Synthaholic

Diamond Member

- Thread starter

- #281

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Yeah, but no!

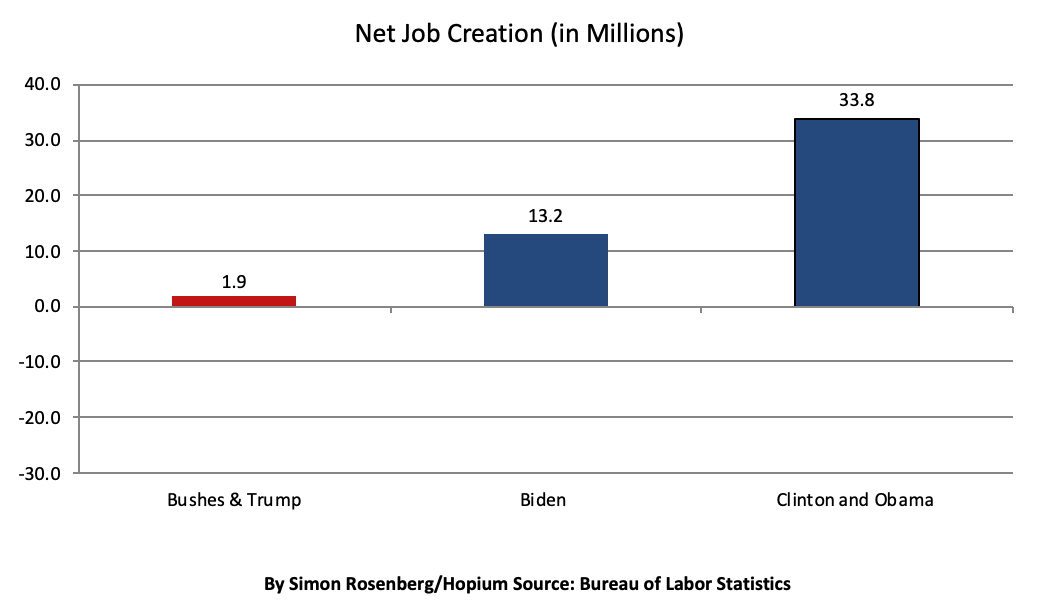

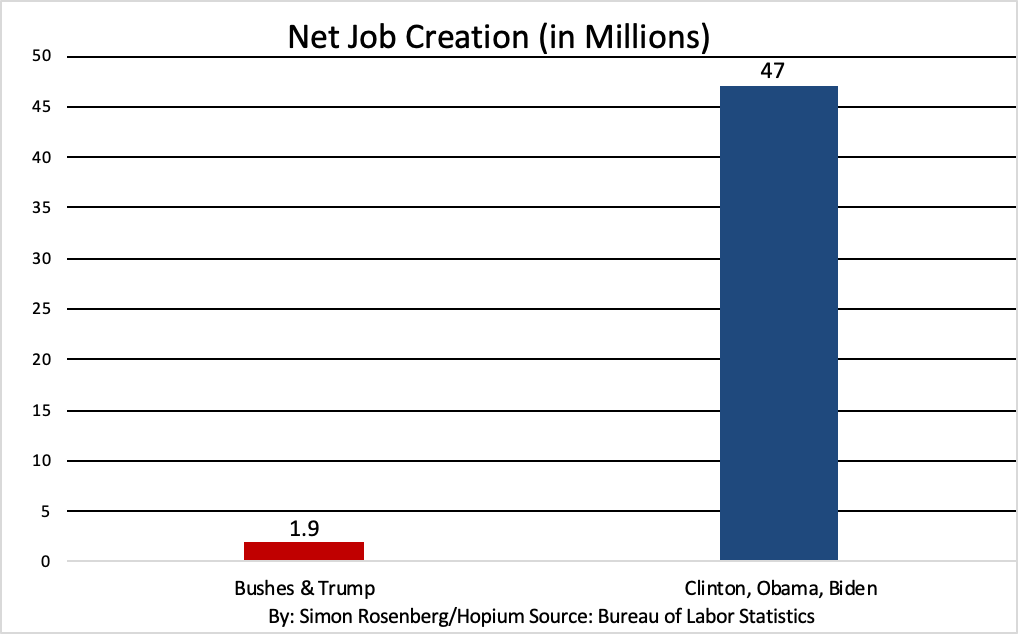

What is never factored into this conversation is the newly created jobs or people going back to work or the increase of exports and imports is that from 2020 to mid 2021 a good amount of the nation was in lockdown because of Covid and millions of Americans were getting a Government check and once the lockdown ended or was somewhat lifted people went back to work which mean the numbers look so beautiful but were not factual!

So let cut the bullshit about how great Biden is because like what has been pointed out is the fact we have supply chain issues, high inflation and gas prices are ridiculous but alas you will not admit it and will proclaim everything is great and wonderful until the GOP take the House and Senate this November!

Greatest president EVAH!!!!!

Does Morgan Stanley report on them.Unicorn farts are equally as believable.

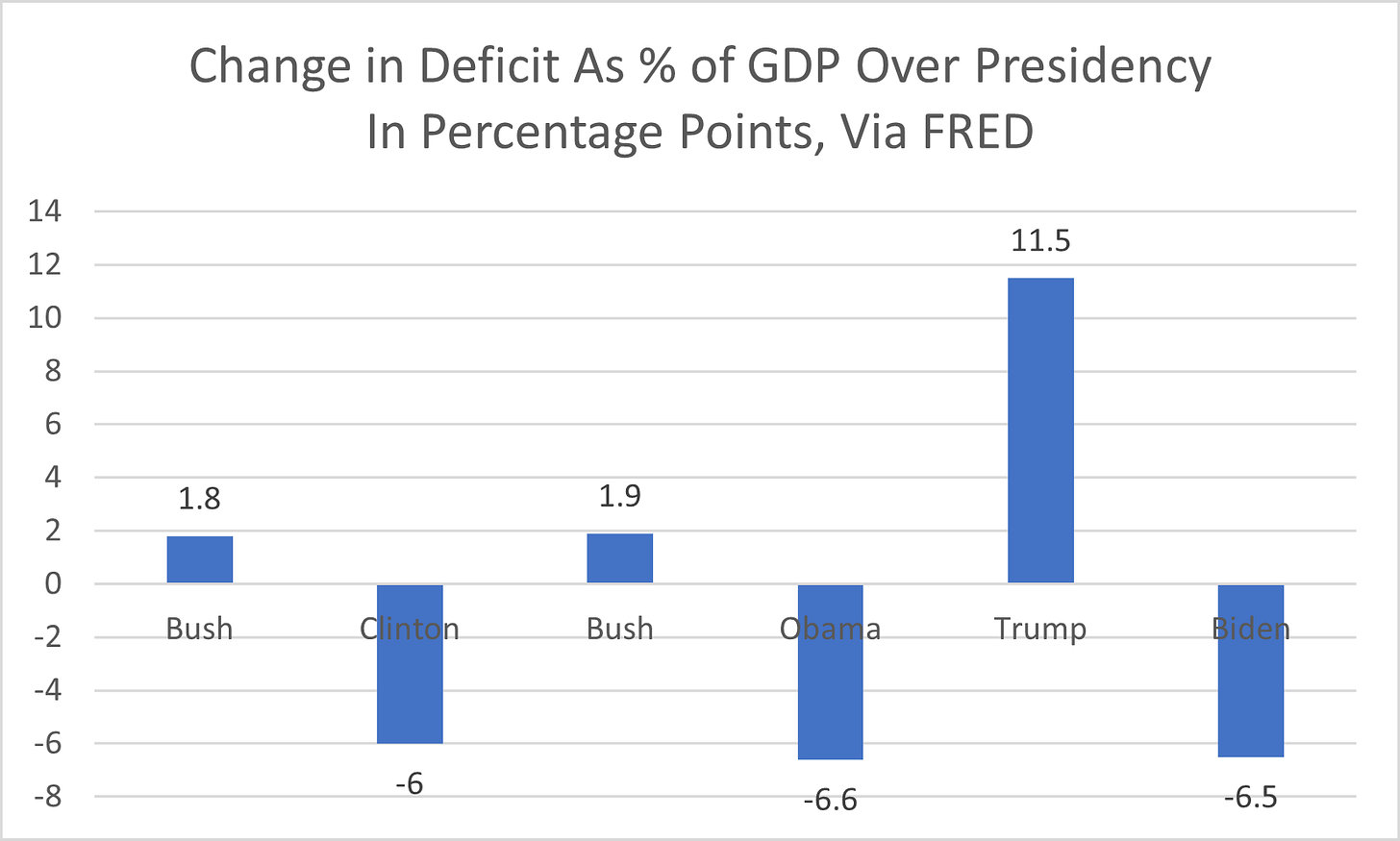

If the economy is so great, why is he so unpopular.

A lot of people asked that same question during the previous admin.

Could it be that people have figured out how little power the POTUS has over the economy?