LA RAM FAN

Diamond Member

- Mar 1, 2008

- 50,055

- 17,415

- 2,250

Only 7.1%!

Lets all circle jerk each other while singing songs dedicated to our pedo rican-n-chief!

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Only 7.1%!

Lets all circle jerk each other while singing songs dedicated to our pedo rican-n-chief!

There are tings beyond the comprehension of those

Inflation slows to 7.1% for November, another sign the economy is cooling off

Compared to October, the inflation rate fell from 7.7%. It's the second consecutive month it has fallen.www.nbcnews.com

The Biden administration and the Fed are doing their job. Good times ahead!

You're in denial.And yet wages have stagnated for 40 years overall. All you have done is scream to the mountain tops that data is noisy. Okay, but we knew that.

Not compelling, sorry. Of course nobody would think the data would be a straight line for 40 years. Better go read up some more.You're in denial.

It can only be prudently explained by those who KnowIt's a "stealth recession." If you don't believe we're in a recession, then it doesn't exist.

The Democrats count the economic numbers the same way they counted the votes.

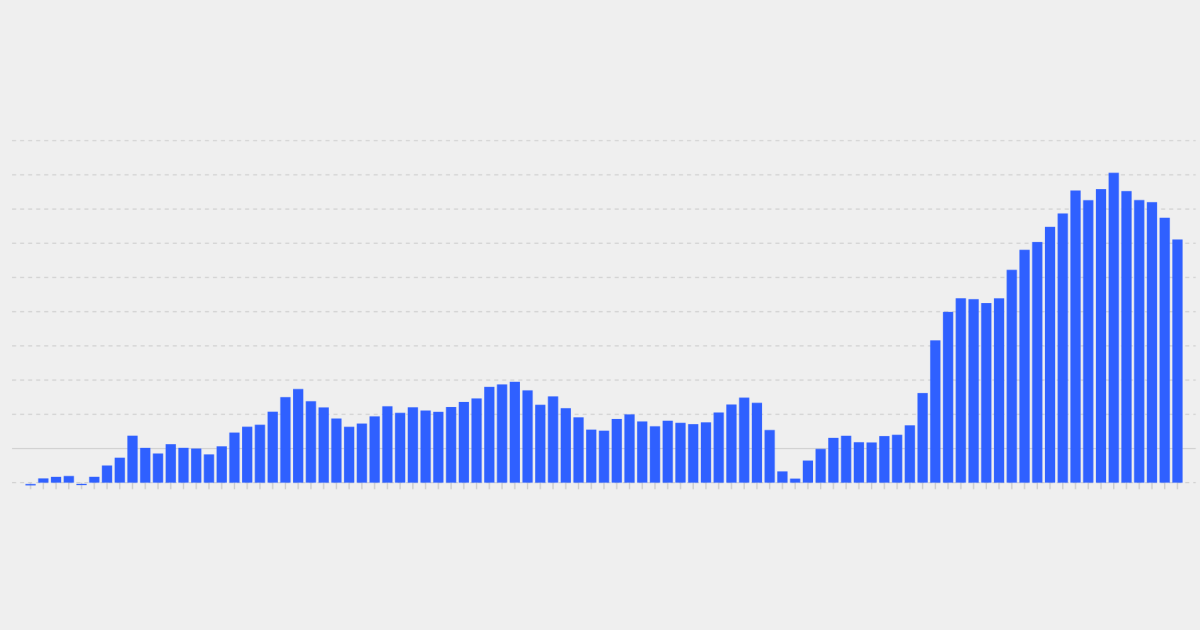

The Federal Reserve has increased interest rates and shrunk the money supply to reduce inflation.And yet people are taking early withdrawals from their 401K's in record numbers:

Hardship withdrawals from 401(k) plans hit record high

More Americans are taking retirement savings out of their accounts due to an "an immediate and heavy financial need."www.cbsnews.com

Amazing to see people triggered by good news.

Losers.

Such pathetic Lies.As if Trumpsters like Larry Kudlow and Ted CruzI realize Trumpsters are economically illiterate and ideologically sheltered, but the last GDP reading was +2.9%.

With Trump, it was at +2.1% when the virus hit.

And this is WITHOUT the trillions of Fed stimulus Trump received. And he BEGGED FOR MORE.

Fake news, right?

Explain how a Money supply gets Reduced.As I posted in earlierThe Federal Reserve has increased interest rates and shrunk the money supply to reduce inflation.

No that's not really stated well. Our inflation is the sign of an overheated economy. A growing and hot economy is a good thing. So what we have here is too much of a good thing.Not triggered, just shocked.

Shocked that liberals consider inflation 7 x higher than it was under Trump good news.

And the sad part is, that IS a lowering of inflation. That's just an indication of how bad things really are.

You're in denial.Not compelling, sorry. Of course nobody would think the data would be a straight line for 40 years. Better go read up some more.

This blubbering mental diarrhea won't help you. Nor will cherry picking a year out of 40 years of noisy data. In fact, they both make you seem very dense.You're in denial.

Why do you support the Democratic party of slavery, oppression, Jim Crow laws, and Quid Pro Quo Pervert Pedo Demento Joe?

You are a brainwashed fool.... we still have inflation and job stagnation has begun... the number of contributors to the national treasury is shrinking... McDonald's jobs won't cut it... fixed income retired folks will see a reduced standard of living very quickly... I presume that includes you and most of the libs here....A video you never watched by Sean Spicer is "truth"? Thas a special religion you have.

So you think you just broke off some wisdom tha any moron can't read for themselves in the news?You are a brainwashed fool.... we still have inflation and job stagnation has begun... the number of contributors to the national treasury is shrinking... McDonald's jobs won't cut it... fixed income retired folks will see a reduced standard of living very quickly... I presume that includes you and most of the libs here....

So you think you just broke off some wisdom tha any moron can't read for themselves in the news?

What even was that? Some sort of spastic siezure?

Exactly. Did you think you were arguing against anything I said? What even was that embarrassing little hissy fit?

Exactly. Did you think you were arguing against anything I said? What even was that embarrassing little hissy fit?

That's better. Good boy.

The Fed can manipulate the money supply by buying and selling Certificates of Deposit. Buying them adds to the money supply and selling them pulls money out. The Fed does not print money. Only the Treasury Dept does that.Explain how a Money supply gets Reduced.As I posted in earlier

the Fed and only the Fed can Print money.Not Spend money but print

Money.Spending is sole purview of our Congress.