Daryl Hunt

Your Worst Nightmare

- Banned

- #21

How will Biden ever get the desired amount of taxes he will need?What the hell does that mean? Is that actionable legislation?

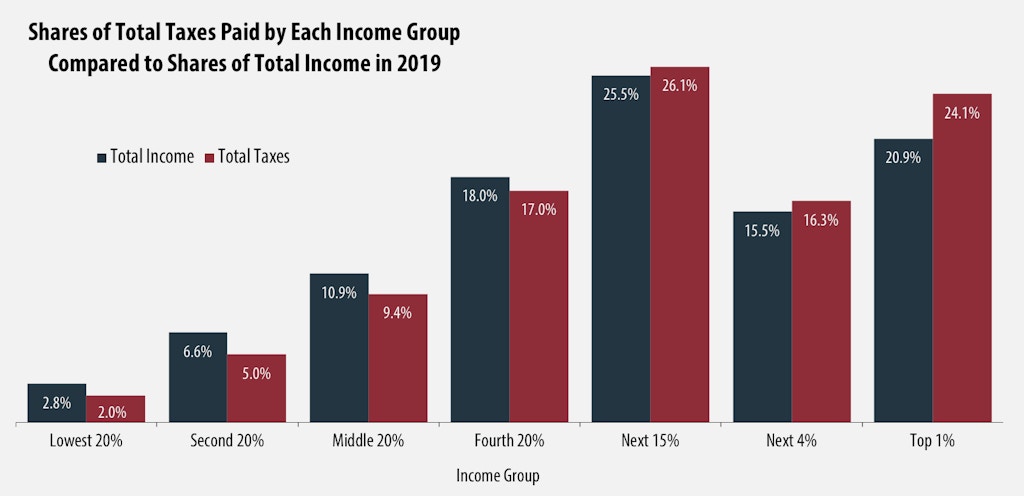

Who is WEALTHY? What is their FAIR SHARE?

Millionaires living in California and New York pay nearly 60% of their earnings in taxes.

If thats not enough...what is enough?

Who is wealthy and what should they be taxed?

What Joe is saying is fucking meaningless drivel.

Except they don't pay 60%. The pay anywhere from 19 to zero.

MY opinion is he'll have to hit the middle and low income, and he's pretty much admitted that.

He hasn't admitted to that. But you are right. The Middle class is going to get hit as well as the rich. After Diamond Donnie the bill is s going to have to be paid.