Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shifting the tax burden to the wealthy class does NOT harm the economy

- Thread starter Billy000

- Start date

Dad2three

Gold Member

I've done it countless times on this forum.Would you mind explaning ( show your work ) how the mortgage interest deduction transfers money from me to a multi-millionaire?

An allegory:

Bernie and Ted earn identical incomes.

Bernie and Ted's fair share of the federal budget is $1000. This means Bernie and Ted are each responsible for $500 at tax time.

But wait! Ted bought the right kind of refrigerator the government wanted him to buy. He gets a tax deduction! Ted also bought other government-approved products. Because that is what tax expenditures are: A massive government behavioral control program.

Ted's tax burden is now $400 instead of $500, thanks to tax expenditures awarded to him. "Woo hoo!", exclaims Ted, "I get to keep more of my own money!"

But Ted is wrong.

Since the federal tax burden for Ted and Bernie is $1000, and Ted is only paying $400 and Bernie is paying $500, tax revenues are going to come up $100 short. There will be a $100 deficit due to Ted's tax expenditures.

What to do...what to do...

So the government raises everyone's tax rates by 5 percent.

Now Bernie owes $525, and Ted owes $425 ($525 - $100 deduction).

Has Ted really saved $100? Nope. His taxes are only $75 lower now, and Bernies are $25 more. And their total tax payment is still $50 short of the goal of $1000.

After the 5% tax hike, Ted's $100 deduction is paid for by each of them paying $25 more, plus a $50 deficit.

And that is how our current tax structure is actually managed, boys and girls. We have this ridiculous system whereby two people earning identical incomes pay radically different taxes, and we have a budget deficit. And everyone's tax rates are higher than they would be.

And the rube with the deductions isn't getting as much as he thinks he is.

Now along comes a deficit hawk who wants a balanced budget. And so taxes are raised 10%.

Now Bernie is paying $550 instead of the original $500. And Ted is paying $450 (after taking out his deduction).

We now have a balanced budget. But look. Ted's $100 deduction has really only netted him $50. And where did that $50 come from? It came out of Bernie's pocket!

And this is why tax expenditures are no different than food stamps or Obamaphones. Someone else has to pay for them with higher tax rates. And you aren't making out as much as you think you are.

But wait! It gets worse!

http://www.taxpolicycenter.org/Uplo...erest-Deduction-Affect-the-Housing-Market.pdf

One widely cited 1996 study by Dennis Capozza, Richard Green, and Patric Hendershott estimated that eliminating the mortgage interest and property tax deductions would reduce housing prices in the short term by an average of 13 percent nationwide, with regional changes ranging from 8 to 27 percent.

Mortgage Interest Deduction: $484 billion

The MID cost taxpayers $484 billion between 2010-2014.

Guess how much the budget deficit was for 2014?

$483 billion.

And that is just ONE tax expenditure, kids.

The Real Estate special interests spent $26,723,151 on House campaign contributions, $11,255,447 on Senate campaign contributions, and $95,563,540 on lobbying in 2014, for a total of $133,542,138.

They didn't spend that money for nothing, boys and girls. It netted them a profit of $96 billion, every penny of which came out of YOUR pockets.

Yep, the single greatest "wealth creator" for the middle class, home ownership, do away with tax deduction of interest? lol

Dad2three

Gold Member

If he is making 100 million a year he WOULD be paying the 90% rate on income ABOVE a certain level.

But his taxes are indeed progressive as his income goes up the scale.

The more he makes the more he pays in taxes ( unless he is a cheating Republican ).

This is exactly why taxes on consumption are superior to taxes on production.

If you knew the next $100,000 you would earn would only net you $10,000, then you won't bother. A 90 percent tax makes people LESS productive. Only a retard believes a 90 percent top tax bracket makes people more productive.

The more you tax something, the less of it you get. So tax consumption, not production.

BUT IT'S THE EFFECTIVE TAX RATES THAT MATTER, NOT MARGINAL.

Guess where studies show the MAXIMUM Gov't generating revenues are Bubs? Hint right about 70% EFFECTIVE rates!

Dad2three

Gold Member

If he had 100 million dollars a year coming in from his factory, and the government lets him keep 10 million, he has LOTS of motivation to expand his operations and start more.

If a producer will only net $10,000 out of his next $100,000 of income, he has NO motivation to bother. You have it exactly backwards.

WE had a 90% at todays adjusted $100,000?

How about someone making $100 million, will they work for the extra $10 mill?

Dad2three

Gold Member

How many times does this myth have to be debunked? Seriously? Before you run with this stuff, does it ever occur to you guys to do some fact-checking, maybe like break down and read the other side?

Now, in the '50s and early '60s, there was no Medicare tax, no needlessly costly EPA regs, no needless costly OSHA regs, and there were huge loopholes for the rich as well so they could shield much of their money from confiscatory taxation.

Do you know who else believed in taxing the rich at sky-high rates? Stalin, Lenin, Castro, Mao, and so forth. How'd that work out?

MORE right wing MYTHOLOGY

Dad2three

Gold Member

Yep, defense spending is out of control.Giving Washington more money is like buying a drunk a drink. First the President and congress must show they can say "no" and control spending.

While you ignore the ones that are even higher.

THE SELF FUNDED ONES

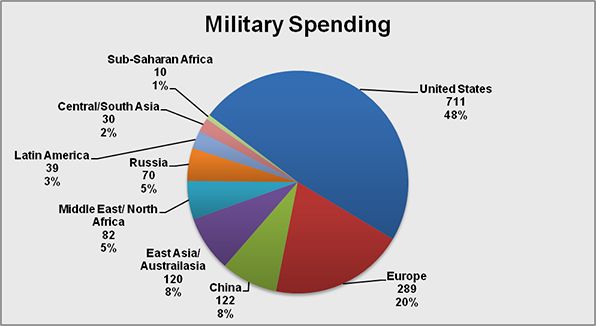

Total U.S. National Security Spending, 2014-2015

Grand Total

2014- 967.9 BILLION

2015- 1,009.5TRILLION

Total U.S. National Security Spending, 2014-2015

Dad2three

Gold Member

"Contrary to what Republicans would have you believe, super-high tax rates on rich people do not appear to hurt the economy or make people lazy: During the 1950s and early 1960s, the top bracket income tax rate was over 90%--and the economy, middle-class, and stock market boom."

THE TRUTH ABOUT TAXES: High Rates On Rich People Do Not Hurt The Economy - Business Insider

The true driving force of the economy is the middle class - not the wealthy. This economy depends on consumer spending. That is why you all should care about income inequality. Despite productivity skyrocketing over the previous decades, wages have remained mostly flat in the lower class and most of the income gains have gone to the top 1%.. The middle class is shrinking and the U.S. has the worst child poverty rate in the developed world.

Wealth And Inequality In America - Business Insider

To sustain a 90% tax bracket this is the formula....first, destroy the industrial base of every other country in the world and decimate their populations. Second) raise your own taxes to 90%.........

And then Kennedy lowered the tax rate and the economy boomed.....and then Reagan did it and the economy boomed.....

If the middle class is suffering, it is because they are being taxed to death....nickle and dimed but taxed for every last thing they do....and the rich can absorg the taxes and fees, the middle class can't...

Cut government spending, cut taxes for everyone....and the economy will boom again.

You meant LBJ cut taxes but NOT for the "job creators"

AND RONNIE CUT TAXES FOR THE RICH, BUT INCREASED IT ON THE MIDDLE CLASS AND HAD A TOP RATE OF 50% THE FIRST 6 YEARS?

Dad2three

Gold Member

Your response went into crazy land when you said the government raises EVERYONE'S RATE.

It doesn't work that way and you know it..

Top tax bracket when Reagan took office: 70%.

Top tax bracket when Reagan left office: 28%

Reagan wiped out a lot of tax expenditures in his tax reform.

Since then tax expenditures have climbed to $1.2 trillion a year.

So what is the top tax rate now?

39.6%

So don't give me this bullshit the government doesn't raise everyone's tax rates to help pay for tax expenditures. The evidence is right in front of your face.

My allegory is sound. Built on bedrock.

You mean when Ronnie GUTTED taxes on the rich but increased it on the middle class when his 11 tax increases took effect?

YET still gutted the overall tax burden by 3% of GDP while BLOWING up spending by nearly 3% of GDP? Hint that's HOW he tripled US debt even though his top tax rate was 50% the first 6 years!!!

g5000

Diamond Member

- Nov 26, 2011

- 125,230

- 68,949

- 2,605

If he had 100 million dollars a year coming in from his factory, and the government lets him keep 10 million, he has LOTS of motivation to expand his operations and start more.

If a producer will only net $10,000 out of his next $100,000 of income, he has NO motivation to bother. You have it exactly backwards.

WE had a 90% at todays adjusted $100,000?

How about someone making $100 million, will they work for the extra $10 mill?

Nope.

g5000

Diamond Member

- Nov 26, 2011

- 125,230

- 68,949

- 2,605

The poor and middle class do not benefit from tax expenditures.Until Ronald Reagan created the largest tax increase on the middle class in history when he took the interest deduction away, except for your home mortgage -- and he WANTED to take that away too.

The mortgage interest deduction should go away. It is a giant scam which steals almost $100 billion a year from the pockets of the common man and transfers it to the rich.

Reagan definitely had the right idea by eliminating as many tax expenditures as he could.

LOL, You mean the ones the poor/middle class used, like CC interest? Weird right?

The only tax credit which has a proven positive record is the EITC.

Dad2three

Gold Member

The poor and middle class do not benefit from tax expenditures.Until Ronald Reagan created the largest tax increase on the middle class in history when he took the interest deduction away, except for your home mortgage -- and he WANTED to take that away too.

The mortgage interest deduction should go away. It is a giant scam which steals almost $100 billion a year from the pockets of the common man and transfers it to the rich.

Reagan definitely had the right idea by eliminating as many tax expenditures as he could.

LOL, You mean the ones the poor/middle class used, like CC interest? Weird right?

The only tax credit which has a proven positive record is the EITC.

Opinion from a Reaganite? I''ll take it for what it's worth Bubs

Mortgage Interest Deduction Is Ripe for Reform

Conversion to Tax Credit Could Raise Revenue and Make Subsidy More Effective and Fairer

Costing at least $70 billion a year, the mortgage interest deduction is one of the largest federal tax expenditures, but it appears to do little to achieve the goal of expanding homeownership. The main reason is that the bulk of its benefits go to higher-income households who generally could afford a home without assistance: in 2012, 77 percent of the benefits went to homeowners with incomes above $100,000. Meanwhile, close to half of homeowners with mortgages — most of them middle- and lower-income families — receive no benefit from the deduction. Three major bipartisan panels have proposed to convert the deduction to a credit and lower the maximum amount of interest it covers. These reforms would be major improvements over current law and would generate significant additional revenue.

Mortgage Interest Deduction Is Ripe for Reform | Center on Budget and Policy Priorities

g5000

Diamond Member

- Nov 26, 2011

- 125,230

- 68,949

- 2,605

That's funny. I said the MID does not benefit the poor and middle class, and you scoff. Then you proceed to provide information which proves me right!The poor and middle class do not benefit from tax expenditures.Until Ronald Reagan created the largest tax increase on the middle class in history when he took the interest deduction away, except for your home mortgage -- and he WANTED to take that away too.

The mortgage interest deduction should go away. It is a giant scam which steals almost $100 billion a year from the pockets of the common man and transfers it to the rich.

Reagan definitely had the right idea by eliminating as many tax expenditures as he could.

LOL, You mean the ones the poor/middle class used, like CC interest? Weird right?

The only tax credit which has a proven positive record is the EITC.

Opinion from a Reaganite? I''ll take it for what it's worth Bubs

Mortgage Interest Deduction Is Ripe for Reform

Conversion to Tax Credit Could Raise Revenue and Make Subsidy More Effective and Fairer

Costing at least $70 billion a year, the mortgage interest deduction is one of the largest federal tax expenditures, but it appears to do little to achieve the goal of expanding homeownership. The main reason is that the bulk of its benefits go to higher-income households who generally could afford a home without assistance: in 2012, 77 percent of the benefits went to homeowners with incomes above $100,000. Meanwhile, close to half of homeowners with mortgages — most of them middle- and lower-income families — receive no benefit from the deduction. Three major bipartisan panels have proposed to convert the deduction to a credit and lower the maximum amount of interest it covers. These reforms would be major improvements over current law and would generate significant additional revenue.

Mortgage Interest Deduction Is Ripe for Reform | Center on Budget and Policy Priorities

Dad2three

Gold Member

If he had 100 million dollars a year coming in from his factory, and the government lets him keep 10 million, he has LOTS of motivation to expand his operations and start more.

If a producer will only net $10,000 out of his next $100,000 of income, he has NO motivation to bother. You have it exactly backwards.

WE had a 90% at todays adjusted $100,000?

How about someone making $100 million, will they work for the extra $10 mill?

Nope.

Sure Bubs, sure, history says you are a moron

Dad2three

Gold Member

That's funny. I said the MID does not benefit the poor and middle class, and you scoff. Then you proceed to provide information which proves me right!The poor and middle class do not benefit from tax expenditures.Until Ronald Reagan created the largest tax increase on the middle class in history when he took the interest deduction away, except for your home mortgage -- and he WANTED to take that away too.

The mortgage interest deduction should go away. It is a giant scam which steals almost $100 billion a year from the pockets of the common man and transfers it to the rich.

Reagan definitely had the right idea by eliminating as many tax expenditures as he could.

LOL, You mean the ones the poor/middle class used, like CC interest? Weird right?

The only tax credit which has a proven positive record is the EITC.

Opinion from a Reaganite? I''ll take it for what it's worth Bubs

Mortgage Interest Deduction Is Ripe for Reform

Conversion to Tax Credit Could Raise Revenue and Make Subsidy More Effective and Fairer

Costing at least $70 billion a year, the mortgage interest deduction is one of the largest federal tax expenditures, but it appears to do little to achieve the goal of expanding homeownership. The main reason is that the bulk of its benefits go to higher-income households who generally could afford a home without assistance: in 2012, 77 percent of the benefits went to homeowners with incomes above $100,000. Meanwhile, close to half of homeowners with mortgages — most of them middle- and lower-income families — receive no benefit from the deduction. Three major bipartisan panels have proposed to convert the deduction to a credit and lower the maximum amount of interest it covers. These reforms would be major improvements over current law and would generate significant additional revenue.

Mortgage Interest Deduction Is Ripe for Reform | Center on Budget and Policy Priorities

Weird, REFORMING a system that benefits the top 77% the most BUT still benefits the poor/middle class (below $100,000)??? lol

YOU UNDERSTAND REFORM VERSUS THROWING OUT, WHICH IS YOUR PLAN RIGHT BUBBA?

Yes I guess ONLY getting $20+ billion isn't a "benefit" right Bubs?

g5000

Diamond Member

- Nov 26, 2011

- 125,230

- 68,949

- 2,605

We have an utterly corrupt system which provides a transfer of wealth from the pockets of the common man into the pockets of higher income people.

We have an utterly corrupt system which allows the bribing of our American Politboro to put these tax expenditures in the tax code which enable this wealth redistribution up the food chain.

We have an utterly corrupt system in which people earning identical incomes are paying radically different federal taxes.

We have utterly corrupt system which has resulted in higher tax rates and massive debt.

How anyone could defend this scheme is beyond me.

We have an utterly corrupt system which allows the bribing of our American Politboro to put these tax expenditures in the tax code which enable this wealth redistribution up the food chain.

We have an utterly corrupt system in which people earning identical incomes are paying radically different federal taxes.

We have utterly corrupt system which has resulted in higher tax rates and massive debt.

How anyone could defend this scheme is beyond me.

g5000

Diamond Member

- Nov 26, 2011

- 125,230

- 68,949

- 2,605

"Gimme gimme gimme, and make that guy over there pay for it."

Everyone wants a handout, but they don't want to pay for it.

That's how we got here, folks. It wasn't food stamps. It wasn't Obamaphones. It wasn't illegal aliens.

It is tax expenditures. And if you think $18 trillion of federal debt should be paid by someone else, then you are an asshole. You took, and now you must pay.

Everyone wants a handout, but they don't want to pay for it.

That's how we got here, folks. It wasn't food stamps. It wasn't Obamaphones. It wasn't illegal aliens.

It is tax expenditures. And if you think $18 trillion of federal debt should be paid by someone else, then you are an asshole. You took, and now you must pay.

g5000

Diamond Member

- Nov 26, 2011

- 125,230

- 68,949

- 2,605

Some of the "one page tax return" plans out there involve a single tax deduction/credit which everyone would get.

Fine, whatever. That deduction/credit will be compensated for by a higher tax rate than you would have without that deduction/credit. It's all smoke and mirrors, rubes.

I can tax you five dollars, or...

I can tax you eight dollars and give you a three dollar deduction. "Woo hoo! I get to keep more of my money!"

Rubes.

Fine, whatever. That deduction/credit will be compensated for by a higher tax rate than you would have without that deduction/credit. It's all smoke and mirrors, rubes.

I can tax you five dollars, or...

I can tax you eight dollars and give you a three dollar deduction. "Woo hoo! I get to keep more of my money!"

Rubes.

Redfish

Diamond Member

We have an utterly corrupt system which provides a transfer of wealth from the pockets of the common man into the pockets of higher income people.

We have an utterly corrupt system which allows the bribing of our American Politboro to put these tax expenditures in the tax code which enable this wealth redistribution up the food chain.

We have an utterly corrupt system in which people earning identical incomes are paying radically different federal taxes.

We have utterly corrupt system which has resulted in higher tax rates and massive debt.

How anyone could defend this scheme is beyond me.

bullshit. the rich already pay almost all federal income taxes. 47% pay no federal income tax, and many have a negative income tax via EIC.

If you take more from the job creators a couple of things wil happen. \

1. they will take their money and leave the country

2. the will put it in swiss and cayman accounts where it is tax free

3. they will not invest in the US market or expansion of businesses

4. the middle class will lose jobs

5. federal revenue will decrease

I realize that you libs hate successful people and are determined to find ways to punish success and reward failure. But in so doing you will destroy this country.

said another way, you are idiots.

David_42

Registered Democrat.

- Aug 9, 2015

- 3,616

- 833

- 245

47% barely have anything to pay and hold virtually no taxable income.We have an utterly corrupt system which provides a transfer of wealth from the pockets of the common man into the pockets of higher income people.

We have an utterly corrupt system which allows the bribing of our American Politboro to put these tax expenditures in the tax code which enable this wealth redistribution up the food chain.

We have an utterly corrupt system in which people earning identical incomes are paying radically different federal taxes.

We have utterly corrupt system which has resulted in higher tax rates and massive debt.

How anyone could defend this scheme is beyond me.

bullshit. the rich already pay almost all federal income taxes. 47% pay no federal income tax, and many have a negative income tax via EIC.

If you take more from the job creators a couple of things wil happen. \

1. they will take their money and leave the country

2. the will put it in swiss and cayman accounts where it is tax free

3. they will not invest in the US market or expansion of businesses

4. the middle class will lose jobs

5. federal revenue will decrease

I realize that you libs hate successful people and are determined to find ways to punish success and reward failure. But in so doing you will destroy this country.

said another way, you are idiots.

Maryland Patriot

Gold Member

- Jun 10, 2015

- 9,966

- 1,394

- 290

What would really help the economy is to completely end all social programs (including obamacare) and shift that money over to paying off obamas debt.

those on welfare dont contribute anyway, the money they spend in the community is generated by the taxes paid by the working members of that community in the first place, so its pretty much a negative however you look at it.

This would do a couple of things, but the biggest thing it would do is to end poverty at the lowest level while reducing the number of unemployed in the country.

those on welfare dont contribute anyway, the money they spend in the community is generated by the taxes paid by the working members of that community in the first place, so its pretty much a negative however you look at it.

This would do a couple of things, but the biggest thing it would do is to end poverty at the lowest level while reducing the number of unemployed in the country.

Similar threads

- Replies

- 71

- Views

- 710

- Replies

- 27

- Views

- 399

- Replies

- 53

- Views

- 897

- Replies

- 26

- Views

- 362

- Replies

- 24

- Views

- 347

Latest Discussions

- Replies

- 75

- Views

- 444

- Replies

- 128

- Views

- 7K

- Replies

- 513

- Views

- 8K

- Replies

- 12

- Views

- 476

- Replies

- 110

- Views

- 493

Forum List

-

-

-

-

-

Political Satire 8510

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 483

-

-

-

-

-

-

-

-

-

-