CrusaderFrank

Diamond Member

- May 20, 2009

- 146,342

- 69,382

- 2,330

They do. Look at the TSLA shorts.Short sellers are a threat to stability. They should get a pasting now and then.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

They do. Look at the TSLA shorts.Short sellers are a threat to stability. They should get a pasting now and then.

The way short shares are borrowed shares (many times without knowledge or permission) is liken to the theme of "the producers" where they float more shares then the 100% that actually exist so if they can crush and crash the stock, they never have to pay it back & that gives incentive to manipulation by shorts to take out weak volume or weak numbers companies.Short sellers are a threat to stability. They should get a pasting now and then.

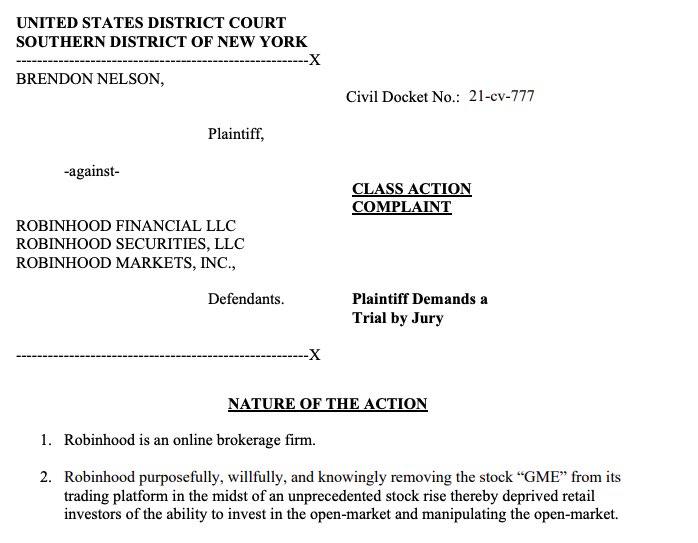

Hedge funds and institutional investors screw over retail investors everyday. This is a case where the big money institutions have the power to change the rules in the middle of the game when the smaller investors are taking advantage of the rules.

If any of this is true, then there should be an investigation.

It's not hedge funds per se, or even robinhood.

It's one particular hedge fund.

Told ya.....knowing when to get out is maybe more important than knowing when to get in.and what happens when he locks that in.....hopefully in near future before it disappears........now is the time to shortOne cat turned $55,000 into $13 million. Heh heh.

Oh boy! The fat cat manipulators have to be pissed they got beat to the punch at their own game.

They might have to start getting up and actually working at this rate. Thus the NASDAQ shutdown, I suppose. They're not having any of that.

They've even gone so far as to monitor people's social media to se who made out. Is that crazy, or what? They did nothing illegal. And they have the right to talk about it.

Man are the vultures pee ohd. Heh heeeee.....

More than one hedge fund got crushed by this short.