Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BREAKING NEWS: Trump proposes 20% tax on imports from Mexico to pay for wall

- Thread starter Lakhota

- Start date

P@triot

Diamond Member

- Jul 5, 2011

- 61,489

- 11,691

Which shows he has more sense than Obama and the Dumbocrats - who forged ahead with their failed and ignorant ideas even after they were informed of how catastrophic they would be. It's nice to have a pragmatist sitting in the Oval Office.Trump's been informed how retarded the 20% tariff is, and he is already running away from it, less than a day later.

g5000

Diamond Member

- Nov 26, 2011

- 125,277

- 68,984

I knew the tariff was a bad idea immediately. So Trump clearly has less sense than I do.Which shows he has more sense than Obama and the Dumbocrats - who forged ahead with their failed and ignorant ideas even after they were informed of how catastrophic they would be. It's nice to have a pragmatist sitting in the Oval Office.Trump's been informed how retarded the 20% tariff is, and he is already running away from it, less than a day later.

How scary is that?

g5000

Diamond Member

- Nov 26, 2011

- 125,277

- 68,984

By your TardLogic™, we shouldn't deport those illegals who are paying for the wall.Due to your unmitigated stupidity - you think I made a statement. When in fact, I asked a question.Are Mexican tomatoes ONLY bought by "illegal aliens"???That depends. Are the products being purchased by illegal aliens in America?

I suspect that a lot of Mexican products are purchased by illegal aliens (they are cheaper, familiar, etc.). So I was asking if the products in question with regards to your question are being purchased by illegal aliens. If the answer is yes - then Mexico is in fact paying for the wall. At least part of it.

nat4900

Diamond Member

- Mar 3, 2015

- 42,021

- 5,965

Yeah. It's illegals who are buying all that lettuce from Mexico. And tomatoes. And machinery. And fuel.

And the other $320 billion of imports from Mexico.

Okay.

Be "kind"....Patsy is NOT that smart......

nat4900

Diamond Member

- Mar 3, 2015

- 42,021

- 5,965

By your TardLogic™, we shouldn't deport those illegals who are paying for the wall.

PERFECT response (but probably over the nitwit's head)

Eloy

Gold Member

- Sep 9, 2016

- 4,949

- 383

See Post # 199If a 20% tariff on Mexican products will "pay for the wall".....Isn't that the EXACT SAME as asking American consumers to pay for the wall?.......Yes or No?

BREAKING NEWS: Trump proposes 20% tax on imports from Mexico to pay for wall

WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,092

But when you ask liberals here why they are against American jobs they give you crickets!Mexico has been screwing us for over 20 years and when someone with balls tightens the screws they cry and run to the media like little bitches

TyroneSlothrop

Diamond Member

- Oct 11, 2013

- 31,543

- 21,415

WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,092

Building that wall will cost less than the yearly cost of illegals in this country.

namvet

Gold Member

- May 20, 2008

- 9,549

- 1,650

BREAKING NEWS: Now Trump has slapped a 20% tax on all imports from Mexico to pay for the border wall. Does that include his stuff made in Mexico?

White House press secretary says border wall will be funded by 20 percent import tax on Mexican goods

nice photoshop

Sun Devil 92

Diamond Member

- Apr 2, 2015

- 32,078

- 11,094

BREAKING NEWS

BREAKING NEWS

BREAKING NEWS

ROTFLMAO

BREAKING NEWS

BREAKING NEWS

ROTFLMAO

usmbguest5318

Gold Member

- Jan 1, 2017

- 10,923

- 1,635

Watch Mexico do the same to us...

Trade war is coming.

Wouldn't this just cause American companies to start making products in America?

Not necessarily. There are two factors suppliers and government officials must consider:

- Incidence of the tax/tariff -- This is merely a economist's way of indicating whether the cost of the tariff can or cannot be passed from the supplier to their customers. Keep in mind that this is not an accounting cost analysis because economics includes opportunity cost -- the cost of not having resources available for additional or alternative uses that may be more profitable -- whereas accounting does not.

- The impact on consumer and producer surplus -- Consumer surplus is the excess value consumers receive as a result of their being willing to pay more than "X," which is the actual price they must pay to demand (buy) a good or service. For the most part, one can think of consumer surplus as the sum by which the selling price (good + tax + fees) can increase without causing a decline in the quantity of that being demanded.

You see this play out every time you buy bottled water, for example. You are willing to pay about $1.50 for a pint of water, yet you don't actually have to pay that much for it. When you buy bottled water, you give up some of the consumer surplus you enjoy by having access to tap water, which quite often is free. The same thing goes on every time you choose to buy, say, Pepsi instead of your grocer's brand of cola. Quite literally, Pepsi is aware that consumers are willing to pay more for cola, thus they charge more, and in so doing, they shift some of the consumer surplus to their benefit. (Marketing is how they do that. That's what marketing is for -- to shift economic principles to facilitate/enhance/favor the producer's efforts to generate profit.)

In the context of evaluating the impact of a tariff (a tax) on consumer surplus, one sees that consumer surplus is greatest when the supplier's products are demanded inelastically. The same analysis shows too when demand is inelastic, the incidence of taxes falls more on the consumer than on the producer. This makes sense because with goods that are inelastically demanded, the price can merely increase. That increase -- be it due to the supplier charging more to recover the cost of an import tariff or for any other reason -- is something consumers are willing to bear, as shown by their being willing to pay more than the market price for the good/service.

It is important to note that it is relative inelasticity/elasticity that matters, not absolute elasticity/inelasticity. For instance, if a shirt producer who produces its goods abroad faces a more inelastic demand curve than does a domestic shirt producer, that supplier's goods can increase in price by some amount and still be demanded at effectively the same quantity (rate) as before the price increase. The key question the supplier must answer is by how much can they increase the price. The answer to that depends on the price of competing and comparable products.

How does this play out in the matter of imposing an import duty on imported goods from Mexico? Well, one must look at the situation of the producers. I'll use the generic term shirtmaker for the illustration; it doesn't matter whether the producer (or class of producers -- industries and industry segments -- if one wants to consider the macroeconomic side of the picture) makes shirts or boxes or cars or anything else.

- "High price" importing shirtmakers face a generally elastic demand curve, so they can't increase the price by very much. Whatever flexibility they have will derive (1) from consumers simply being wealthy enough to be willing to bear the cost increase and (2) the price of domestically made comparable shirts.

- "High price" domestic shirtmakers face a similarly elastic demand curve as do the importers, but they, in all likelihood, will elect to increase their prices in light of the tariff on their importing competitors' goods, and in so doing, claim for themselves a greater portion of whatever consumer surplus exists. If the tariff increases prices enough and it cannot be easily avoided by makers shifting to a place other than Mexico, some aspiring domestic entrepreneurs may see this as an opportunity and enter the "high price" shirt market. (Though that is theoretically possible and must therefore be mentioned, as a practical matter, it's unlikely to happen in the U.S. as we already have "high price" shirtmakers in the U.S. Indeed, that's about the only kind of shirtmakers we have in the U.S. That's so for garments, but it's also so for all goods. America has high labor costs compared to many other places.)

- "Low price" importing shirtmakers face a comparatively inelastic demand curve, so they have the greatest degree of flexibility when it comes to increasing their prices to recover the cost of an import duty. While they may experience lower quantities demanded by some of their least wealthy customers, they will acquire new customers who now see the price of the higher priced shirts they formerly bought as too high and who, after the tariff, choose a substitute shirt that has a lower price than does the shirt they formerly would have purchased.

- It is worth noting here that Trump has singled out Mexico for his tariff. There is a very good likelihood that producers will evaluate the cost of shifting production to lower cost locales like Bangladesh or other low cost nations. Whether they do will depend on transportation costs and the differential between the costs of land, labor and capital, and mostly labor unless the producer must build a factory of its own, in those localities and in the U.S. It will also depend on the extent of commitment they have in Mexican production. If they own their factory in Mexico, they have a greater commitment than if they do not; however, if they've owned it for a long time, they may have already realized their desired return on their investment in it such that they are willing to sell it and move elsewhere or keep it and simply open another factory elsewhere, thereby making a play not only for domestic Mexican production, but also for U.S. sales by securing lower cost production alternatives in countries having even lower labor costs than Mexico.

- "Low price" domestic shirtmakers face a similarly inelastic demand curve; however, as the cost of labor is higher domestically than abroad, in Mexico in this instance, the demand curve they face is more elastic than that of their competitors who import. These producers may also increase their prices as did the "high price" producers, but they also may not in an effort to make a play for greater quantities demanded and so as to acquire the customers lost by their importing customers. Whether they increase their prices depends on whether the tariff increases the price of imported shirts so that it is at least the same as or higher than what the domestic producers charged before the tariff.

- Tariff makes imported shirts from Mexico cost more than domestic shirts --> Domestic producers can pursue either strategy. Which any given producer elects to pursue is purely a business decision based on the firm's core competencies and readiness to act.

- Tariff makes imported shirts from Mexico cost more than domestic shirts --> Some entrepreneurs may see this as an opportunity and enter the "low price" shirt market. At the low price end of the shirt market, this is more likely to occur than it is as the prices of shirts increases. The concern, however, at least as goes Trump's desire to restore manufacturing jobs to the U.S., is that in the 21st century, production of most goods can be automated thus whether to enter the market will depend on the internal rate of return (how long it'll take to recoup the cost of buying production equipment, capital) that a producer can reasonably expect and the opportunity cost the would be producer experiences by choosing to use his resources to make shirts instead of something else.

- Tariff leaves imported shirt from Mexico lower or equal in price with domestic ones --> Domestic producers do not increase their price.

- Incidence of tax/tariffs

- Consumer surplus

- Price elasticity of demand

- Opportunity cost

- Substitute goods

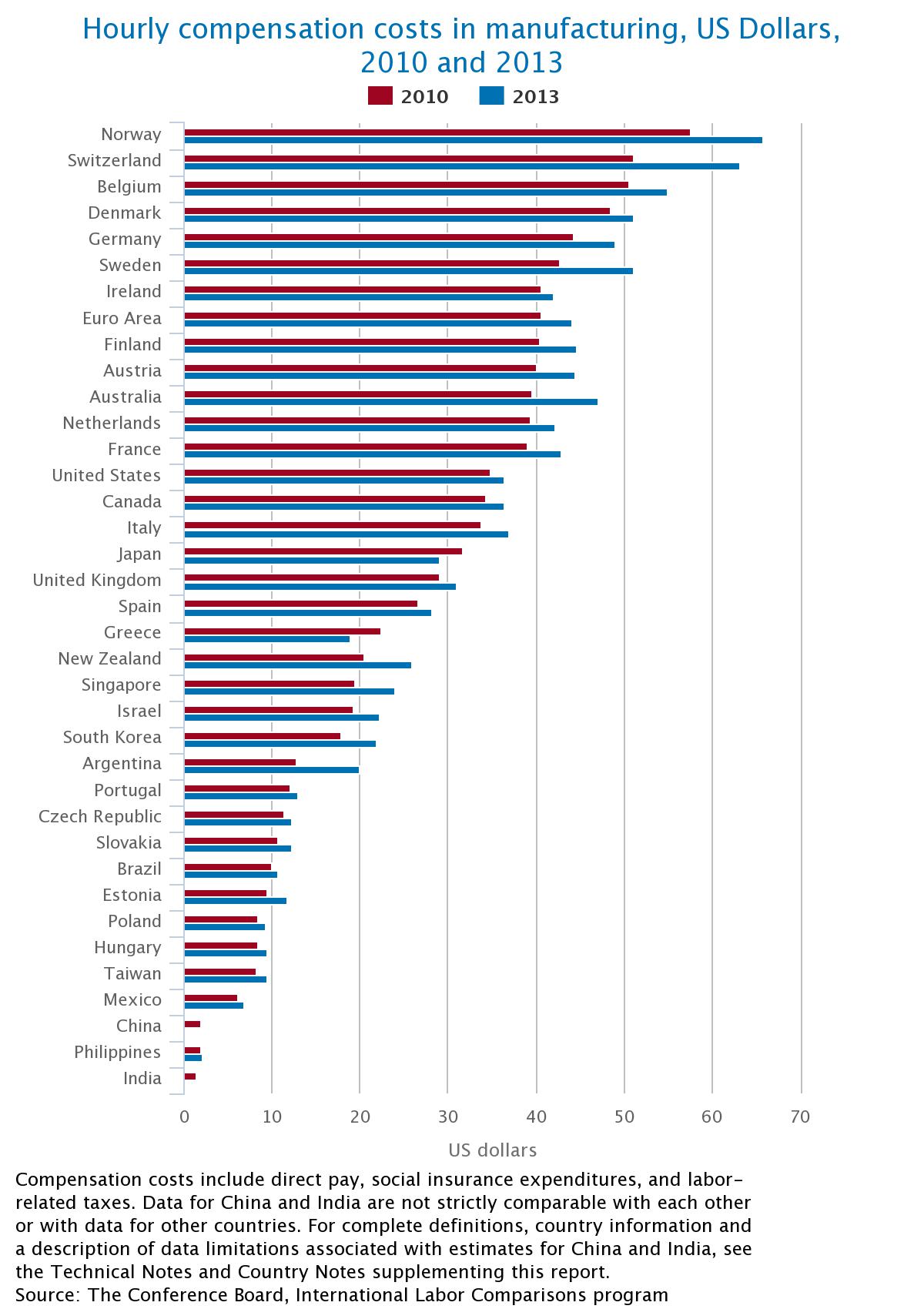

- Labor costs for selected counties

- Tax incidence and consumer surplus considered together

The following formal illustration shows the movement from a situation where the is a tariff to one where there is not. I've chosen this depiction because it allows one to see that the situation viewed from the opposite direction works exactly the same as it does if one goes from no tariff to having a tariff. Math's just like that, and in economics f(P) = Q, thus it doesn't matter from which starting point one commences. (Don't allow the fact that economists put quantity on the x-axis. Quantity is a function of price, not the other way round. We have Alfred Marshall to thank for that oddity.)

The left hand diagram depicts the current (pre cut) situation where the considered good faces a tariff (t0) which entails a domestic price of Pw+T0 (Pw is world price) and, given the structure of the demand, an imported quantity of Q0. The following variables are captured by the graphics:

The right hand graphics depicts the impact of reducing the tariff from t0 to t1. Since the domestic price (Pw+t1) is lowered compared with the initial state, import demand increases from Q0 to Q1 with consequences on the variables seen above:

The left hand diagram depicts the current (pre cut) situation where the considered good faces a tariff (t0) which entails a domestic price of Pw+T0 (Pw is world price) and, given the structure of the demand, an imported quantity of Q0. The following variables are captured by the graphics:

- Initial Tariff Revenue (TR0): is represented by the horizontal red stripe rectangle and is equal to Q0*T0.

- Initial Consumer Surplus (CS0): is represented by the diagonal blue stripe triangle and is broadly defined as the difference between the consumer's willingness to pay (marginal value) and the amount she actually pays.

- Initial Dead-Weight Loss (DWL0): is represented by the vertical green stripe triangle and represents what the economy looses in terms of welfare by imposing tariff t0 on the imported good.

- Final Tariff Revenue (TR1): is represented by the horizontal stripe rectangle and is equal to Q1*T1. The result is not straightforward and depends on the magnitude of the import demand elasticity.

- Final Consumer Surplus (CS1): is represented by the diagonal stripe triangle.

- Final Dead-Weight Loss (DWL1): is represented by the vertical green stripe triangle and represents what the economy still looses in terms of welfare because of the remaining tariff protection.

- Welfare Change (DW): is represented by the a-b-c-d area and is what the economy as a whole gains by reducing the tariff from t0 to t1 (the reduction in dead-weight loss). This gain is made of:

- The additional tariff revenue entailed by the increase in imports (Q1-Q0)*t1

- The additional consumer surplus entailed by the increase in imports

½*(Q1-Q0)*(t0-t1).

- A tariff revenue loss at constant import value, which corresponds to a transfer from the State to consumers and is equal to Q0*(t0-t1).

- A tariff revenue gain through the increase in imports which enlarges the tax base and is equal to (Q1-Q0)*t1.

- The tariff will increase prices consumers must pay for Mexican-made goods subject to the tariff. It will do so either by (1) inspiring domestic producers to raise their prices simply because they can, (2) by literally making imported Mexican goods cost more, and/or (3) both.

- A tariff on Mexican goods merely prejudices consumers and producers to eschew Mexico as a source of goods. It has no impact on the cost of production in other places.

- The consumers most adversely affected by a tariff on Mexican produced goods are the consumers least able to pay higher prices. Such consumers will either pay the higher price or shift to purchasing less expensive goods made somewhere other than the U.S. or Mexico. They won't do this by expressly demanding that the goods be made in XYZ locality, but rather by simply choosing to demand (buying) less expensive items that are made elsewhere or by by demanding fewer U.S./Mexican made items over a given time period. Which course any given individual takes depends on how they perceive their own price elasticity of demand for the items in question. (To consumers, their elasticity is found in the concept they refer to as "worth it." They don't formally measure it, but they all know what it is when they shop.)

- While the total cost of labor is important and it a fact that U.S. labor costs (wages plus benefits and ancillary costs) are higher than many places, it's also so that the U.S. along with a few Western European countries has the lowest labor market risk. That said, we have some half a century or more experience producing goods in countries having notably higher labor market risk than does the U.S. Thus it's irrational to heavily weigh labor market risk when considering the calculus of whether to import or produce domestically in the U.S. In other words, yes, labor market risk is a factor to consider, but it's not a controlling or influencing one except in places that are politically and socially unstable.

- The reality of labor costs:

Labor Market Risk Score by Country, April 2016

Looking at the chart below, one sees the price of labor in the U.S. runs about $36/hour and in Mexico it's about $6.50/hour. Trump has proposed a 20% tariff, that will increase the cost by a factor of 1.20. Thus a "shirt" made in Mexico now for $2 will cost, including the tariff, $2.40. Now you might ask where the hell can one buy a shirt in the U.S. that costs so little to make? Walmart. I actually purchased one of those fleece pullovers at Walmart some years ago for $3, marked down from $5. It hasn't fallen apart through now six years of laundering and wear. It was made in China, which now has a roughly comparable labor cost than does Mexico, though some sources say it's now, in 2017 higher than in Mexico.

With labor costs so low, in comparison to the U.S., in Mexico, China and other places, a 20% tariff isn't likely to do anything other than make everything cost more.

The chart is a graphic presentation of the data found at the site accessed by clicking the image. The chart was prepared by these folks. You'll find the Indian and Chinese data presented also at the source data site.

Bangladesh wages -- One may recall Bangladesh's sordid history; however, now that it reigns as the lowest cost of production country on the planet, it's been availing itself of that opportunity to stabilize its politics and society so as to be more appealing to would be producers.

-- Bangladesh Development Update: Economy Moving Forward Despite Internal and External Challenges

-- Political stability is the key to growth in Bangladesh | East Asia Forum

-- Bangladesh in 2016: Growth without stability

-- Bangladesh Development Update: Growth Resilient, But Can Be Better

Sad as it may seem for the prospects of U.S. manufacturing, the reality is that the Western world's producers face a difficult choice: pursue cost savings there and strive to bolster the nation against the threat of ISIS establishing another stronghold there, or forgo the cost savings and accept having charge higher prices due to producing in Mexico with a tariff or in the U.S. without it, but still at higher than current production costs.

Last edited:

usmbguest5318

Gold Member

- Jan 1, 2017

- 10,923

- 1,635

nat4900

Diamond Member

- Mar 3, 2015

- 42,021

- 5,965

But when you ask liberals here why they are against American jobs they give you crickets!

Now THAT is a truly dumb premise (but expected)......here, let me rephrase your erudite conclusion: "Liberals are against American jobs...." Absolutely "brilliant"......

No, nitwit, the stopping of imports from Mexico does NOT mean more jobs for Americans, what it DOES mean is that the newly hired American worker will demand MORE pay than a Mexican worker and will have to pay MORE to buy that pound of tomatoes that we used to get from Mexico.

How much would an American worker demand in salary to fix your roof in August?

WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,092

We just had our roof fixed by Americans. It cost $8000.00. So you would rather have 95million unemployed Americans so you can buy a cheap tomato? Why don't you get up off your Anti American ass and grow a tomato? Then they are free.But when you ask liberals here why they are against American jobs they give you crickets!

Now THAT is a truly dumb premise (but expected)......here, let me rephrase your erudite conclusion: "Liberals are against American jobs...." Absolutely "brilliant"......

No, nitwit, the stopping of imports from Mexico does NOT mean more jobs for Americans, what it DOES mean is that the newly hired American worker will demand MORE pay than a Mexican worker and will have to pay MORE to buy that pound of tomatoes that we used to get from Mexico.

How much would an American worker demand in salary to fix your roof in August?

TyroneSlothrop

Diamond Member

- Oct 11, 2013

- 31,543

- 21,415

In My neighborhood this would be seen as a "Candy-ass move"

Mexico claims Trump agreed to not debate wall in public

Source: The Hill

The Mexican government on Friday claimed that President Trump agreed not to publicly discuss payment of the border wall during an hour-long call with Mexican President Enrique Peña Nieto.

"With regards to the payment of the border wall, both Presidents recognized their clear and very public different positions on this very sensitive subject, and agreed to resolve these differences as part of an integral discussion on all aspects of the bilateral relationship," read a statement released by Peña Nieto's office.

"The Presidents also agreed for now to not publicly talk about this controversial topic."

The White House in a statement confirmed the call with Peña Nieto had taken place. But while the statement is nearly identical to Mexico's, it does not explicitly state that Trump has agreed to not discuss the wall in public.

Read more: Mexico claims Trump agreed to not debate wall in public

WillowTree

Diamond Member

- Sep 15, 2008

- 84,532

- 16,092

Every word you posted here states you are against American jobs! Does this mean you oppose the $15.00 minimum wage?But when you ask liberals here why they are against American jobs they give you crickets!

Now THAT is a truly dumb premise (but expected)......here, let me rephrase your erudite conclusion: "Liberals are against American jobs...." Absolutely "brilliant"......

No, nitwit, the stopping of imports from Mexico does NOT mean more jobs for Americans, what it DOES mean is that the newly hired American worker will demand MORE pay than a Mexican worker and will have to pay MORE to buy that pound of tomatoes that we used to get from Mexico.

How much would an American worker demand in salary to fix your roof in August?

TyroneSlothrop

Diamond Member

- Oct 11, 2013

- 31,543

- 21,415

If you own Stock in these companies you can Thank Orange Ugly Gringo

Mexicans Launch Boycotts of U.S. Companies in Fury at Donald Trump

Mexicans Launch Boycotts of U.S. Companies in Fury at Donald Trump

Ioan Grillo / Mexico City 11:30 AM Central

The digital image shows a clenched fist bathed in the red, white and green of Mexico’s flag and decorated with the nation’s emblematic eagle. “Consumers, to the Shout of War,” it says in Spanish above the fist. “Consume products made in country…Use your buying power to punish the companies that favor the politics of the new U.S. government.”

Created by a Mexican food-activist group, the image is part of a slew of messages, memes and videos that have been spreading in Mexico in recent days as President Donald Trump pushes for a border wall, deportations and punishing new trade rules.

Others messages call for specific boycotts of U.S. companies in Mexico, including McDonalds, Walmart and Coca-Cola. One of the most heavily trending hashtags is #AdiosStarbucks, or “Goodbye Starbucks,” referring to the Seattle company which has opened hundreds of coffee houses here.

Mexicans Launch Boycotts of U.S. Companies in Fury at Donald Trump

Mexicans Launch Boycotts of U.S. Companies in Fury at Donald Trump

Mexicans Launch Boycotts of U.S. Companies in Fury at Donald Trump

Ioan Grillo / Mexico City 11:30 AM Central

The digital image shows a clenched fist bathed in the red, white and green of Mexico’s flag and decorated with the nation’s emblematic eagle. “Consumers, to the Shout of War,” it says in Spanish above the fist. “Consume products made in country…Use your buying power to punish the companies that favor the politics of the new U.S. government.”

Created by a Mexican food-activist group, the image is part of a slew of messages, memes and videos that have been spreading in Mexico in recent days as President Donald Trump pushes for a border wall, deportations and punishing new trade rules.

Others messages call for specific boycotts of U.S. companies in Mexico, including McDonalds, Walmart and Coca-Cola. One of the most heavily trending hashtags is #AdiosStarbucks, or “Goodbye Starbucks,” referring to the Seattle company which has opened hundreds of coffee houses here.

Mexicans Launch Boycotts of U.S. Companies in Fury at Donald Trump

Similar threads

- Replies

- 8

- Views

- 223

- Replies

- 230

- Views

- 4K

- Replies

- 37

- Views

- 689

Latest Discussions

- Replies

- 174

- Views

- 515

- Replies

- 0

- Views

- 1

- Replies

- 2

- Views

- 17

Forum List

-

-

-

-

-

Political Satire 8513

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 483

-

-

-

-

-

-

-

-

-

-