Brain357

Platinum Member

- Mar 30, 2013

- 37,068

- 4,189

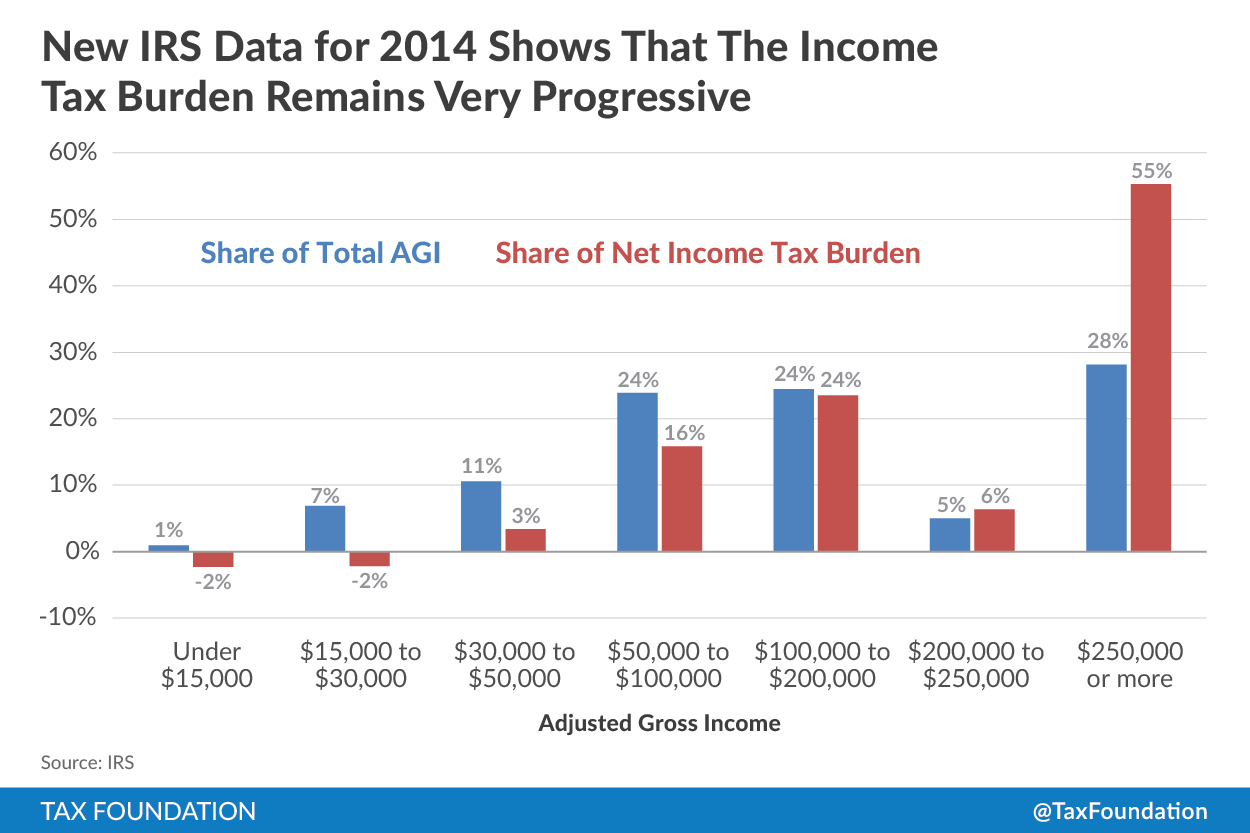

'Why American Workers Pay Twice As Much In Taxes As Wealthy Investors'

FLASHBACK:

Obama 'stole' hard-working American tax dollars to ensure his big donors who had invested in Solyndra and 12 other bankrupt 'Green Energy' companies did not lose a dime of their investment money. The tax payers did not invest in those companies, still lost money when they went bankrupt, and no one ever paid them back....

Obama-backed green energy failures leave taxpayers with $2.2 billion tab, audit finds

It is amazing corporate welfare is still going strong and supported by many "conservatives".