eagle1462010

Diamond Member

- May 17, 2013

- 69,505

- 34,566

- 2,290

Flat tax - Wikipedia, the free encyclopediaThe Rabbi

Why haven't you answered my question? You said that a flat tax is working well in Eastern European countries. I asked which ones.

How about it?

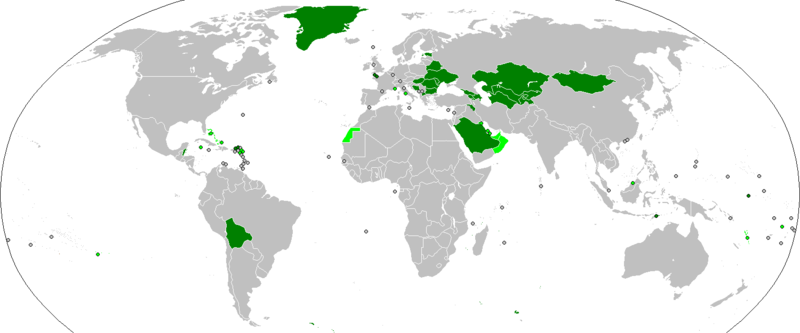

The countries that have recently reintroduced flat taxes have done so largely in the hope of boosting economic growth. The Baltic countries of Estonia, Latvia and Lithuania have had flat taxes of 24%, 25% and 33% respectively with a tax exempt amount, since the mid-1990s. On 1 January 2001, a 13% flat tax on personal income took effect in Russia. Ukraine followed Russia with a 13% flat tax in 2003, which later increased to 15% in 2007. Slovakia introduced a 19% flat tax on most taxes (that is, on corporate and personal income, for VAT, etc., almost without exceptions) in 2004. Romania introduced a 16% flat tax on personal income and corporate profit on 1 January 2005. Macedonia introduced a 12% flat tax on personal income and corporate profit on 1 January 2007 and promised to cut it to 10% in 2008.[21] Albania has implemented a 10% flat tax from 2008.[22] Bulgaria applies flat tax rate of 10% for corporate profits and personal income tax since 2008.[23]