Hutch Starskey

Diamond Member

- Mar 24, 2015

- 35,389

- 9,168

And?$250k for a married couple.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

And?$250k for a married couple.

Yeah, that's how loans work. Do you have a point?[ The More You Know ]

Report Highlights. The average student borrower takes 20 years to pay off their student loan debt.

Related reports include Student Loan Debt Statistics | Average Student Loan Debt | Student Loan Debt by State | Average Student Loan Interest Rate | Student Loan Refinancing

- Some professional graduates take over 45 years to repay student loans.

- 21% of borrowers see their total student loan debt balance increase in the first 5 years of their loan.

- The average medical school graduate’s salary is not sufficient to make their student loan payments.

Undergraduate Class of 2022 Projected Student Loan Repayment Timelines (3.73% APR, $37,175 Average Debt†)

†The average debt is based on the federal student loan debt portfolio and does not necessarily reflect the true average debt for 2022 undergraduates.

Monthly

PaymentUltimate

CostTime to Zero Debt $461‡ $42,863 7 yrs, 9 mos $372 $44,595 10 yrs, 0 mos $345◊ $45,341 10 yrs, 11 mos

‡ 10% of the typical starting gross income value for recent graduates (Bachelor’s).

◊10% of the typical starting net income value for recent graduates (Bachelor’s).

Average Student Loan Repayment Timelines

The amount of time it takes for an individual to repay their student loan debt depends on the initial amount borrowed, the loan’s interest rate, and repayment habits, among other factors.

*More recent reports claim shorter timelines (~18.5 years), but this comes from a poll of 2,200 borrowers between the ages of 26 to 45.

- 10 years is the ideal timeline for paying off student loan debt according to financial experts and the U.S. Department of Education (ED).

- In practice, it takes borrowers closer to 20 years to pay off their student loans.

- 21.1 years was the average length of repayment in a 2013 study of 61,000 respondents.*

- 45% of student loan borrowers decrease their balance in the first five years of repayment.

- 21% of student loan borrowers increase their balance in that same period.

- The average medical school graduate’s salary is not sufficient to make their student loan payments.

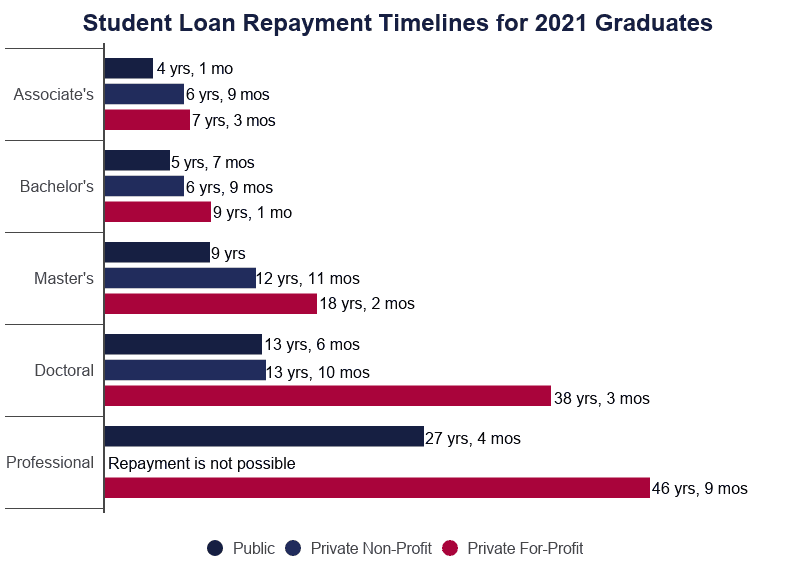

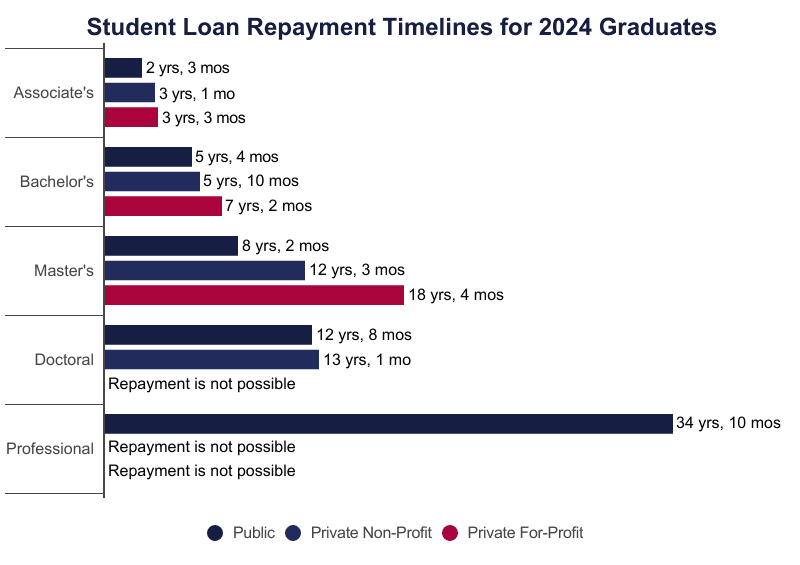

Class of 2021 Student Loan Repayment Timelines

Because student loan interest rates are at historic lows, current students may reasonably expect to pay off their student loan debts within the recommended 10-year timeline.

Associate’s Degree Debt Repayment (2.75% APR, $384 Monthly Payment)

- 3.73% is the 2021-2022 interest rate for Direct Subsidized and Unsubsidized federal student loans to undergraduate borrowers.

- 2.75% is the 2020-2021 interest rate for Direct Subsidized and Unsubsidized federal student loans.

- 10% of income should go toward paying off debts according to federal guidelines.

- 36% of income is the maximum amount that should go toward paying off debt.

- $42,500 is the low-end starting salary for a new graduate with a bachelor’s degree.

- $73,800 is the high-end salary.

- $64,900 is the average annual salary for a recent graduate with a bachelor’s degree.

- $52,000 is the median salary for new graduates with bachelor’s degrees.

- 4 to 12+ years is the projected student loan debt repayment period for bachelor’s degree holders who graduate in 2021.

Average Debt Ultimate Cost Time to Zero Debt $17,800 $18,800 4 yrs, 1 mos $28,300 $31,000 6 yrs, 9 mos $30,100 $33,200 7 yrs, 3 mos Associate’s Degree Debt Repayment

Student borrowers with associate’s degrees are significantly less likely to take on student loan debt if they attend public institutions. Private school attendees are actually more likely than their bachelor’s degree-seeking peers to use student loans to pay for school.

Bachelor’s Degree Debt Repayment (2.75% APR)

- Just 41% of Associate’s degree holders who graduated from public institutions use student loans to pay for school.

- 84% of attendees of private, nonprofit schools take on student loan debt.

- 88% of attendees of private, for-profit schools take on student loan debt.

- $46,100 is the average annual salary for a recently graduated associate’s degree holder.

- 4 to 7+ years is the projected student loan debt repayment period for associate’s degree holders who graduate in 2021.

Monthly

PaymentAverage

DebtUltimate

CostTime to Zero Debt $354 $29,500 $32,800 7 yrs, 9 mos $354 $35,000 $39,700 9 yrs, 4 mos $354 $45,300 $53,700 12 yrs, 8 mos $541 $29,500 $31,500 4 yrs, 10 mos $541 $35,000 $37,900 5 yrs, 10 mos $541 $45,300 $50,400 7 yrs, 9 mos $615 $29,500 $31,300 4 yrs, 3 mos $615 $35,000 $37,500 5 yrs, 1 mos $615 $45,300 $49,700 6 yrs, 9 mos Graduate Student Loan Debt Repayment Timelines

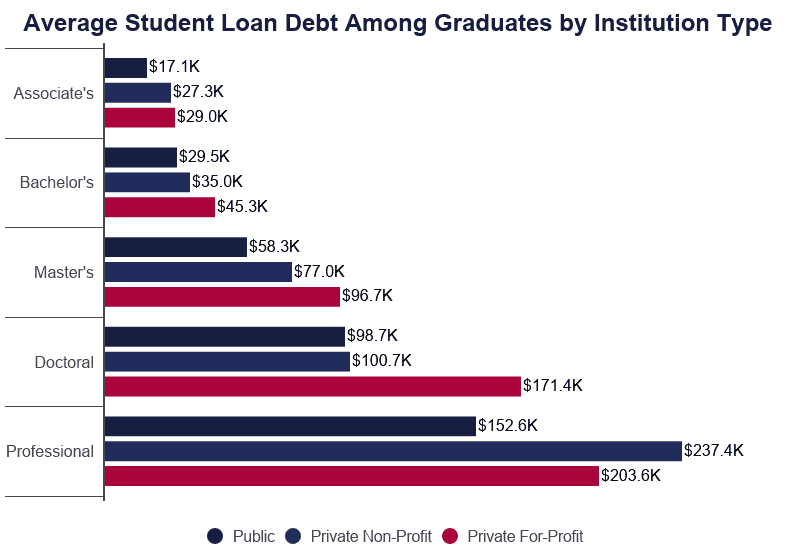

Graduate and professional students, on average, borrow more for school than undergraduate students. Their income rates tend to be higher, as well.

Master’s Graduate Student Loan Repayment ($669 Monthly Payment)

- 4.3% is the interest rate for Direct Unsubsidized federal student loans to graduate or professional borrowers.

- 5.3% is the interest rate for Direct PLUS loans, which go to graduate or professional borrowers as well as parents of undergraduates borrowing on their behalf.

- $58,300 is the average student debt for a borrower who graduated from a public institution with a Master’s degree.

- $96,700 is the average debt for master’s degree holders who attended a private, for-profit institution.

- $101,200-$175,600 is the range of average debt for doctoral degree holders.

- $243,300 is the average debt for professional degree holders who attended private, nonprofit institutions.

- $77,800 is the average salary for a master’s degree holder.

- $96,800 and $97,900 are the average respective salaries for people with professional and doctoral degrees.

Doctoral Graduate Student Loan Repayment ($833 Monthly Payment)

APR % Current

DebtUltimate

CostTime to Zero Debt 4.3% $58,300 $70,000 8 yrs, 9 mo 4.3% $77,000 $99,500 12 yrs, 5 mos 4.3% $96,700 $136,500 17 yrs, 0 mos 5.3% $58,300 $73,700 9 yrs, 2 mos 5.3% $77,000 $107,800 13 yrs, 5 mos 5.3% $96,700 $154,400 19 yrs, 3 mos

APR % Current

DebtUltimate

CostTime to Zero Debt 4.3% $98,700 $128,700 12 yrs, 11 mos 4.3% $100,700 $132,200 13 yrs, 3 mos 4.3% $171,400 $311,300 31 yrs, 2 mos 5.3% $98,700 $140,000 14 yrs, 0 mos 5.3% $100,700 $144,300 14 yrs, 5 mos 5.3% $171,400 $452,600 45 yrs, 3 mos

Postgraduate Student Loan Debt Repayment Timelines

When indebted students return to school, they may not be required to make payments on any outstanding student loan debts. This does not mean, however, that these debts stop collecting interest. Students seeking postgraduate work may take out additional loans on top of existing student loan debt.

Professional Graduate Student Loan Repayment ($843 Monthly Payment)

Alternative Professional Graduate Student Loan Repayment

APR % Current

DebtUltimate

CostTime to Zero Debt 4.3% $152,600 $246,500 24 yrs, 4 mos 292 4.3% $237,400 NA** NA 4.3% $203,600 $472,700 46 yrs, 9 mos 561 5.3% $152,600 $307,400 30 yrs, 5 mos 365 5.3% $237,400 NA NA 5.3% $203,600 NA NA

Monthly

Payment% of

IncomeAPR % Current

DebtUltimate

CostTime to Zero Debt $1,685 20% 4.3% $237,400 $331,100 16 yrs, 5 mos $2,528 30% $237,400 $289,900 9 yrs, 7 mos $1,685 20% 5.3% $203,600 $291,700 14 yrs, 5 mos

(full article online)

Average Time to Pay Off Student Loans [2023]: Data Analysis

An in-depth analysis of how long it takes to pay off student loan debt with various incomes and educational attainment levels.educationdata.org

And?

Nope. It means they each get $10k like everyone else.And a couple of rich white lawyers who make $249,999 a year are getting their loans paid off by you!

LOL

Democrats and Republicans are shocked by it. Stop make it into just one party.In a related story, skyrocketing cost of college shocks dumb lefties.

More than that, since the limit for married couples is $250K.

Think of that, Biden cultists. A rich white couple making $249,000 a year is getting their student loans paid off by you.

LOL

Nope. It means they each get $10k like everyone else.

Like Who?And a couple of rich white lawyers who make $249,999 a year are getting their loans paid off by you!

LOL

Like Who?

And you do know of the financial status of each one of those lawyers, how their career is going, how many children, etc......And a couple of rich white lawyers who make $249,999 a year are getting their loans paid off by you!

LOL

As I thought. You do not know of anyone, you just throw it to the wall and hope it sticks.Anyone who has a student loan they don't want to pay back. Pick someone.

Nope. It means they each get $10k like everyone else.

I think each qualify under the rules. Neither you nor I will pay anything more.So you think two rich white lawyers making $249,999 deserve $10K, no strings attached, from your taxes?

^^^^How about the Republicans?

Great. They also then have $100k in loans for their law degrees.Or $40K if they both had Pell grants in undergrad and maybe get released years ealier from an IDR plan if their payment count adjustments happen depending on their ages. Lots of balls in the air for borrowers right now. By waiting until the last minute to make this announcement that could have been made months ago, they have sent a lot of people scrambling like mad at the 11th hour trying to redo their loans to land in the Direct Loan pile for relief by October 31.

Thank you for not caring about all of those Republicans whose debts are making their lives and finances more difficult to move on.^^^^

Whataboutism.

Thank you for agreeing that the Democrats are buying votes.

Irrelevant to the fact you agree the Democrtats are buying votes.Thank you for not caring about all of those Republicans...

I agreed to no such thing. Because it is not the case.Irrelevant to the fact you agree the Democrtats are buying votes.