Toddsterpatriot

Diamond Member

TAXES ON THE RICH GREATLY WERE REDUCED BUBS, BUT RONNIE INCREASED TAXES ON THE POOR/MIDDLE CLASS 11 TIMES TO MAKE UP REVENUES!

It's a good thing the tax cuts for the poor and middle class were larger than the hikes, eh?

Well the treasury disagrees Bubs, the middle 40% (between bottom 40%-80%) paid more federal taxes in 1989 than 1980!

But glad to see you think it's ok to not only starve US treasury of revenues BUT to benefit those at the very top the most which is what Reaganomics is

Well the treasury disagrees Bubs, the middle 40% (between bottom 40%-80%) paid more federal taxes in 1989 than 1980!

Show me. And show me how much more the top 20% paid.

Sorry my old link of treasury study is gone, "link not found", best I have is this

The average percentage of income that households in the middle fifth of the income spectrum paid in total federal taxes in 2000, before last year's tax cut was enacted, was close to the lowest on record for the period from 1979 to the present. These households paid an estimated average of 17.2 percent of their income in federal taxes in 2000, only slightly higher than the low point of 17.1 percent of income in 1983

Overall Federal Tax Burden on Most Families Including Middle-Income Families at Lowest Levels in More Than Two Decades, 4/10/02

LETS SEE WHAT HAPPENED TO THE RICHEST BUBS THE ANKLE BITER

TAXES ON THE RICH GREATLY WERE REDUCED BUBS, BUT RONNIE INCREASED TAXES ON THE POOR/MIDDLE CLASS 11 TIMES TO MAKE UP REVENUES!

It's a good thing the tax cuts for the poor and middle class were larger than the hikes, eh?

Well the treasury disagrees Bubs, the middle 40% (between bottom 40%-80%) paid more federal taxes in 1989 than 1980!

But glad to see you think it's ok to not only starve US treasury of revenues BUT to benefit those at the very top the most which is what Reaganomics is

Well the treasury disagrees Bubs, the middle 40% (between bottom 40%-80%) paid more federal taxes in 1989 than 1980!

Show me. And show me how much more the top 20% paid.

My link is gone, best I have is this Bubba ankle biter

The average percentage of income that households in the middle fifth of the income spectrum paid in total federal taxes in 2000, before last year's tax cut was enacted, was close to the lowest on record for the period from 1979 to the present. These households paid an estimated average of 17.2 percent of their income in federal taxes in 2000, only slightly higher than the low point of 17.1 percent of income in 1983

Overall Federal Tax Burden on Most Families Including Middle-Income Families at Lowest Levels in More Than Two Decades, 4/10/02

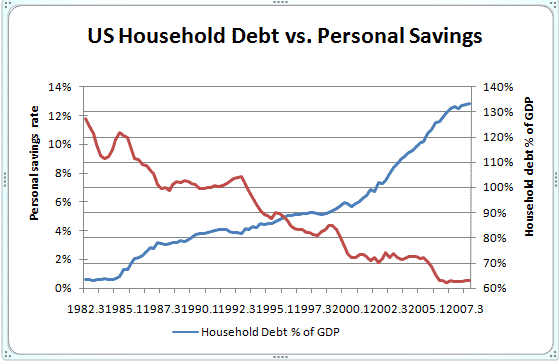

LET'S LOOK AT THOSE "JOB CREATORS" BUBBA

AS THEIR "SHARE" OF INCOME SKYROCKETED BUBS

SEE A TREND HERE?

These households paid an estimated average of 17.2 percent of their income in federal taxes in 2000, only slightly higher than the low point of 17.1 percent of income in 1983

The low point was after Reagan's 1981 tax cuts?

Thanks!

Believe what you want Bubs, but since Ronnie increased taxes 11 times (AFTER 1981 TAX CUTS ON THE RICH) including SS taxes by 40% in 1986 which hit the middle class, you don't have much to stand on, I'm just not willing to try to find another link

BUT YOU DO KNOW WHAT THE "LOW POINT" IN 1983 MEANS? LOL

Believe what you want Bubs, but since Ronnie increased taxes 11 times (AFTER 1981 TAX CUTS ON THE RICH)

OMG! That's awful! Terrible! Horrible!

So when he took office, the top rate was 70%.

After all those tax hikes....at the end of his term....the top rate was 28%.

including SS taxes by 40% in 1986 which hit the middle class

He raised SS taxes by 40%? Got a link?

you don't have much to stand on, I'm just not willing to try to find another link

Why would you need to find another link?

The one you have shows the lowest percent of income paid by the middle class in federal taxes was 1983.

That means your claim that they paid more in 1989 than in 1980 is still unproven.