JonKoch

VIP Member

- May 14, 2017

- 1,779

- 151

- 65

Trump, as I expected, is talking giving companies tax breaks to create jobs here. Well if you give them tax breaks, then guess who pays the taxes. The Poor! Slavery in action. The more that things change, the more they stay the same.

Here is the way things work in the U.S. Capitalism-Corporations = Society = Government = AMERICA! We are "supposed" to live in a democracy. But the business world rules your lives. How many people in business did you vote for. Do you vote for business or government. People in business who aren't elected shouldn't be directing how people live. That is the government's job.

I say to hell with bribing companies with tax breaks or outright corporate welfare to create jobs. If the private sector can't create jobs, I say that the government should just cut away that that dead weight and start doing the job themselves. Also, want to see something interesting? Go to the internet and look up any year in the last 50 years and see the number of companies in whatever year paid no taxes at all.

The poor pay no income taxes you fucking moron.

Yes but they pay other taxes, and since the bottom 50% of US receive less than 12% of ALL US income, a drop from almost 18% in 1980, think that matters? Hint that's almost $5,000 PER FAMILY

Poor Pay a Higher Percentage of Income in Taxes

Jan 15, 2015 - The poor pay a higher percentage of their income in state and local taxes—in every state.

Poor Pay a Higher Percentage of Income in Taxes

Misconceptions and Realities About Who Pays Taxes

When all federal, state, and local taxes are taken into account, the bottom fifth of households pays about 16 percent of their incomes in taxes, on average. The second-poorest fifth pays about 21 percent.

Misconceptions and Realities About Who Pays Taxes

Tell the poor don't vote for democrats then.....vote Republican less taxes and

Less cost of living.

.

Yes all those poor red states look good

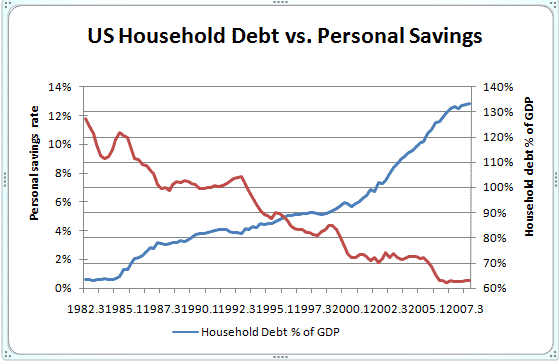

GOPers just put things on the credit card

Blue States are from Scandinavia, Red States are from Guatemala

In the red states, government is cheaper, which means the people who live there pay lower taxes. But they also get a lot less in return. The unemployment checks run out more quickly and the schools generally aren’t as good. Assistance with health care, child care, and housing is skimpier, if it exists at all. The result of this divergence is that one half of the country looks more and more like Scandinavia, while the other increasingly resembles a social Darwinist’s paradise.

Blue States are from Scandinavia, Red States are from Guatemala