harmonica

Diamond Member

- Sep 1, 2017

- 43,841

- 20,017

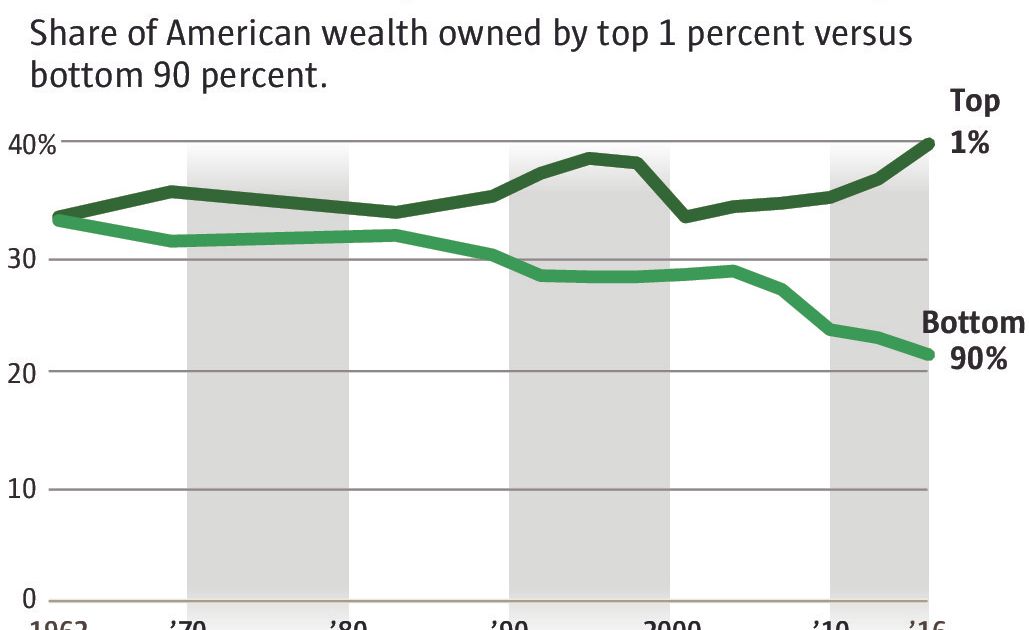

MORE babble crap from you--keep it goingNot babbling, maybe you're having a stroke or something?hahhahahha--you can't babble shit it......hahahhahahahhahaThe 1% have 90% of the wealth. Their fair share is 90% of the taxes.the rich pay MORE than their fair share--DUH!!!!!Trickle down economics doesn't work......the rich create the businesses that create jobs .....the poverty people are lazy dumbassesHow much do you suppose tRump's tax cuts for rich people helped child poverty?Turns out a couple thousand bucks more per year goes a long way for those who need it most.

Center on Poverty and Social Policy

The American Family Act's proposed reforms to the Child Tax Credit present an opportunity to transform the credit into one that works for all children, not just those whose parents earn enough to qualify. We find that the AFA would move 4 million children out of poverty and cut deep poverty amonwww.povertycenter.columbia.edu

Hint: it didn't.

Get over it.

The Rich Pay More Than Their Fair Share of Federal Income Taxes

The top 1 percent of income earners pay 39.5 percent of all federal income taxes, nearly twice the share of national income they earn.observer.com