Luddly Neddite

Diamond Member

- Sep 14, 2011

- 63,947

- 9,980

- 2,040

Trump, as I expected, is talking giving companies tax breaks to create jobs here. Well if you give them tax breaks, then guess who pays the taxes. The Poor! Slavery in action. The more that things change, the more they stay the same.

Here is the way things work in the U.S. Capitalism-Corporations = Society = Government = AMERICA! We are "supposed" to live in a democracy. But the business world rules your lives. How many people in business did you vote for. Do you vote for business or government. People in business who aren't elected shouldn't be directing how people live. That is the government's job.

I say to hell with bribing companies with tax breaks or outright corporate welfare to create jobs. If the private sector can't create jobs, I say that the government should just cut away that that dead weight and start doing the job themselves. Also, want to see something interesting? Go to the internet and look up any year in the last 50 years and see the number of companies in whatever year paid no taxes at all.

Trump, as I expected, is talking giving companies tax breaks to create jobs here. Well if you give them tax breaks, then guess who pays the taxes. The Poor!

If Trump cuts the corporate tax rate from 35% to 15%, the Poor have to pay taxes?

Walk thru the steps for me. Be as precise as you can.

Look at post #10.

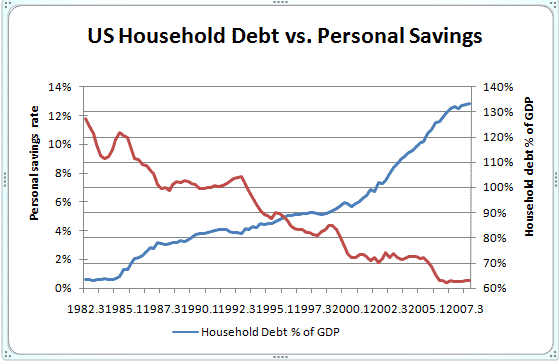

Silly charts without a link back to their source are useless.

Useless? Well now you know there is a thing to search for on the internet. Just enter into your browser something like "Percentage of taxes paid based on income level." You will probably not only find that graph, but much more to support it.

The source is on the graph.

Always amazes me to read RWNJs demand the right to give more of their money to the 1% but, they always do.

Same bunch voted to give the 1% control over their votes too. This last election, they voted to keep Citizens United.

Why would they believe that's a good idea?

Sent from my iPad using USMessageBoard.com