jotathought

Diamond Member

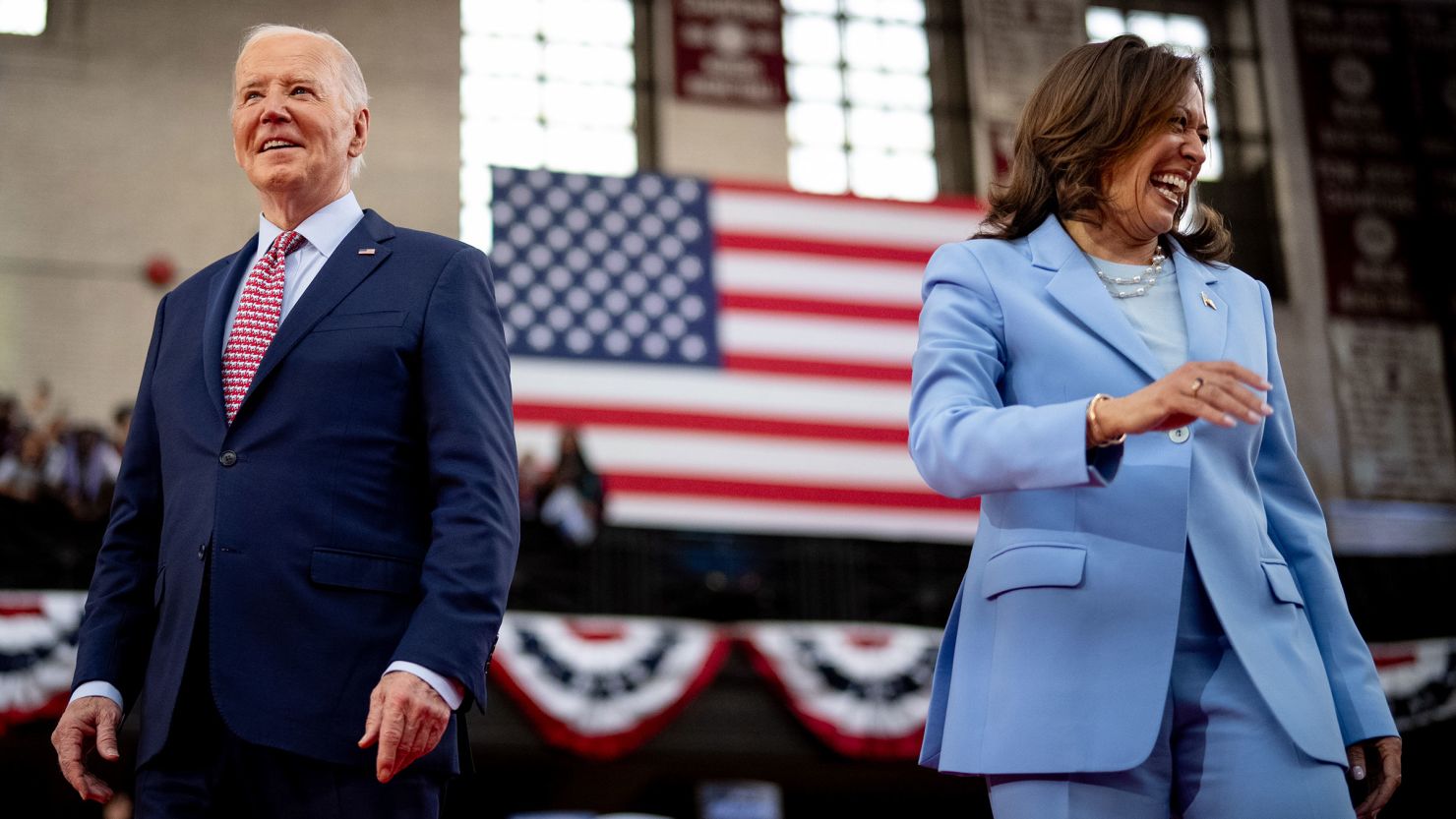

That's not the point .. it's a policy position of Kamala (and Biden) that would be devasting to the investment market. If Democrats were to take the majority in the House and Senate, it would move forward.Don't all politicians blow smoke up your ass? They can say anything they want and most of what they say has to get through congress. So how much gets through?