Such ignorance. "All corporate taxes are paid by the consumers". Did Trump not cut corporate taxes? What the hell happened, why did prices not drop? Fool.Winnie - you're dumb as a stump.

All corporate taxes are paid by the consumer. Your gouging scheme to grow government increases the cost of goods to the consumer - we with triple digit IQ's call that "inflation."

Loss of equilibrium, that is increased fiat currency chasing a static or declining pool of goods and services is the primary cause of inflation. But massive tax increases will also cause prices to consumers to rise.

If I didn't know better, I'd say the Nazi democrats are waging war to destroy the American middle class. Come to think of it, I don't know better and that's exactly what the fascist left is doing - from dozens of angles.

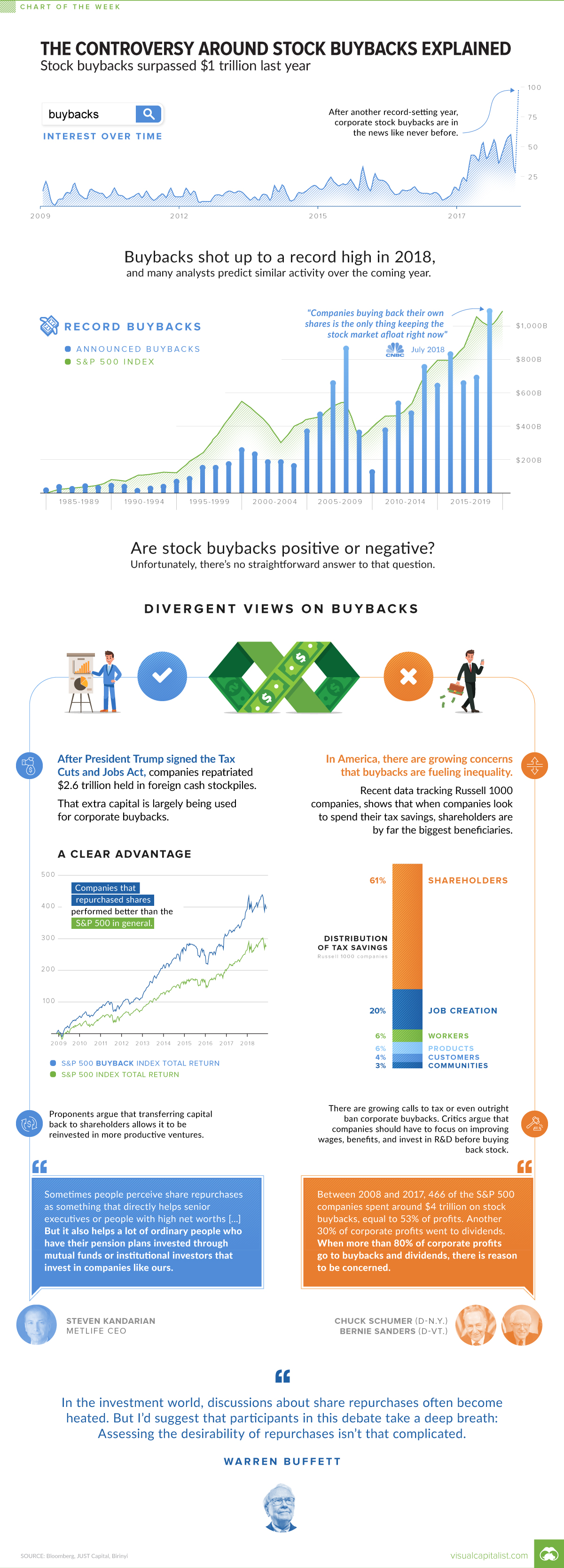

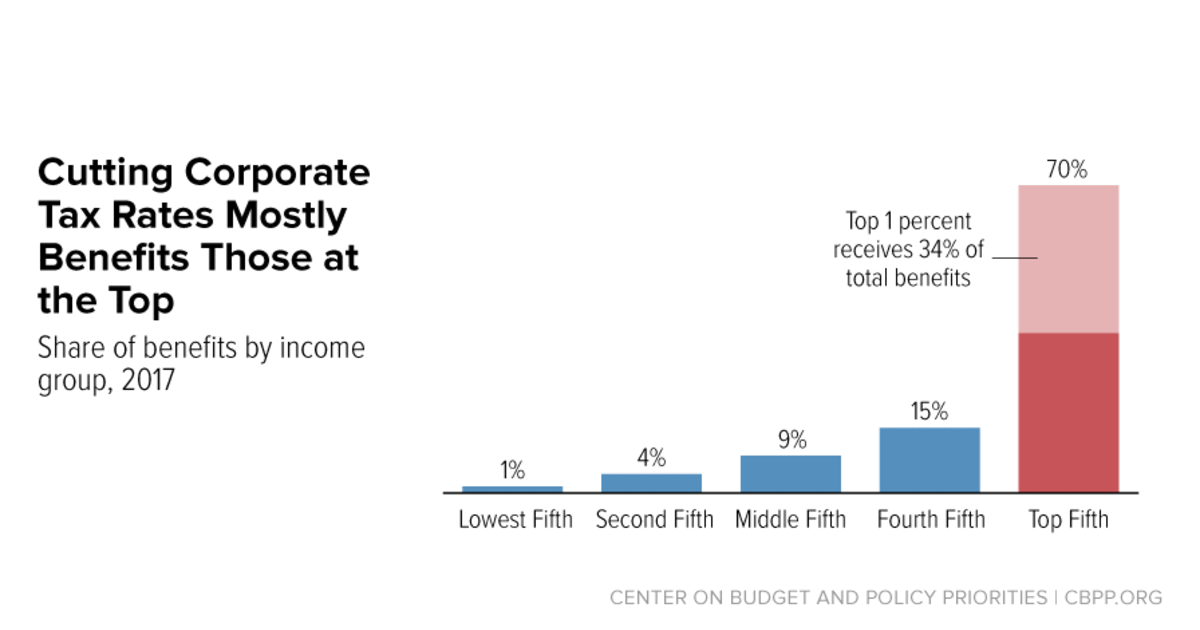

Corporate Tax Cuts Skew to Shareholders and CEOs, Not Workers as Administration Claims | Center on Budget and Policy Priorities

The eventual spending cuts or tax increases to pay for corporate rate cuts could leave most workers worse off.

www.cbpp.org

I swear, if you have a triple digit IQ I am the second coming of Christ. Fiat currency? Just what is that? Why don't you define it for me. Because with Quantitative easing backing off every month and the deficit being reduced at record levels I am wondering, just what the hell you believe "fiat currency" really is. Define it, and provide examples, or crawl back into your hole and STFU.