bripat9643

Diamond Member

- Apr 1, 2011

- 170,164

- 47,312

- 2,180

"Republicans Senators are working hard to pass the biggest Tax Cuts in the history of our Country.

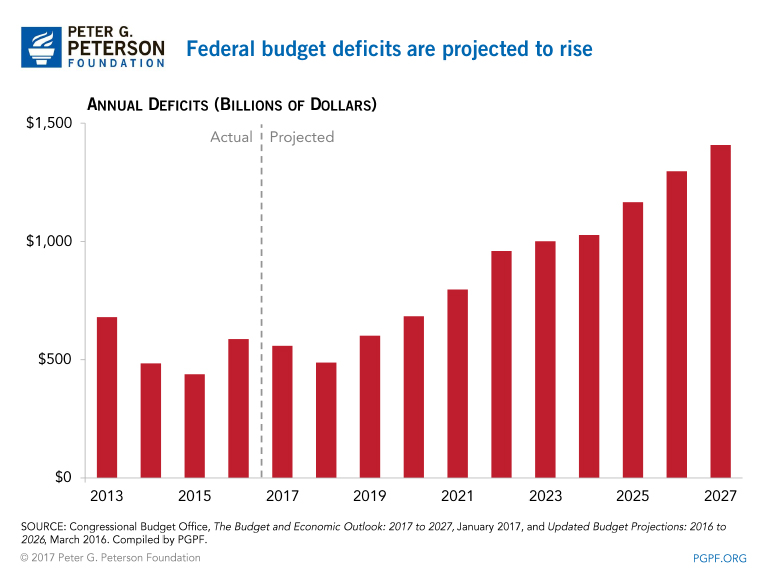

...AT A TIME WHEN ECONOMY IS DOING WELL AND DEFICITS ARE HEADED FOR A HUGE DISASTER!

This is not good, this is good ol' thought-free tax-cut cult.

Yeah, the CBO has done a great job of predicting the economic consequences of tax legislation!