JonKoch

VIP Member

- May 14, 2017

- 1,779

- 151

Sorry cupcake, IF you want to make a posit, or refute the REAL numbers do it, don't provide a link and leave it at that as if I'm supposed to understand right wing nutjobbery!

ONCE MORE CUPCAKE:

For those earning between 0.01 percent and 0.1 percent, the rates were 55.3 percent in 1960, 59.1 percent in 1970, 51.0 percent in 1980, 34.3 percent in 1990, 40.2 percent in 2000 and 34.1 percent in 2004.

Finally, for those in the top 0.01 percent of the income distribution, the effective tax rate was 71.4 percent in 1960, 74.6 percent in 1970, 59.3 percent in 1980, 35.4 percent in 1990, 40.8 percent in 2000 and 34.7 percent in 2004.

So for each of these elite income groups, the effective tax rates were at or near historical lows in 2004, though for certain groups, the effective rate was equal or slightly lower in 1990. Of course, this data is seven years old.

Barack Obama says tax rates are lowest since 1950s for CEOs, hedge fund managers

Oh, so you don't want to read it yourself? Allow me to help:

It does show those making more than $250,000 and those earning more than $2 million paying a lower effective tax rate in 2008 than in 1960. The decline was much greater for those making more than $2 million. But both groups of high-income earners were paying just about the same rate in the late 1980s as they were in 2008, according to the White House graph. The rates increased during the 1990s and began to fall again during the early years of the last decade. Update, April 15: We originally said that the rates in the late ’80s were "similar or possibly lower" than they are today. The Office of Management and Budget later provided specific figures that show the tax rates in the ’80s were similar. The OMB figures show that those earning more than $2 million paid the same rate (25 percent) in 2008 as they did in 1988, 1989 and 1990, and those making more than $250,000 paid 25 percent — the same rate since 2003. The latter group had a rate of 26 percent in the late ’80s.

Hey cupcake WHAT do you "think" my posit was??

" It does show those making more than $250,000 and those earning more than $2 million paying a lower effective tax rate in 2008 than in 1960. The decline was much greater for those making more than $2 million."

YOU KNOW WHAT EFFECTIVE TAX RATES ARE RIGHT CUPCAKE?

I think your post was about Obama having the lowest tax rates in 50 years, and FactCheck disagrees with that. The tax rate for the wealthy is the same as it was during Reagan's administration.

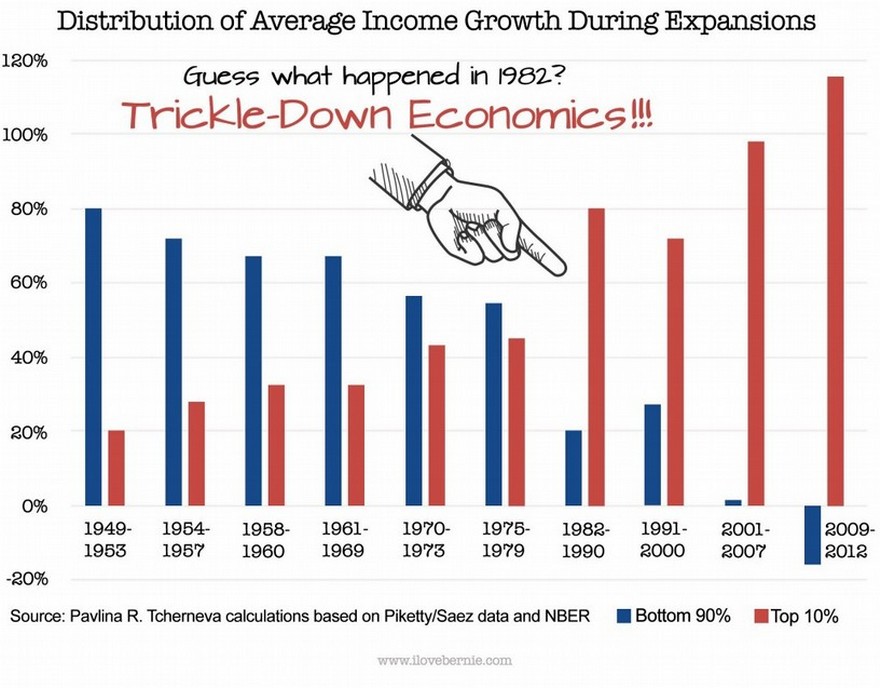

The same as the last two years of Reagan's term. But, during that same two years capital gains were taxed at the same rate as earned income. Now, with the capital gains maximum rate at 20% the EFFECTIVE marginal tax rate is at an all time low.

Thing is since Dubya GUTTED taxes on the richest, the SUSTAINED effective tax rate hasn't been this low for those "job creators" since the 1920's