JimBowie1958

Old Fogey

- Sep 25, 2011

- 63,590

- 16,767

- Thread starter

- #21

Is 'chained CPI' a thing?I'm talking about chained CPI, Jimbo.

If so how is it different from the current tax brackets being tied to CPI each and every year?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Is 'chained CPI' a thing?I'm talking about chained CPI, Jimbo.

Yeah, the way they calculate the CPI is fraudulent. they exclude things like the cost of fuel and food and then over weight the increase in value of things like computers.Last week’s "Big Six" Republican proposal would make two big changes in this inflation-adjusted world. First, it would repeal the personal exemption, which is indexed for inflation, and partially replace it with a bigger Child Tax Credit, which currently is not. While the higher CTC would help many families today, inflation would erode the additional benefit over time.

More importantly, the outline would revise the way the tax code measures inflation. Today, it uses the Consumer Price Index for urban consumers (the CPI-U), a measure the government nearly always uses to adjust for price changes. The GOP framework would shift to an index known as chained CPI (C-CPI). This initiative parallels long-standing Republican efforts to make the same change for Social Security and other government benefit programs.

The Hidden Tax Increase In The Big Six Tax Outline

-------------------------------------

Are they going to up the standard deduction to include it all. I know a few whose 2% SS raise will be eaten by a raise in their Medicare payments next year, then ins companies also raise medigaps and Part D ins. So how is this going to help the SS recipients who got raises in the checks, pay for increases in electricity, heat, food costs, etc.

It's not.

Is 'chained CPI' a thing?I'm talking about chained CPI, Jimbo.

If so how is it different from the current tax brackets being tied to CPI each and every year?

Is 'chained CPI' a thing?I'm talking about chained CPI, Jimbo.

If so how is it different from the current tax brackets being tied to CPI each and every year?

Um...I'm not concerned about 2026.go back and tell us about 2026.

Here use this one, it has years.

Use this calculator to see how the tax bill affects your paycheck - CNNPolitics

It is putting my income back into my possession.

According to this calculator it will be 1.8%.

Of course not, seems the Pubs love a sugar high, and only can concern themselves about today and the immediate future.

I do have a wife and you are all the same.

You can't control your spending habits.

Voting For Great Douche gave his voters more debt and

Voting For Great Douche gave his voters more debt and More falsehoods.Well, Based on these calculations, I'm so glad they passed tax cuts. So I pay more in taxes. In 2018 and way more by 2027.

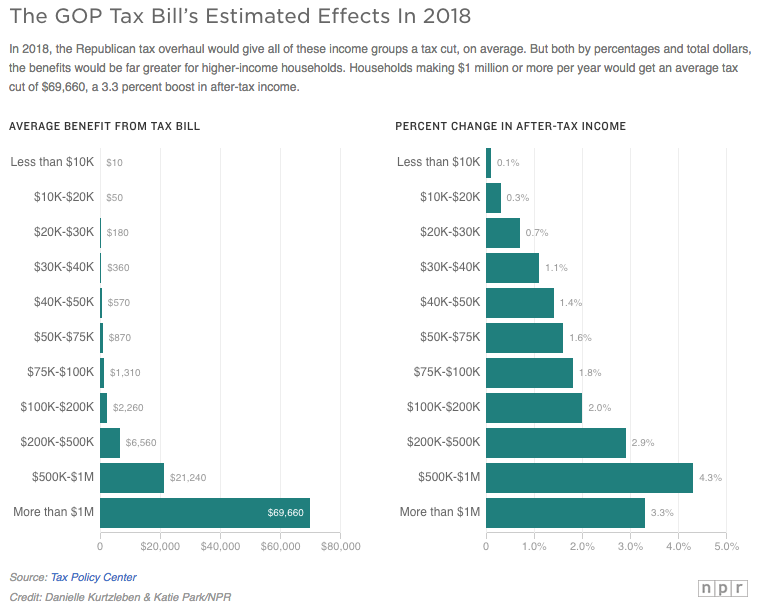

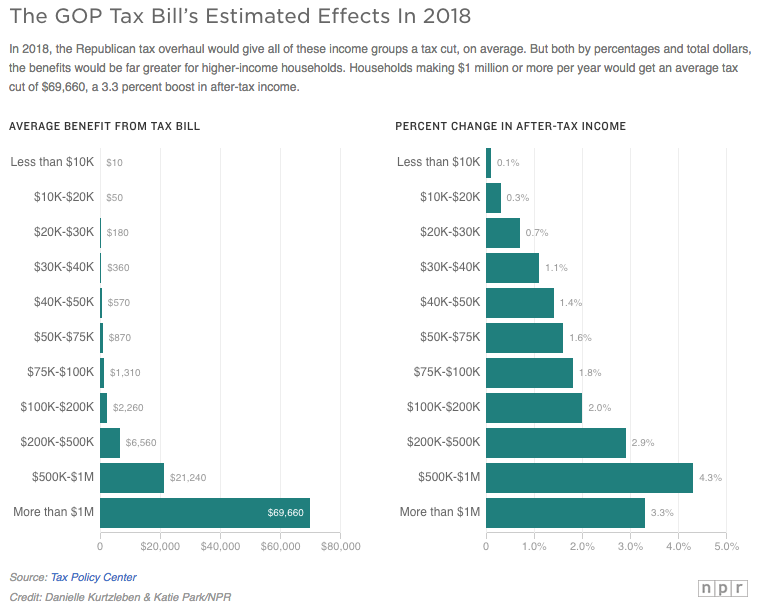

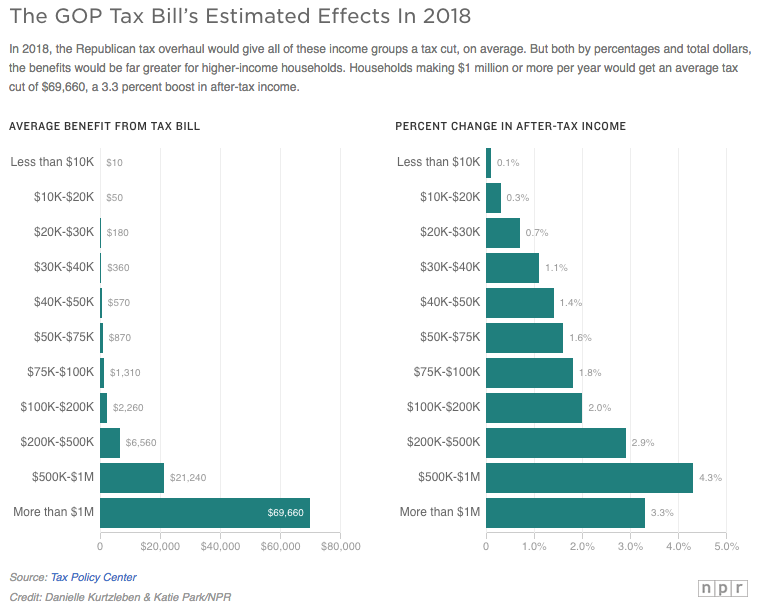

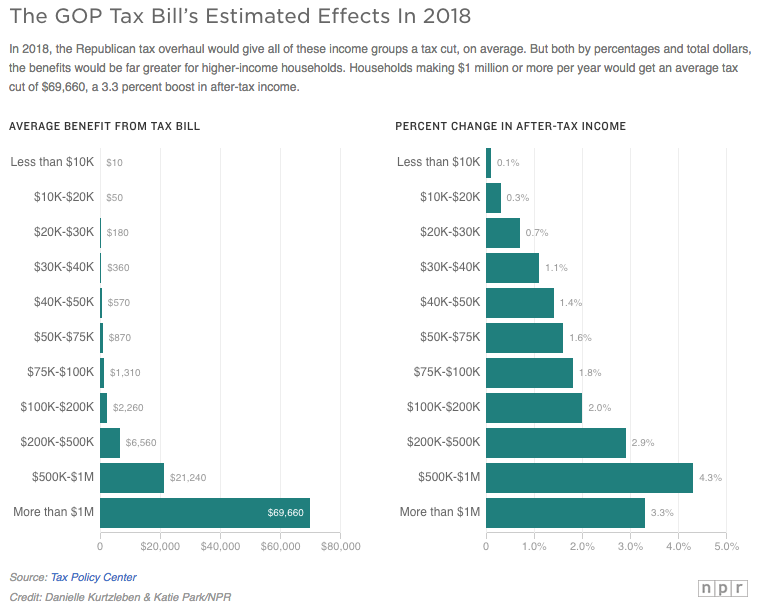

Well, Everyone making from 30K-200K is truly screwed. Really, WTF can you do with 600-1,310 bucks? If you get that.

If you can't move down a lower tax bracket, this all means nothing in the end. YOU THE MIDDLE CLASS GOT NOTHANG!

Plus..

If your local taxes hit you with raised tax percentages. That cost you 800-2,000 more a year?

You get screwed TWIC+E! Below 30K and above too 1M, it really makes no real impacts.

WOW! Over 1M really make out YUGE! What a conservative winning feeling this is.

Btw: Every new trillion that the national debt grows, means each taxpayer that files a return will own 6-$8300.

Only 136 Million returns were filed in 2016. Most of the income the IRS get come from the 30K- 200K range.

As most Corporations have no taxable income at the end of the year.

Forbes Welcome

Why 70% Of Companies Paid Zero In Corporate Taxes: They Had Zero Profits

In 2012, out of 1.6 million corporate tax returns, only 51% were returns that had positive “net incomes,” and only 32% were returns that had positive “incomes subject to tax.”

More falsehoods.Well, Based on these calculations, I'm so glad they passed tax cuts. So I pay more in taxes. In 2018 and way more by 2027.

Well, Everyone making from 30K-200K is truly screwed. Really, WTF can you do with 600-1,310 bucks? If you get that.

If you can't move down a lower tax bracket, this all means nothing in the end. YOU THE MIDDLE CLASS GOT NOTHANG!

Plus..

If your local taxes hit you with raised tax percentages. That cost you 800-2,000 more a year?

You get screwed TWIC+E! Below 30K and above too 1M, it really makes no real impacts.

WOW! Over 1M really make out YUGE! What a conservative winning feeling this is.

Btw: Every new trillion that the national debt grows, means each taxpayer that files a return will own 6-$8300.

Only 136 Million returns were filed in 2016. Most of the income the IRS get come from the 30K- 200K range.

As most Corporations have no taxable income at the end of the year.

Forbes Welcome

Why 70% Of Companies Paid Zero In Corporate Taxes: They Had Zero Profits

In 2012, out of 1.6 million corporate tax returns, only 51% were returns that had positive “net incomes,” and only 32% were returns that had positive “incomes subject to tax.”

Gee, paid liars.More falsehoods.Well, Based on these calculations, I'm so glad they passed tax cuts. So I pay more in taxes. In 2018 and way more by 2027.

Well, Everyone making from 30K-200K is truly screwed. Really, WTF can you do with 600-1,310 bucks? If you get that.

If you can't move down a lower tax bracket, this all means nothing in the end. YOU THE MIDDLE CLASS GOT NOTHANG!

Plus..

If your local taxes hit you with raised tax percentages. That cost you 800-2,000 more a year?

You get screwed TWIC+E! Below 30K and above too 1M, it really makes no real impacts.

WOW! Over 1M really make out YUGE! What a conservative winning feeling this is.

Btw: Every new trillion that the national debt grows, means each taxpayer that files a return will own 6-$8300.

Only 136 Million returns were filed in 2016. Most of the income the IRS get come from the 30K- 200K range.

As most Corporations have no taxable income at the end of the year.

Forbes Welcome

Why 70% Of Companies Paid Zero In Corporate Taxes: They Had Zero Profits

In 2012, out of 1.6 million corporate tax returns, only 51% were returns that had positive “net incomes,” and only 32% were returns that had positive “incomes subject to tax.”

Gee. The National CPA Association reports can educate you. Try proving them wrong.

Holy S***. I need to go home and check all my numbers. According to the OP's link I'm going to save a boat load of $$$.

HA!I do have a wife and you are all the same.

You can't control your spending habits.

"And just like that, Yousaidwhat had to go into hiding for fear for his life..."

go back and tell us about 2026.

Here use this one, it has years.

Use this calculator to see how the tax bill affects your paycheck - CNNPolitics

Says I save $240 a year

$20 a month

Says I save $240 a year

$20 a month

Or roughly $5 a week.

Don't spend it all in one place!