eflatminor

Classical Liberal

- May 24, 2011

- 10,643

- 1,669

- 245

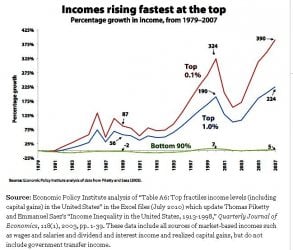

Yet, they hold 90% of the wealth in this country.

This statement suggests you believe that if a fat man is standing next to a skinny man, the fat man necessarily consumed the food that belonged to the skinny man. That is a false assumption.

Regardless of the wealth held by an individual, or an arbitrarily defined group of individuals, it does not mean another person must hold less wealth. Wealth is not a finite pile of cash from which we all must draw. It can be created or destroyed.

I realize this fact does not support your collectivist ideas.