Flopper

Diamond Member

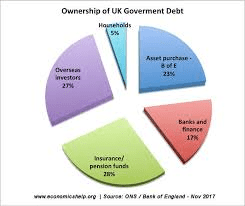

In effect, they create more money. That's the wonderful thing about running a government. If you run out of money, just print more. In reality, the government borrows more money; that is, they offer more treasury bills for sale. If they need a lot of money, then they may have to pay a higher rate interest to get the money they need. However, in times of crisis such as this, institutions and individuals seek a safe place for their savings and the US treasuries are a favorite place. Although the treasury can print more currency that is not usually done. Also, the federal reserve can help by buying treasuries.When the US government does not have money and it needs to spend money it does not have and they do not want higher tax.

Does the US government borrow money from the big banks? Or does the US government print money or give out government bonds?