Brain357

Platinum Member

- Mar 30, 2013

- 37,068

- 4,189

We are deeply in debt?

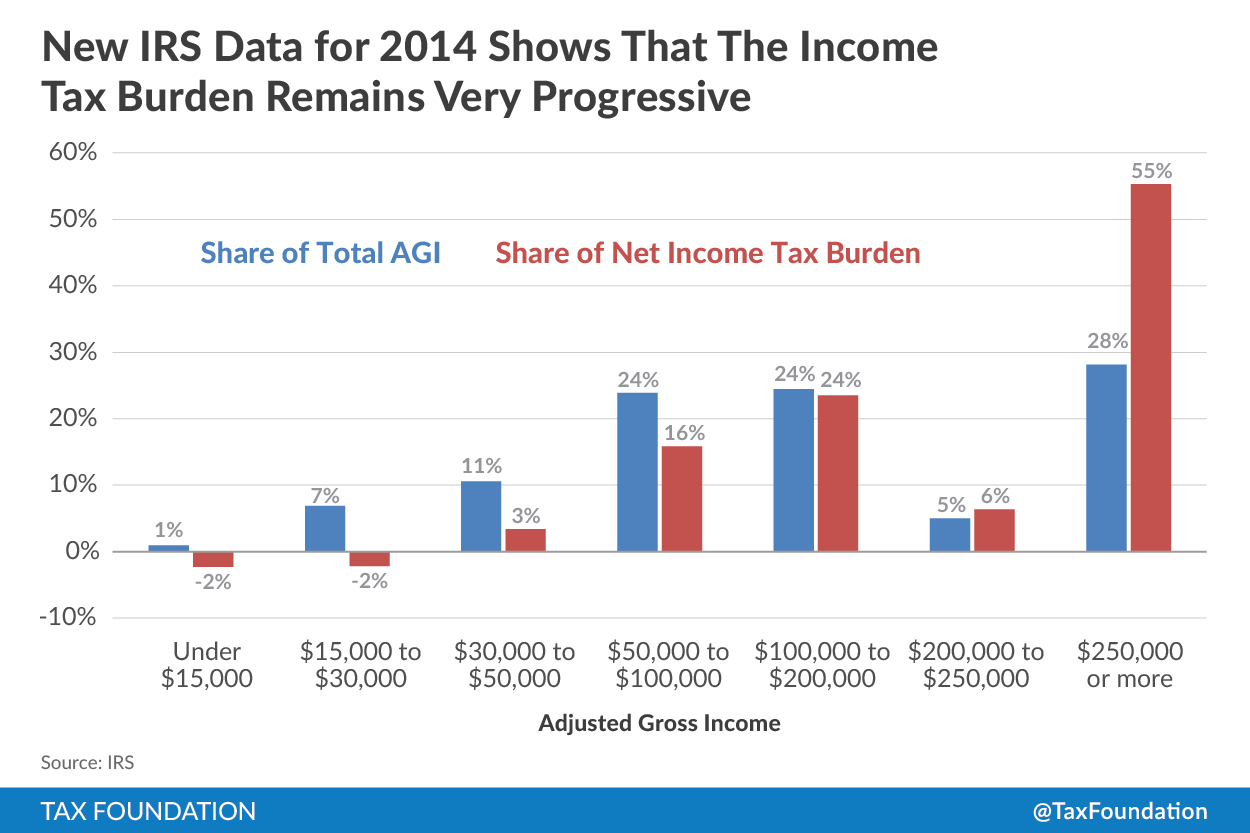

There are others ways to help that. Either stop spending more than we know we have and/or have the half that pay zero income taxes do their part.

Sure tell repubs to stop spending. So ask those with nothing to pay taxes. Brilliant.

I'm asking those that live in society to contribute to society. That's what you pieces of shit on the left use to justify a progressive tax system. Suddenly, when it involves those that don't contribute to society actually doing what you claim should be done, you run from it.

I'm an independent. When will congress stop spending?

Bullshit. That's the cop out from lefties that don't have the guts to admit what they are. Funny how all of you claiming that status support the left side of the aisle when it comes to policy.

I could take some chicken shit, make it look like and call it chicken salad. Would you eat it?

Do I? I asked what regulations. How is that left or right?