HereWeGoAgain

Diamond Member

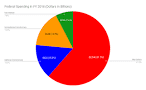

did You receive any benefit from the tax break? The Poor still have to pay higher rent prices, higher gas prices; and need a fifteen dollar an hour minimum wage and unemployment compensation for simply being unemployed.not even a financed tax break that helps make You richer simply passing on greater Debt, to the People.Top 3% received the greatest benefit from the collective efforts of all the rest, especially the "defense" provided.

As a member of the top 3% ?

You're a fuken liar. I receive nothing from the gov.

You obviously dont know who the 3% consists of.

If you knew anything about the tax cuts you'd know i received almost zero benefit.