Thinker101

Diamond Member

- Mar 25, 2017

- 24,688

- 14,873

- 1,415

The motherfucking federal government has no claim to future perceived taxes, they have no right to think they do.Ah, a supply-side True Believer.

Supply side policies always fail, of course, because they're fantasy-based. In their mythical world, cutting taxes on rich people and leaving less for the middle class means rich people will create jobs, and eventually it will trickle back down on everyone else.

Not what happens, of course. The rich people just pocket the money, so the middle class pays more and gets nothing.

First, there's no shortage of investment capital, so having more investment capital available doesn't do anything.

Second, cutting taxes on the rich doesn't actually create make more capital. Tax cuts have to be paid for by selling T-bills, which take the money that the rich saved in tax cuts right back out of the economy.

And third, economies are demand driven, not supply driven. If there's demand for products from the middle class, then the supply will follow. Someone will want to make money satisfying that demand. That's capitalism. It builds up from the bottom.

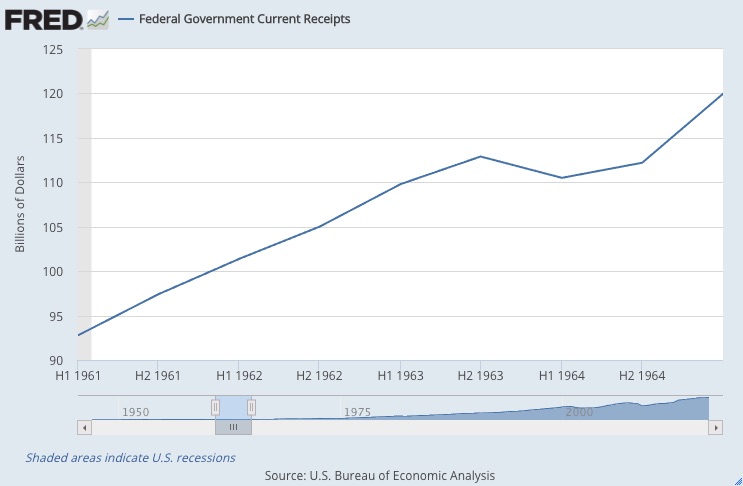

They do not have a right to perceived taxes, but they base their budgets on last years budget and taxes received. Let's just say they "assume" they're getting at least the same dollars they did in the prior year....and they always need more.