Uncensored2008

Libertarian Radical

[

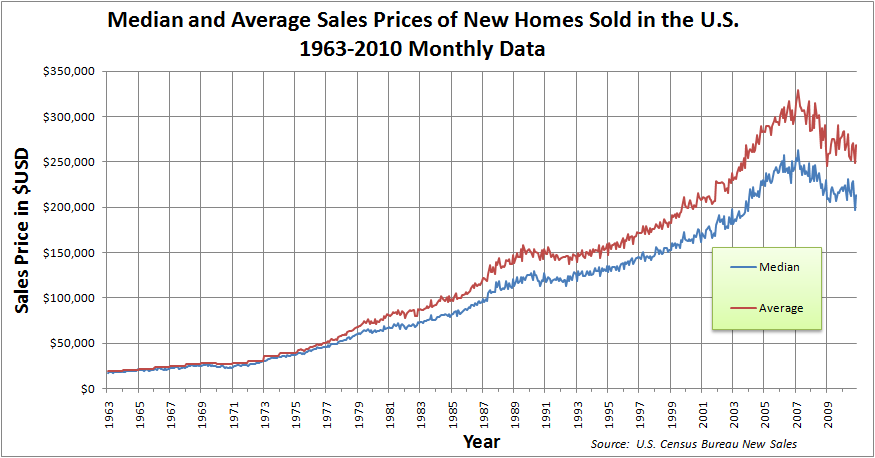

So then why is it that Conservatives are the ones who give us those bubbles? Dotcom bubble in 2000 thanks to the Capital Gains Tax Cut of 1997, Mortgage bubble in 2004-7 thanks to Bush deregulating the mortgage industry and his tax cuts.

Wait, you're claiming the housing bubble started in 2004?

I thought you claimed that you didn't lie?

Or is this one of those definition issues, where a lie is anything that opposes the party and truth is anything that promotes the party?

Q When did the Bush Mortgage Bubble start?

A The general timeframe is it started late 2004.

From Bush's President's Working Group on Financial Markets October 2008

"The Presidents Working Group's March policy statement acknowledged that turmoil in financial markets clearly was triggered by a dramatic weakening of underwriting standards for U.S. subprime mortgages, beginning in late 2004 and extending into 2007."

Q Did the Community Reinvestment Act under Carter/Clinton caused it?

A "Since 1995 there has been essentially no change in the basic CRA rules or enforcement process that can be reasonably linked to the subprime lending activity. This fact weakens the link between the CRA and the current crisis since the crisis is rooted in poor performance of mortgage loans made between 2004 and 2007. "

http://www.federalreserve.gov/newsevents/speech/20081203_analysis.pdf

Q Why is it commonly called the subprime bubble ?

A Because the Bush Mortgage Bubble coincided with the explosive growth of Subprime mortgage and politics. Also the subprime MBS market was the first to collapse in late 2006. In 2003, 10 % of all mortgages were subprime. In 2006, 40 % were subprime. This is a 300 % increase in subprime lending. (and notice it coincides with the dates of the Bush Mortgage bubble that Bush and the Fed said)

FACTS on Dubya's great recession

The problem I have with what you post is that it is so rarely true.

The Bubble started in 1997.

The link to the Fed doesn't work and SURE the fuck doesn't say what you posted.

{

One of the few positive developments from the housing bubble is that many mainstream economists have recognized the pernicious role played by the Federal Reserve. Indeed, some analysts on CNBC have discussed the outright abolition of the Fed.

The case against the Fed is straightforward: In an attempt to jumpstart the economy out of recession, Greenspan slashed the federal funds target from 6.5% in January 2001 down to a ridiculous 1% by June 2003. After holding rates at 1% for a year, the Fed then steadily ratcheted them back up to 5.25% by June 2006. The connection between these moves by the central bank, versus the pumping up and popping of the housing bubble, seemed to be more than just a coincidence. On the contrary, it looked like a classic example of the Misesian theory of the business cycle, in which artificially low interest rates lead to malinvestments, which then require a recession to correct.}

Did the Fed Cause the Housing Bubble?