Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,901

- 1,530

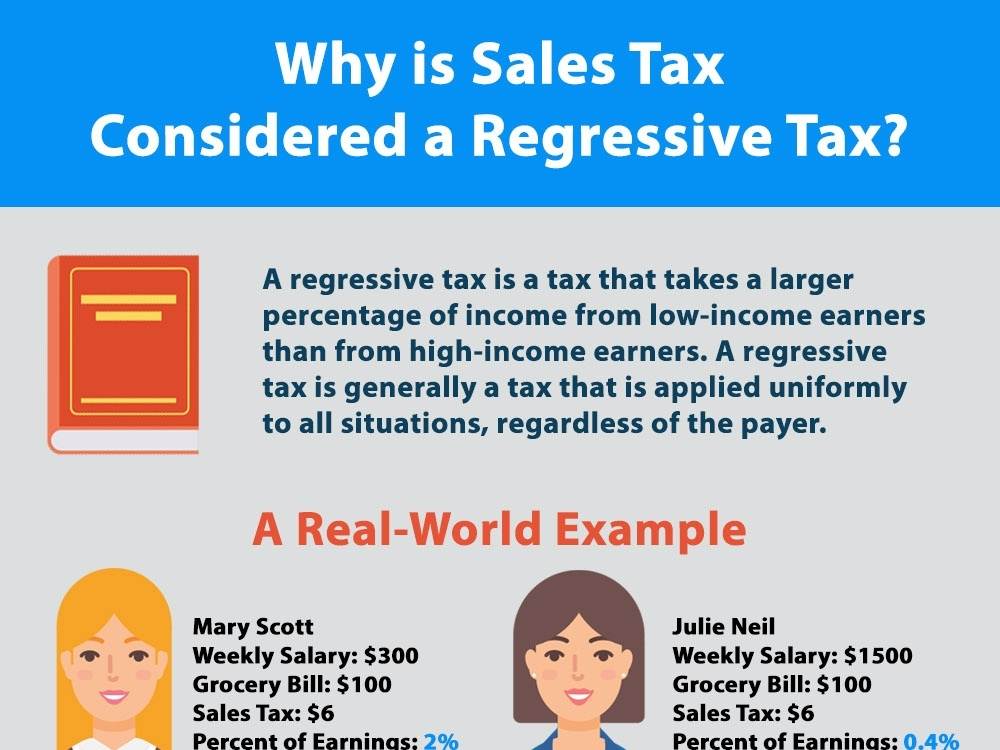

It makes no sense to charge X% and then give some of that money back to people just charge a lower rate to begin with and skip the extra step and the costs associated with it.The reason for the prebate is because a sales tax is regressive. The prebate covers the tax on necessities, and everyone gets the same prebate amount regardless of their income.