Penelope

Diamond Member

- Jul 15, 2014

- 60,265

- 15,791

- 2,210

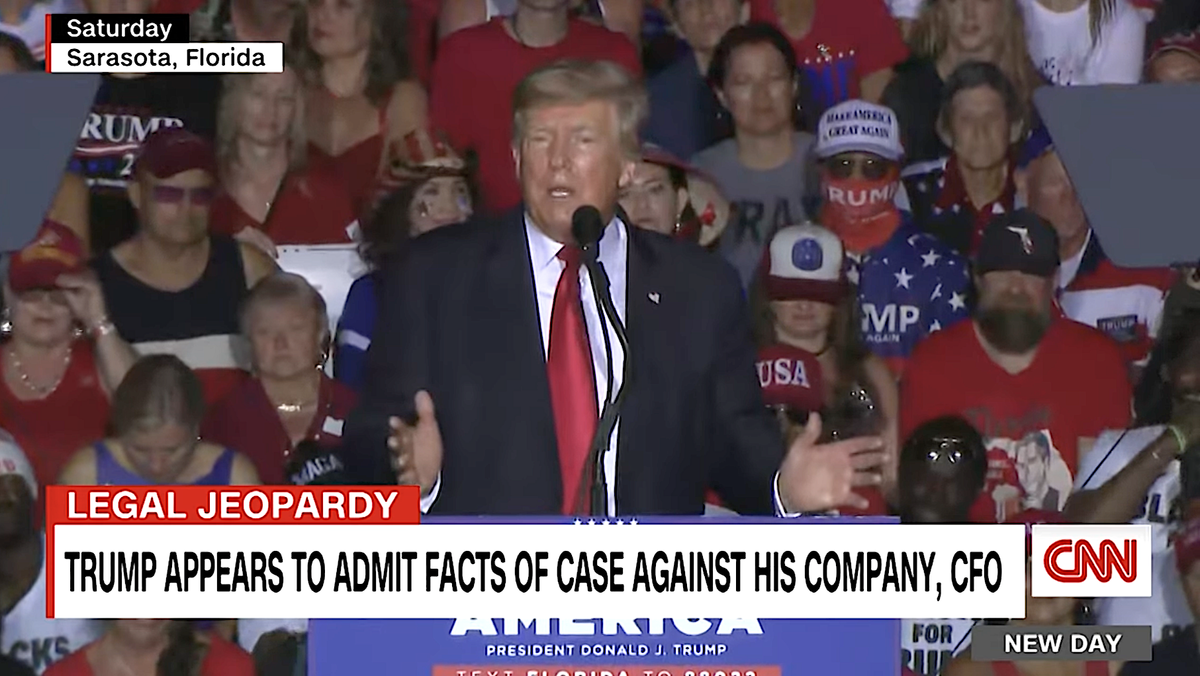

You may even have to pay tax on the gift. The person who receives your gift does not have to report the gift to the IRS or pay gift or income tax on its value. ... If you are married, both you and your spouse can give separate gifts of up to $10,000 to the same person each year without making a taxable gift.What's crooked about a gift? A gift whose taxes were already paid when the original buyer bought them?Looks like the Daughter business has consequences. Who would have the authority in that organisation to sanction these crooked payments?

She will never get "in." Another FAIL for Tommy the Aintant.When she gets out she can relaunch herself as a prison reformer.

GIFT GIVING - Internal Revenue Service

tramp didn't pay taxes on any gift, he gave bonuses and he did NOT pay tax on those either.

Last edited: