progressive hunter

Diamond Member

- Dec 11, 2018

- 62,662

- 38,431

- 2,615

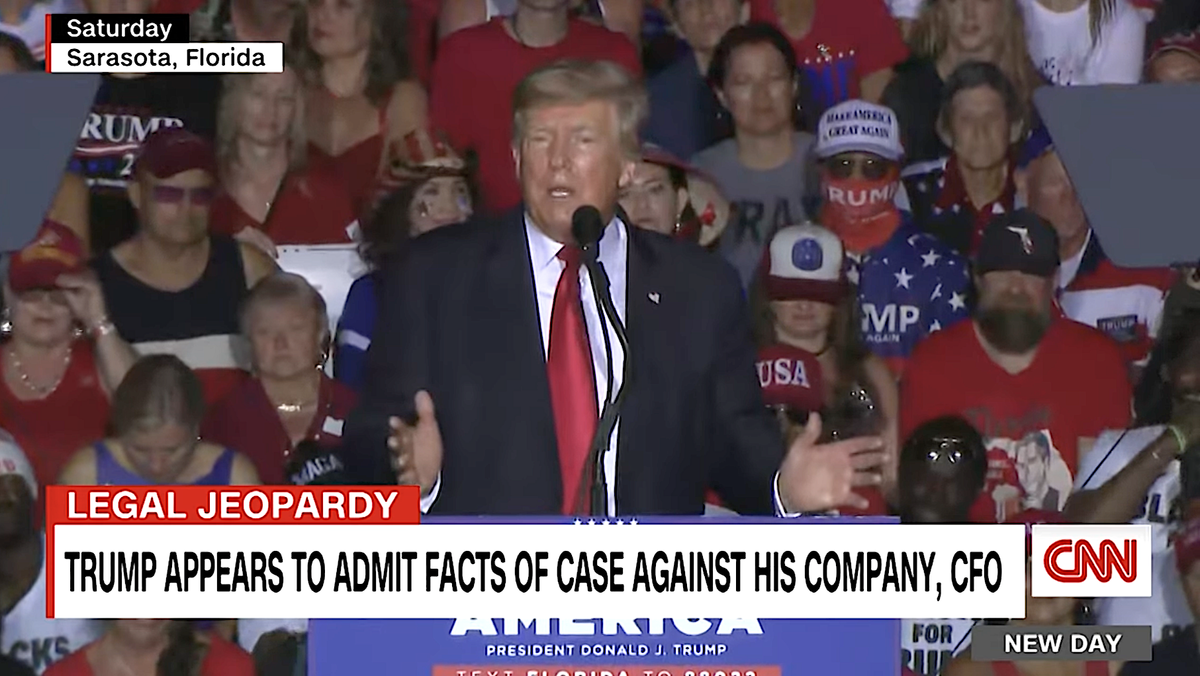

does what?? what was he talking about??so now you believe trump,, youre one fucked in the head moron,,might be the case in your country , but in ours thats not the case,,There is LEGALLY minimizing exposure to taxation, and their is ILLEGALLY minimizing exposure to taxation.

Obviously too complicated a notion for some.

When the president does something it’s not a crime.

see why its better you mind youre own fucking business??

That’s what Donald Trump said. When the president does something it’s not a crime. Nixon tried that too. It didn’t work for him either.

Thank you for confirming that Trump can’t get away with shit just because he was president. I didn’t expect you to agree with that.

Do you have a problem with reading comprehension? I quoted Donald Trump’s statement that when a president does something it’s not illegal, and you jumped all over it and said “maybe in your country but not here”.

I didn’t say I agreed with what Trump said I just quoted him.

This just proves that when you think someone other than Trump says the shit that Trump says, you think it’s wrong. But when Trump says that you’re prepared to defend him to the death.

You’re such a Trump humper that you will tie yourself into knots to defend him.