Avorysuds

Gold Member

It is an "income" tax

Those who have the most "income" pay the most tax

And funny how that happens even with a flat tax....

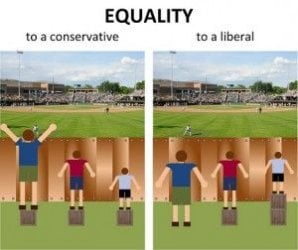

Nobody is saying that if you earn more, your total tax bill should be less.. but the RATE should be identical to everyone else's on each and every dollar...

Funny how people don't care how government spends, hands shit out, or anything else, when they do not have a stake in the game

RW does not care about hand outs, he gets one in a form of his "job."