and the subprime mortgage crisis. This is a story from 2012, June the 2nd: "When she's not looking out for the little guy being taken advantage of by predatory lenders, Elizabeth Warren is making high-interest, short-term loans to family members and flipping homes for a profit.

"That's the revelation in a story published today by the Boston Herald, which identifies nine instances when Warren made a quick profit either buying and reselling homes or loaning money to family members to flip homes in the late '90s. For instance, in 1993 [Pocahontas] purchased a foreclosed home in Oklahoma City for $61,000. She resold the home 18 months later for $95,000. In several more cases, [Pocahontas] provided loans so that her brother could buy homes and flip them. In 2000, she reportedly gave her brother a loan with 9.5% interest so he could buy a home for $35,000. He sold the home three months later for a 10% profit.

"Flipping homes was a profitable investment for the Warren family, which made as much as 383% on a five-month transaction. The average gain [in the Warren home-flipper family] seems to have been closer to 40%. There was nothing illegal about the practice, but it was singled out by progressives connected to the Obama administration as one of the irresponsible practices that led directly to the financial crisis," and therein lies the route to my next point. Here you have Elizabeth Warren engaging in the home flipping by buying low, selling high, taking advantage of it.

The same thing they're accusing Donald Trump of being a bad guy for doing, she did it.

It will be thrown back in her face if she keeps this up. Trump will do it himself. And he won't wait for an event; he'll do a Twitter thing on it. We'll have a whole Twitter thread about it at some point. And then we find out that Obama was out ridiculing this kind of behavior as filthy profiteering and as one of the things that led to the housing crisis, the financial crisis. And, no, it's not. What led to the housing crisis is Bill Clinton and people like Barney Frank and the attorney general at the time, Janet Reno, who were demanding that banks lend money to people that had no hope of ever paying it back.

The Democrats were trying to capitalize on "a home for every American."

I think that was even the phrase: "A home for every American," like "affordable health care for all Americans." As Nancy Pelosi said, "A home has always been the symbol of the American dream." And, of course, not everybody can afford a home. Well, that's just not right, and that's just not gonna stand. So how are we gonna do it? Well, people who can't afford loans, we're gonna give them loans, and we're gonna find other ways for people to pay that money back. But we're gonna have people in homes, and we Democrats are gonna get the credit for every American that wants one being in a home, 'cause we care, 'cause we're compassionate. Because we don't like concept of winners and losers! We don't think it's right some people have big homes; others have small homes.

We don't think it's right some people have homes and others don't.

And don't forget in Half-Baked Moon Bay, California, they tried to suspend homework on the premise that not everybody had a home. It wasn't fair to assign homework because some kids don't have homes and therefore they can't do work at home so it's not fair.

Jimmy Carter actually concocted the original scheme and then it went dormant for awhile. Clinton revived it, much as Obama and Eric Holder revived Fast and Furious, which, by the way, is coming back. There have been some documents apparently hidden that are coming back to life on Fast and Furious. That's resurfacing. But more on that later.

Well, your average Democrat has never heard this version of the story. Your average Democrat thinks that the subprime mortgage crisis is owed to one thing: evil, greedy bankers. This is what your average Democrat, including elected Democrats, believe. They believe that on their own, bankers, because they're reprobates and scum, and forever wanting to profiteer on the backs of the poor and the insolvent, they found a way to trick people into taking out mortgages.

They honestly believe this, folks. This is what they're on television saying throughout this crisis. The banks tricked people. Obama even has said it. That the banks tricked people, unsuspecting low income, who only wanted to live the American dream. They just wanted a home. The banks lent them money, and they knew they'd never be able to pay it back.

And why did the banks do this? Because the banks wanted the homes. The banks couldn't wait to foreclose on these poor people and take the property away and call it their own without having to actually invest in it in the first place. And this is what your average Democrat, your average reader at Media Matters, your average reader at any Democrat blog, this is what they think, folks. This is what the mayor of Philadelphia, no doubt, believes. This is what they all believe at CNN, that the subprime mortgage crisis originated with evil, cheating, thieving bankers. That's why they hate them so much, among many other reasons. And, besides that's just what corporate people do.

The Democrats would have you believe that all corporations either want to kill their customers or screw them, right? Take a look at how they talk about Big Pharma and about Big Box Retail, about Big Oil, are not corporations either killing their customers with foul water, dirty air, poisoned water, or screwing their customers with high prices or what have you? Along come the bankers, lending money, tricking innocent old middle class Americans into buying a home they can't afford.

And then shortly it gets foreclosed on, and people end up homeless and it's just horrible. The bankers don't care. And at that point Obama and the boys get to come in and claim that they saved the day rescuing this or that and the other thing, by punishing the bankers and all this other stuff that never really happened. The banks underwrite the Democrat Party.

What really happened was in the nineties Bill Clinton ordered these loans to be made, and Janet Reno, who was the attorney general at the time, threatened these banks with investigations, open-ended investigations into whatever they might be doing if they didn't comply. And so they did, just like they were all called into a room during the financial crisis and told they were going to take loans or subsidies or buyouts or whatever, $25 billion, even the banks that didn't need it. This was TARP.

So that's what led to the subprime mortgage. It was a disaster brought to you by the United States government as presided over by Bill Clinton at the time. It's inarguable, this is what happened. Your average Democrat doesn't know it. They have bought hook, line, and sinker a total different story, including elected Democrats.

So my point is that when somebody informed on this stuff appears with them on TV during this campaign and tells the truth about this you're gonna have Democrats react like the mayor of Philadelphia did the other night on CNN, got this empty look on his Face, Nutter is his name, he's got this empty look on his face. He had no idea what he was hearing. He looked quizzically at who was saying this, "I've not heard this before."

He didn't reject it out of hand, he was just stunned, he'd never heard this. And this happens a lot, as I watch certain cable news networks, particularly CNN, it's amazing what the people that work there don't know. Whatever event we're talking about or policy, you name it, if it is not something that is part of the leftist narrative, they don't know it. Because they don't take the time to read things other than stuff that they're familiar with.

That's why they don't know what conservatism really is, and they don't know who conservatives really are and what they believe in. They just have never exposed themselves to it 'cause it's not worth the trouble. And it's that way on many other things. I predict that the Trump campaign is going to actually cause this kind of elucidation to occur more and more as more and more left, and a lot of the liberal hypocrisy is gonna be exposed in ways nobody else has done it, either.

BREAK TRANSCRIPT

RUSH: I knew it was gonna happen. I'm always prepared. I checked the email during the break, a bunch of doubting Thomases. "You know, you say that Clinton was responsible for the subprime mortgage, but you never offer any proof. You just say it and you expect everybody to believe it. And your mind-numbed audience believes everything, but I don't. You're not fooling me."

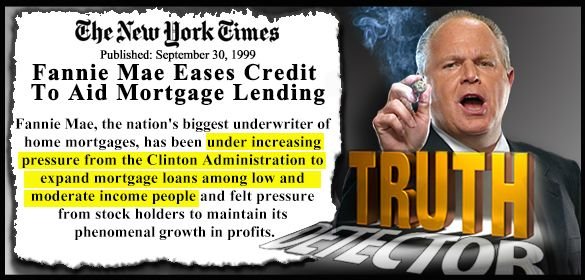

After 28 years you would figure that, even the left would know, I don't make it up. But let me share with you from the New York Times, September 30th, 1999. And, Koko, I want you to go get this, I want you to bullet point this, or I want you to pull quote this or box it or whatever you do up there at RushLimbaugh.com for this segment. September 30, 1999, New York Times, from the article.

"Fannie Mae Eases Credit To Aid Mortgage Lending." That's the headline. Here's the details. "Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits."

Well, the banks make loans, but who underwrites them is Fannie Mae. The banks do it but Fannie Mae underwrites them and so forth. What this story is saying is that Clinton was pressuring the underwriters of all of these mortgages, Fannie Mae, to make more loans available to the poor. Exactly what I told you he was doing. But the other side of that is, Fannie Mae has stockholders, and they weren't crazy about it 'cause it made no business sense to do this.

"In July, the Department of Housing and Urban Development proposed that by the year 2001, 50 percent of Fannie Mae's and Freddie Mac's portfolio be made up of loans to low and moderate-income borrowers."

How much plainer do you people need it?

September 30, 1999, New York Times. "In July, Department of Housing and Urban Development proposed --" that's the Clinton administration, "-- proposed that by the year 2001, 50 percent --" that's half, "-- of Fannie Mae's and Freddie Mac's portfolio --" i.e., underwritten mortgages "-- be made up of loans to low and moderate-income borrowers."

This was the beginning of it. Well, actually, '97 was, but don't doubt me on this stuff. This is what happened. "Last year," it says here, which would have been 1998, "44% of loans Fannie Mae purchased are from moderate and low income." It was expanding. The pressure was on. Janet Reno was out demanding these banks lend the money or we're gonna investigate you for whatever we can find.

And then finally from the New York Times: "The change in policy also comes at the same time that HUD is investigating allegations of racial discrimination in the automated underwriting systems used by Fannie Mae and Freddie Mac to determine the credit-worthiness of credit applicants."

So, the sum total of this is Housing and Urban Development via Fannie Mae, Freddie Mac, demanding the banks loan more and more money to people that couldn't pay it back, and then Housing and Urban Development was investigating the banks for racial discrimination. This is how they made it all happen.

George W. Bush was governor of Texas. George W. Bush had nothing to do with any of this. In fact, the truth of the matter is, George W. Bush and the inspectors general, the investigators, tried to shut it down, and Barney Frank told the investigators to go pound sand.

RUSH: We even played the audio sound bite of a number of those hearings. The Bush administration tried to bring some sanity to this.

I didn't make up a word of it. I find it amazing, here we are in 2016 and we're still trying to get the truth of this out there. But, see, this is my point. This is what's gonna happen in this campaign. The Democrats think that they've already won this story by painting Republicans as the evil, heartless, cold, mean, whatever. And the truth is gonna come out.

The more Elizabeth Warren Pocahontas keeps talking and the more Hillary Clinton keeps talking, Hillary Clinton of Whitewater fame, she wants to go out there and try to accuse Trump of profiteering, the woman that made a hundred thousand dollars on a $10,000 cattle investment?

They are gonna pay a price for all of the cover the media has given them their entire careers. They're gonna pay a price 'cause this stuff's gonna get exposed because the media can't help itself, it's gonna coverTrump. Now, it's somewhat related, NBC Nightly News last night, the two lead stories were on the TSA and VA problems. Transportation, whatever it is, authority, and the VA, and they detailed the problems. And it was pretty bad. I mean, they really, really, really spelled out how badly these two units are operating.

But not once in the entire NBC Nightly News newscast was the phrase "Obama administration" uttered. So whoever watches the NBC Nightly News, has no clue. They were not told that the TSA and the VA are part of the Regime. They were not told they're part of the Obama administration. Therefore Limbaugh Theorem wide open once again, Obama's ability to totally escape all accountability and responsibility for the bad things happening during his presidency.

Everybody else gets blamed. Obama gets portrayed as the guy trying to fix it. Obama gets portrayed as the guy who's being sabotaged and screwed with. Here's a great president, our first African-American president, he's trying to get health care for everybody, and he's trying to get jobs for everybody, he's trying to do everything, and he's got people at the TSA and the VA undermining him every day. It's a scandal. It's a scandal.

Never, ever does he get blamed. Limbaugh Theorem on full display here. Well, that's another thing that's gonna end in this campaign, I predict. I mean, you see the evidence of it as the campaign's unfolding even now.

END TRANSCRIPT

LOL

Bush Minority Homeownership Plan Rests Heavily on Fannie and Freddie

When President Bush announced his Minority Homeownership plans last week in Atlanta, his top priorities were new federal programs: a $2.4 billion tax credit to facilitate home purchases by lower-income first-time buyers, and a $200 million national downpayment grant fund.

But none of the new federal programs--if passed by Congress--will come even close to achieving the 5.5 million-household increase in minority homeownership the President set as his target.

Instead, most of the heavy lifting was assigned to two mortgage market players that have sometimes come under fire from Bush administration officials and Congressional Republicans: Fannie Mae and Freddie Mac.

Fannie's and Freddie's commitments are the bedrock core of the President's ambitious plans--but didn't get the headlines. Fannie Mae agreed to increase its already substantial lending efforts to minority families by targeting another $260 billion of mortgage purchases to them during the next nine years. Freddie Mac agreed to buy an additional $180 billion in minority-household home loans during the same period.

Besides its $180 billion mortgage purchase commitment, Freddie Mac gave President Bush a promise to implement a 25-point program aimed at increasing minority homeownership. Some of the points were cutting-edge. For example, as part of an effort to remove the fear of financial loss from first-time minority home buyers, Freddie committed itself to "explor(e) the viability of equity assurance products to protect home values in economically distressed areas."

Faun, for your reluctant edification.

For many years the President and his Administration not only warned of the systemic consequences of financial turmoil at a housing government-sponsored enterprise (GSE) but also put forward thoughtful plans to reduce the risk that either Fannie Mae or Freddie Mac would encounter such difficulties. President Bush publicly called for GSE reform 17 times in 2008 alone before Congress acted. Unfortunately, these warnings went unheeded, as the President’s repeated attempts to reform the supervision of these entities were thwarted by the legislative maneuvering of those who emphatically denied there were problems.

2001

April: The Administration’s FY02 budget declares that the size of Fannie Mae and Freddie Mac is “a potential problem,” because “financial trouble of a large GSE could cause strong repercussions in financial markets, affecting Federally insured entities and economic activity.”

2002

May: The President calls for the disclosure and corporate governance principles contained in his 10-point plan for corporate responsibility to apply to Fannie Mae and Freddie Mac. (OMB Prompt Letter to OFHEO, 5/29/02)

2003

January: Freddie Mac announces it has to restate financial results for the previous three years. [Obama advisor, Franklin Raines was CEO of Freddie Mac when they lied about earnings to increase bonuses]

February: The Office of Federal Housing Enterprise Oversight (OFHEO) releases a report explaining that “although investors perceive an implicit Federal guarantee of [GSE] obligations,” “the government has provided no explicit legal backing for them.” As a consequence, unexpected problems at a GSE could immediately spread into financial sectors beyond the housing market. (“Systemic Risk: Fannie Mae, Freddie Mac and the Role of OFHEO,” OFHEO Report, 2/4/03).

September: Fannie Mae discloses SEC investigation and acknowledges OFHEO’s review found earnings manipulations.

September: Treasury Secretary John Snow testifies before the House Financial Services Committee to recommend that Congress enact “legislation to create a new Federal agency to regulate and supervise the financial activities of our housing-related government sponsored enterprises” and set prudent and appropriate minimum capital adequacy requirements.

October: Fannie Mae discloses $1.2 billion accounting error.

November: Council of the Economic Advisers (CEA) Chairman Greg Mankiw explains that any “legislation to reform GSE regulation should empower the new regulator with sufficient strength and credibility to reduce systemic risk.” To reduce the potential for systemic instability, the regulator would have “broad authority to set both risk-based and minimum capital standards” and “receivership powers necessary to wind down the affairs of a troubled GSE.” (N. Gregory Mankiw, Remarks At The Conference Of State Bank Supervisors State Banking Summit And Leadership, 11/6/03).

2004

February: The President’s FY05 Budget again highlights the risk posed by the explosive growth of the GSEs and their low levels of required capital, and called for creation of a new, world-class regulator: “The Administration has determined that the safety and soundness regulators of the housing GSEs lack sufficient power and stature to meet their responsibilities, and therefore…should be replaced with a new strengthened regulator.” (2005 Budget Analytic Perspectives, pg. 83)

February: CEA Chairman Mankiw cautions Congress to “not take [the financial market's] strength for granted.” Again, the call from the Administration was to reduce this risk by “ensuring that the housing GSEs are overseen by an effective regulator.” (N. Gregory Mankiw, Op-Ed, “Keeping Fannie And Freddie’s House In Order,” Financial Times, 2/24/04).

June: Deputy Secretary of Treasury Samuel Bodman spotlights the risk posed by the GSEs and called for reform, saying “We do not have a world-class system of supervision of the housing government sponsored enterprises (GSEs), even though the importance of the housing financial system that the GSEs serve demands the best in supervision to ensure the long-term vitality of that system. Therefore, the Administration has called for a new, first class, regulatory supervisor for the three housing GSEs: Fannie Mae, Freddie Mac, and the Federal Home Loan Banking System.” (Samuel Bodman, House Financial Services Subcommittee on Oversight and Investigations Testimony, 6/16/04).

2005

April: Treasury Secretary John Snow repeats his call for GSE reform, saying “Events that have transpired since I testified before this Committee in 2003 reinforce concerns over the systemic risks posed by the GSEs and further highlight the need for real GSE reform to ensure that our housing finance system remains a strong and vibrant source of funding for expanding homeownership opportunities in America… Half-measures will only exacerbate the risks to our financial system.” (Secretary John W. Snow, “Testimony Before The U.S. House Financial Services Committee,” 4/13/05).

2007

July: Two Bear Stearns hedge funds invested in mortgage securities collapse.

August: President Bush emphatically calls on Congress to pass a reform package for Fannie Mae and Freddie Mac, saying “first things first when it comes to those two institutions. Congress needs to get them reformed, get them streamlined, get them focused, and then I will consider other options.” (President George W. Bush, Press Conference, The White House, 8/9/07).

September: RealtyTrac announces foreclosure filings up 243,000 in August – up 115 percent from the year before.

September: Single-family existing home sales decreases 7.5 percent from the previous month – the lowest level in nine years. Median sale price of existing homes fell six percent from the year before.

December: President Bush again warns Congress of the need to pass legislation reforming GSEs, saying “These institutions provide liquidity in the mortgage market that benefits millions of homeowners, and it is vital they operate safely and operate soundly. So I’ve called on Congress to pass legislation that strengthens independent regulation of the GSEs – and ensures they focus on their important housing mission. The GSE reform bill passed by the House earlier this year is a good start. But the Senate has not acted. And the United States Senate needs to pass this legislation soon.” (President George W. Bush, Discusses Housing, The White House, 12/6/07).

2008

January: Bank of America announces it will buy Countrywide.

January: Citigroup announces mortgage portfolio lost $18.1 billion in value.

February: Assistant Secretary David Nason reiterates the urgency of reforms, says “A new regulatory structure for the housing GSEs is essential if these entities are to continue to perform their public mission successfully.” (David Nason, Testimony On Reforming GSE Regulation, Senate Committee On Banking, Housing And Urban Affairs, 2/7/08).

March: Bear Stearns announces it will sell itself to JPMorgan Chase.

March: President Bush calls on Congress to take action and “move forward with reforms on Fannie Mae and Freddie Mac. They need to continue to modernize the FHA, as well as allow State housing agencies to issue tax-free bonds to homeowners to refinance their mortgages.” (President George W. Bush, Remarks To The Economic Club Of New York, New York, NY, 3/14/08).

April: President Bush urges Congress to pass the much needed legislation and “modernize Fannie Mae and Freddie Mac. [There are] constructive things Congress can do that will encourage the housing market to correct quickly by … helping people stay in their homes.” (President George W. Bush, Meeting With Cabinet, the White House, 4/14/08).

May: President Bush issues several pleas to Congress to pass legislation reforming Fannie Mae and Freddie Mac before the situation deteriorates further.

· “Americans are concerned about making their mortgage payments and keeping their homes. Yet Congress has failed to pass legislation I have repeatedly requested to modernize the Federal Housing Administration that will help more families stay in their homes, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance sub-prime loans.” (President George W. Bush, Radio Address, 5/3/08).

· “[T]he government ought to be helping creditworthy people stay in their homes. And one way we can do that – and Congress is making progress on this – is the reform of Fannie Mae and Freddie Mac. That reform will come with a strong, independent regulator.” (President George W. Bush, Meeting With The Secretary Of The Treasury, the White House, 5/19/08).

· “Congress needs to pass legislation to modernize the Federal Housing Administration, reform Fannie Mae and Freddie Mac to ensure they focus on their housing mission, and allow State housing agencies to issue tax-free bonds to refinance subprime loans.” (President George W. Bush, Radio Address, 5/31/08).

June: As foreclosure rates continued to rise in the first quarter, the President once again asks Congress to take the necessary measures to address this challenge, saying “we need to pass legislation to reform Fannie Mae and Freddie Mac.” (President George W. Bush, Remarks At Swearing In Ceremony For Secretary Of Housing And Urban Development, Washington, D.C., 6/6/08).

July: Congress heeds the President’s call for action and passes reform of Fannie Mae and Freddie Mac as it becomes clear that the institutions are failing.

Cite the Bill's passed and the political support it had from both sides in terms of ACTUAL VOTES.Of course it was their policies...They were in charge but it wasn't their stupid ass policies that created the housing disaster.Who knows what you’re rambling about now? The economy began collapsing before Democrats took over in 2007. In 2006, we had a record number of foreclosures up until that time. And Republicans were in charge.

Another stupid uninformed fool

“Thanks to our policies, home ownership in America is at an all time high!” ~ George Bush, 2004 RNC acceptance speech

You won't of course because it will prove me right.

And if you're going to give Bush credit for it then you also have to give credit for the warnings he put out when the results of those policies became clear!

Face it, I've bested you in yet another grampaMURKEDu debate

LOLOL

It’s cute how you think you bested me after I just quoted Republicans taking credit for the policies which grew real estate markets to record busting levels.

I also like how you post a video about Republican-led Congresses between 2001-2006 ignoring the red flags and passing no legislation to increase oversight on the GSE’s — but then you blame Democrats.

Nope, he’s not wrong. Sadly, you and boedicca are brain-dead conservatives who fail at reality. Meanwhile, the BLS confirms edthecynic’s claim that 200K people dropped out of the labor force...That's because 200K dropped out of the labor force, you left that part out, no surprise there!Total Unemployed people DECREASED by 300K

Nope, you're wrong again.

Here is the Labor Participation Rate as of 3/09/2019

Bureau of Labor Statistics Data

LOLOL

You post Bush’s warnings about the GSE’s as though he didn’t pile on minority home ownership onto the GSE’s anyway.

And how many times are you going to highlight the failure of Republicans to not get a GSE reform bill onto Bush’s desk during 2001, 2002, 2003, 2004, 2005 and 2006. One of your own links said the financial collapse could have been averted had they only done that.

Nope, he’s not wrong. Sadly, you and boedicca are brain-dead conservatives who fail at reality. Meanwhile, the BLS confirms edthecynic’s claim that 200K people dropped out of the labor force...That's because 200K dropped out of the labor force, you left that part out, no surprise there!Total Unemployed people DECREASED by 300K

Nope, you're wrong again.

Here is the Labor Participation Rate as of 3/09/2019

Bureau of Labor Statistics Data

Dumbfuck, for the 400th time... which party controlled both chambers of Congress in 2003?LOLOL

You post Bush’s warnings about the GSE’s as though he didn’t pile on minority home ownership onto the GSE’s anyway.

And how many times are you going to highlight the failure of Republicans to not get a GSE reform bill onto Bush’s desk during 2001, 2002, 2003, 2004, 2005 and 2006. One of your own links said the financial collapse could have been averted had they only done that.

From the New York Times

New Agency Proposed to Oversee Freddie Mac and Fannie Mae

By STEPHEN LABATON

Published: September 11, 2003 WASHINGTON,

Sept. 10— The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

The new agency would have the authority, which now rests with Congress, to set one of the two capital-reserve requirements for the companies. It would exercise authority over any new lines of business. And it would determine whether the two are adequately managing the risks of their ballooning portfolios.

The plan is an acknowledgment by the administration that oversight of Fannie Mae and Freddie Mac -- which together have issued more than $1.5 trillion in outstanding debt -- is broken. A report by outside investigators in July concluded that Freddie Mac manipulated its accounting to mislead investors, and critics have said Fannie Mae does not adequately hedge against rising interest rates.

Read more: New Agency Proposed to Oversee Freddie Mac and Fannie Mae

LOLOLNope, he’s not wrong. Sadly, you and boedicca are brain-dead conservatives who fail at reality. Meanwhile, the BLS confirms edthecynic’s claim that 200K people dropped out of the labor force...That's because 200K dropped out of the labor force, you left that part out, no surprise there!Total Unemployed people DECREASED by 300K

Nope, you're wrong again.

Here is the Labor Participation Rate as of 3/09/2019

Bureau of Labor Statistics Data

We have to excuse rederp. He has a different experience in the use of words.You have to spoonfeed. And even then information doesn’t take.I'm sorry, I thought you had a fucking brain & could use your fucking computer instead of whining here blaming me for your ignorance.Do you know how to link to an article when starting a worthless leftist traitor hack thread? Dumass?Any Trumpettes want to talk about this yet?

I'm never wrong, you always try to lie by deflecting to something else. Dropping out of the labor force falls under the "NOT IN LABOR FORCE" catagory, as if you didn't know.That's because 200K dropped out of the labor force, you left that part out, no surprise there!Total Unemployed people DECREASED by 300K

Nope, you're wrong again.

Here is the Labor Participation Rate as of 3/09/2019

Bureau of Labor Statistics Data

I would add to that the deregulation the bush boy did that allowed Fannie Mae to buy sub prime loans.

It was illegal for Fannie Mae to buy sub prime loans before the bush boy.

Those sub prime loans were bundled with a few good ones and ll were marked prime even though it was known that was a lie. The rational was the good loans would cancel out the bad ones. We all know how that worked out.

Before deregulation, sub prime loans were considered predatory lending and illegal in a lot of states.

My highlight above.

Re-writing history I see.

UPDATED: Obama Sued Citibank Under CRA to Force it to Make Bad Loans

Posted on 03 October 2008

Do you remember how we told you that the Democrats and groups associated with them leaned on banks and even sued to get them to make bad loans under the Community Reinvestment Act which was a factor in causing the economic crisis (see HERE ) … well look at what some fellow bloggers have dug up while researching Obama’s legal career. Looks like a typical ACORN lawsuit to get banks to hand out bad loans.

In these lawsuits, ACORN makes a bogus claim of Redlining (denying poor people loans because of their ethnic heritage). They protest and get the local media to raise a big stink. This stink means that the bank faces thousands of people closing their accounts and get local politicians to lobby to stop the bank from doing some future business, expansions and mergers. If the bank goes to court, they will win, but the damage is already done because who is going to launch a big campaign to get the bank’s reputation back?

It is important to understand the nature of these lawsuits and what their purpose is. ACORN filed tons of these lawsuits and ALL of them allege racism.

Thanks to the IUSB Vision Weblog for providing additional details of this story.

UPDATED: Obama Sued Citibank Under CRA to Force it to Make Bad Loans - Media Circus | Media Circus

Regarding the Democrats actions on Capitol Hill.

Here the Democrats are railing that there is nothing wrong with Fannie and Freddie and to simply leave them alone.

Your posted a fake news article that said President Obama sued Citibank in October 2008. Obama wasn’t elected President until November 2008.

Your posted a fake news article that said President Obama sued Citibank in October 2008. Obama wasn’t elected President until November 2008.

Before he was elected to any office, he was a "community organizer".

He was well known for shaking down businesses with threats of boycotts and lawsuits.

just more LIES!

He was a famous shakedown artist here in Chicago. A worthless POS from way back.

So typical of how the lying scum Right lie. They only tell half truths, like in this case, as I have already shown, the GOP only TALKED reform while BLOCKING every reform bill in committee. Every reform bill in 2003 was sent to committee where it died, but you knew that already every time you repeated your lie.LOLOL

You post Bush’s warnings about the GSE’s as though he didn’t pile on minority home ownership onto the GSE’s anyway.

And how many times are you going to highlight the failure of Republicans to not get a GSE reform bill onto Bush’s desk during 2001, 2002, 2003, 2004, 2005 and 2006. One of your own links said the financial collapse could have been averted had they only done that.

From the New York Times

New Agency Proposed to Oversee Freddie Mac and Fannie Mae

By STEPHEN LABATON

Published: September 11, 2003 WASHINGTON,

Sept. 10— The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

The new agency would have the authority, which now rests with Congress, to set one of the two capital-reserve requirements for the companies. It would exercise authority over any new lines of business. And it would determine whether the two are adequately managing the risks of their ballooning portfolios.

The plan is an acknowledgment by the administration that oversight of Fannie Mae and Freddie Mac -- which together have issued more than $1.5 trillion in outstanding debt -- is broken. A report by outside investigators in July concluded that Freddie Mac manipulated its accounting to mislead investors, and critics have said Fannie Mae does not adequately hedge against rising interest rates.

Read more: New Agency Proposed to Oversee Freddie Mac and Fannie Mae

I'm never wrong

You're just jealous!!!I'm never wrong

In the immortal words of truthmattersnot: You are a LAIR!

I'm never wrong, you always try to lie by deflecting to something else. Dropping out of the labor force falls under the "NOT IN LABOR FORCE" catagory, as if you didn't know.

Bureau of Labor Statistics Data

2019 Jan 95,010,000 Feb 95,208,000

51 PM)

51 PM)

200K is NOT percentage.I'm never wrong, you always try to lie by deflecting to something else. Dropping out of the labor force falls under the "NOT IN LABOR FORCE" catagory, as if you didn't know.

Bureau of Labor Statistics Data

2019 Jan 95,010,000 Feb 95,208,000

You're embarrassing yourself.

Do you even know what this chart is about? I assume you do not. The title of the chart is:

Data extracted on: March 9, 2019 (1051 PM)

Labor Force Statistics from the Current Population Survey

Series Id: LNS11300000

Seasonally Adjusted

Series title: (Seas) Labor Force Participation Rate

Labor force status: Civilian labor force participation rate

Type of data: Percent or rate

Age: 16 years and over

Bureau of Labor Statistics Data

What an idiot that guy is not to know that.200K is NOT percentage.I'm never wrong, you always try to lie by deflecting to something else. Dropping out of the labor force falls under the "NOT IN LABOR FORCE" catagory, as if you didn't know.

Bureau of Labor Statistics Data

2019 Jan 95,010,000 Feb 95,208,000

You're embarrassing yourself.

Do you even know what this chart is about? I assume you do not. The title of the chart is:

Data extracted on: March 9, 2019 (1051 PM)

Labor Force Statistics from the Current Population Survey

Series Id: LNS11300000

Seasonally Adjusted

Series title: (Seas) Labor Force Participation Rate

Labor force status: Civilian labor force participation rate

Type of data: Percent or rate

Age: 16 years and over

Bureau of Labor Statistics Data

Nope, he’s not wrong. Sadly, you and boedicca are brain-dead conservatives who fail at reality. Meanwhile, the BLS confirms edthecynic’s claim that 200K people dropped out of the labor force...That's because 200K dropped out of the labor force, you left that part out, no surprise there!Total Unemployed people DECREASED by 300K

Nope, you're wrong again.

Here is the Labor Participation Rate as of 3/09/2019

Bureau of Labor Statistics Data

LOLOL

You post Bush’s warnings about the GSE’s as though he didn’t pile on minority home ownership onto the GSE’s anyway.

And how many times are you going to highlight the failure of Republicans to not get a GSE reform bill onto Bush’s desk during 2001, 2002, 2003, 2004, 2005 and 2006. One of your own links said the financial collapse could have been averted had they only done that.

From the New York Times

New Agency Proposed to Oversee Freddie Mac and Fannie Mae

By STEPHEN LABATON

Published: September 11, 2003 WASHINGTON,

Sept. 10— The Bush administration today recommended the most significant regulatory overhaul in the housing finance industry since the savings and loan crisis a decade ago.

Under the plan, disclosed at a Congressional hearing today, a new agency would be created within the Treasury Department to assume supervision of Fannie Mae and Freddie Mac, the government-sponsored companies that are the two largest players in the mortgage lending industry.

The new agency would have the authority, which now rests with Congress, to set one of the two capital-reserve requirements for the companies. It would exercise authority over any new lines of business. And it would determine whether the two are adequately managing the risks of their ballooning portfolios.

The plan is an acknowledgment by the administration that oversight of Fannie Mae and Freddie Mac -- which together have issued more than $1.5 trillion in outstanding debt -- is broken. A report by outside investigators in July concluded that Freddie Mac manipulated its accounting to mislead investors, and critics have said Fannie Mae does not adequately hedge against rising interest rates.

Read more: New Agency Proposed to Oversee Freddie Mac and Fannie Mae