BluesLegend

Diamond Member

- Sep 7, 2014

- 76,780

- 54,388

stop financing your tax cuts, "parasites".Get a job losers, pay your fair share you mooching parasites.

You losers suck up the lions share of government spending, pay your share.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

stop financing your tax cuts, "parasites".Get a job losers, pay your fair share you mooching parasites.

You should not be making Profit; not for profit is what we should be saving as the difference.The right wing needs to pay for their warfare programs;Until the Tax Code includes a per capita maximum tax amount, it can never be truly fair.

Once you have paid ... pick a number... then you have paid enough. Make it a million dollars - i don't care - but for the maximum to be open ended, thus punishing success, it is unfair.

In consideration of the monstrous sacrifice in property and blood that each war demands of the people, personal enrichment through a war must be designated as a crime against the people. Therefore, we demand the total confiscation of all war profits.

We do. Considering we pay the majority of taxes.

You should not be making Profit; not for profit is what we should be saving as the difference.The right wing needs to pay for their warfare programs;Until the Tax Code includes a per capita maximum tax amount, it can never be truly fair.

Once you have paid ... pick a number... then you have paid enough. Make it a million dollars - i don't care - but for the maximum to be open ended, thus punishing success, it is unfair.

In consideration of the monstrous sacrifice in property and blood that each war demands of the people, personal enrichment through a war must be designated as a crime against the people. Therefore, we demand the total confiscation of all war profits.

We do. Considering we pay the majority of taxes.

Yet the left screams they are not paying their fair share and should pay moreOk, so the top 50% paid 90% of all income taxes. That's only fair since they made 90% of all the income.Seems like they are paying their fair share to me

-Geaux

--------------------

(Bloomberg) -- Individual income taxes are the federal government’s single biggest revenue source. In fiscal year 2018, which ended Sept. 30, the individual income tax is expected to bring in roughly $1.7 trillion, or about half of all federal revenues, according to the Congressional Budget Office.

If past statistics can offer any guidance, in 2016, $1.44 trillion income taxes were paid by 140.9 million taxpayers reporting a total of $10.2 trillion in adjusted gross income, according to data recently released by the Internal Revenue Services.

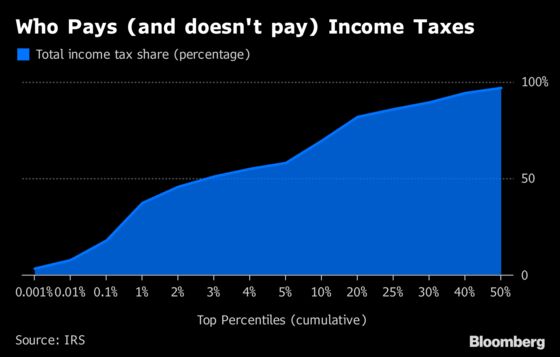

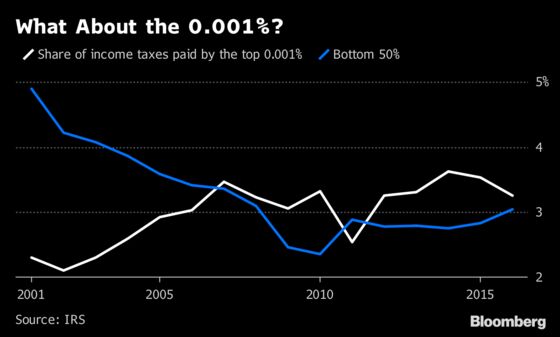

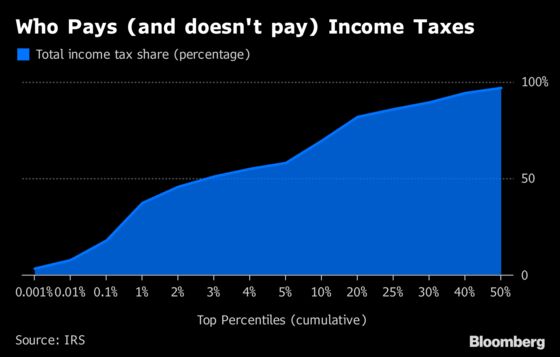

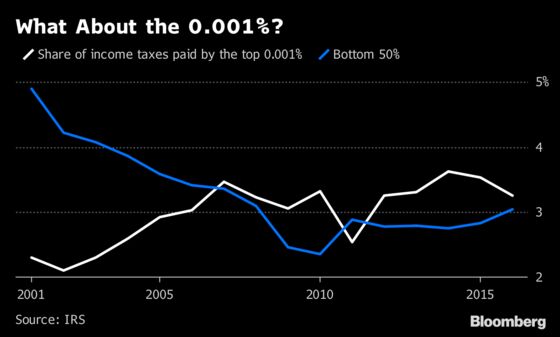

Bloomberg looked into the 2016 individual returns data in detail for some additional insights illustrated in the charts below:

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes.

- In other words, the bottom 50 percent paid 3 percent. Which small percentile of tax payers also paid 3 percent or more? You might have guessed it. It is the top 0.001%, or about 1,400 taxpayers. That group alone paid 3.25 percent of all income taxes. In 2001, the bottom 50 percent paid nearly 5 percent whereas the top 0.001 percent of filers paid 2.3 percent of income taxes.

Top 3% of U.S. Taxpayers Paid Majority of Income Taxes in 2016

- The individual income tax system is designed to be progressive – those with higher incomes pay at higher rates. While the indentation, or the reduction in the steepness of the "progressivity" curve, is visible at the highest levels.

Do you see the problem yet?

-Geaux

inflation happens anyway; at least the Poor will benefit.You are ignorant. $15 minimum wage wot correct the defect. Your socialist posts are always moonbeamsraise the minimum wage until the poor pay enough in taxes.Well we know its not 47% of the population

-Geaux

15 minimum wage would in fact reduce federal spending on low income people and increase how much they pay in taxes.

But as always you ignore the fact that products will increase in cost to make up for the loss in income.

the right wing, "hates it when that happens".

Majority use stolen fake SS numbersNo, let the poor get a higher paying job, then they will pay higher taxes.raise the minimum wage until the poor pay enough in taxes.Well we know its not 47% of the population

-Geaux

-Geaux

WTF?...who is not letting people get a better paying job?

But intill they do get one, minimum wage ensures they are minimaly compensated for their labor.

29 million filthy, low iQ, illiterate wetbacks that can’t speak the native language and have zero communication skills fuck shit all up don’t they?

No you stupid racist shit. Those "wetbacks that can't speak the native language" pay billions, yes BILLIONS with a B, in Social Security taxes and they will never collect a dime. Better yet, you never ever hear them bitch about it. In my book, that makes them more of a "real American" than you can ever hope to be.

did You receive any benefit from the tax break? The Poor still have to pay higher rent prices, higher gas prices; and need a fifteen dollar an hour minimum wage and unemployment compensation for simply being unemployed.not even a financed tax break that helps make You richer simply passing on greater Debt, to the People.Top 3% received the greatest benefit from the collective efforts of all the rest, especially the "defense" provided.

As a member of the top 3% ?

You're a fuken liar. I receive nothing from the gov.

You obviously dont know who the 3% consists of.

Because we have to pay down right wing deficit spending; for the global wars not global trade.But the left wants higher taxes regardless of who is in officeBecause the right wing prefers to be cognitively dissonant regarding Spending.why?it is about raising more tax revenue.You are ignorant. $15 minimum wage wont correct the defect. Your socialist posts are always moonbeamsraise the minimum wage until the poor pay enough in taxes.

-Geaux

-Geaux

You should not be making Profit; not for profit is what we should be saving as the difference.The right wing needs to pay for their warfare programs;Until the Tax Code includes a per capita maximum tax amount, it can never be truly fair.

Once you have paid ... pick a number... then you have paid enough. Make it a million dollars - i don't care - but for the maximum to be open ended, thus punishing success, it is unfair.

In consideration of the monstrous sacrifice in property and blood that each war demands of the people, personal enrichment through a war must be designated as a crime against the people. Therefore, we demand the total confiscation of all war profits.

We do. Considering we pay the majority of taxes.

So you're saying we shouldnt be paid or our work?

You seem to have a twisted idea of who the top 3% are.

We're people who have worked hard and invested wisely.

How can you think you deserve a bigger cut when you've done nothing to earn it?

it was about morals from the Age of Iron; don't like it, stop whining about "laziness from the Poor".why complain about it? the rich should be Taxed into Heaven; it is the moral thing to do.lol. Only if You convince the right wing to stop whining about the cost of social services for the Poor.No, let the poor get a higher paying job, then they will pay higher taxes.raise the minimum wage until the poor pay enough in taxes.

-Geaux

Considering we pay for it.....

a fifteen dollar an hour minimum wage and unemployment compensation at fourteen dollars an hour equivalent should be ok, to start with.

In response to your funny....here's one for you.

For one, if they are paying rent in California, they should move to a more economical, state income tax free state. I can't help if they want to live beyond their meansdid You receive any benefit from the tax break? The Poor still have to pay higher rent prices, higher gas prices; and need a fifteen dollar an hour minimum wage and unemployment compensation for simply being unemployed.not even a financed tax break that helps make You richer simply passing on greater Debt, to the People.Top 3% received the greatest benefit from the collective efforts of all the rest, especially the "defense" provided.

As a member of the top 3% ?

You're a fuken liar. I receive nothing from the gov.

You obviously dont know who the 3% consists of.

You losers can't employ, Everyone and whine about the cost of social services, even in alleged Right to Work States.stop financing your tax cuts, "parasites".Get a job losers, pay your fair share you mooching parasites.

You losers suck up the lions share of government spending, pay your share.

No we don'tBecause we have to pay down right wing deficit spending; for the global wars not global trade.But the left wants higher taxes regardless of who is in officeBecause the right wing prefers to be cognitively dissonant regarding Spending.why?it is about raising more tax revenue.You are ignorant. $15 minimum wage wont correct the defect. Your socialist posts are always moonbeams

-Geaux

-Geaux

Profit is usually after expenses. Capitalists should know that.You should not be making Profit; not for profit is what we should be saving as the difference.The right wing needs to pay for their warfare programs;Until the Tax Code includes a per capita maximum tax amount, it can never be truly fair.

Once you have paid ... pick a number... then you have paid enough. Make it a million dollars - i don't care - but for the maximum to be open ended, thus punishing success, it is unfair.

In consideration of the monstrous sacrifice in property and blood that each war demands of the people, personal enrichment through a war must be designated as a crime against the people. Therefore, we demand the total confiscation of all war profits.

We do. Considering we pay the majority of taxes.

So you're saying we shouldnt be paid or our work?

You seem to have a twisted idea of who the top 3% are.

We're people who have worked hard and invested wisely.

How can you think you deserve a bigger cut when you've done nothing to earn it?

Majority use stolen fake SS numbersNo, let the poor get a higher paying job, then they will pay higher taxes.raise the minimum wage until the poor pay enough in taxes.

-Geaux

WTF?...who is not letting people get a better paying job?

But intill they do get one, minimum wage ensures they are minimaly compensated for their labor.

29 million filthy, low iQ, illiterate wetbacks that can’t speak the native language and have zero communication skills fuck shit all up don’t they?

No you stupid racist shit. Those "wetbacks that can't speak the native language" pay billions, yes BILLIONS with a B, in Social Security taxes and they will never collect a dime. Better yet, you never ever hear them bitch about it. In my book, that makes them more of a "real American" than you can ever hope to be.

-Geaux

You losers can't employ, Everyone and whine about the cost of social services, even in alleged Right to Work States.stop financing your tax cuts, "parasites".Get a job losers, pay your fair share you mooching parasites.

You losers suck up the lions share of government spending, pay your share.

Capitalism has a Natural rate of unemployment. It is for the benefit of Capitalists, not the Poor.

lol. what "harder work do the wealthier do"?You should not be making Profit; not for profit is what we should be saving as the difference.The right wing needs to pay for their warfare programs;Until the Tax Code includes a per capita maximum tax amount, it can never be truly fair.

Once you have paid ... pick a number... then you have paid enough. Make it a million dollars - i don't care - but for the maximum to be open ended, thus punishing success, it is unfair.

In consideration of the monstrous sacrifice in property and blood that each war demands of the people, personal enrichment through a war must be designated as a crime against the people. Therefore, we demand the total confiscation of all war profits.

We do. Considering we pay the majority of taxes.

So because we work harder and smarter we shouldnt receive more for our efforts?

You sir need a bullet in the head.

With a fifteen dollar an hour minimum wage and unemployment compensation for simply being unemployed?inflation happens anyway; at least the Poor will benefit.You are ignorant. $15 minimum wage wot correct the defect. Your socialist posts are always moonbeamsraise the minimum wage until the poor pay enough in taxes.

15 minimum wage would in fact reduce federal spending on low income people and increase how much they pay in taxes.

But as always you ignore the fact that products will increase in cost to make up for the loss in income.

the right wing, "hates it when that happens".

How do the poor benefit in that situation?

not even a financed tax break that helps make You richer simply passing on greater Debt, to the People.Top 3% received the greatest benefit from the collective efforts of all the rest, especially the "defense" provided.

As a member of the top 3% ?

You're a fuken liar. I receive nothing from the gov.

You obviously dont know who the 3% consists of.

So? Too low.Seems like they are paying their fair share to me

-Geaux

--------------------

(Bloomberg) -- Individual income taxes are the federal government’s single biggest revenue source. In fiscal year 2018, which ended Sept. 30, the individual income tax is expected to bring in roughly $1.7 trillion, or about half of all federal revenues, according to the Congressional Budget Office.

If past statistics can offer any guidance, in 2016, $1.44 trillion income taxes were paid by 140.9 million taxpayers reporting a total of $10.2 trillion in adjusted gross income, according to data recently released by the Internal Revenue Services.

Bloomberg looked into the 2016 individual returns data in detail for some additional insights illustrated in the charts below:

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes.

- In other words, the bottom 50 percent paid 3 percent. Which small percentile of tax payers also paid 3 percent or more? You might have guessed it. It is the top 0.001%, or about 1,400 taxpayers. That group alone paid 3.25 percent of all income taxes. In 2001, the bottom 50 percent paid nearly 5 percent whereas the top 0.001 percent of filers paid 2.3 percent of income taxes.

Top 3% of U.S. Taxpayers Paid Majority of Income Taxes in 2016

- The individual income tax system is designed to be progressive – those with higher incomes pay at higher rates. While the indentation, or the reduction in the steepness of the "progressivity" curve, is visible at the highest levels.