Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Biden won't raise taxes, but.

- Thread starter Woodznutz

- Start date

Woodznutz

Platinum Member

- Dec 9, 2021

- 19,156

- 9,106

- 473

- Thread starter

- #22

Adjusted gross income for the year in question was $96,000. Taxable after deductions was $89,000.The whole cut amounted to half that for your income.

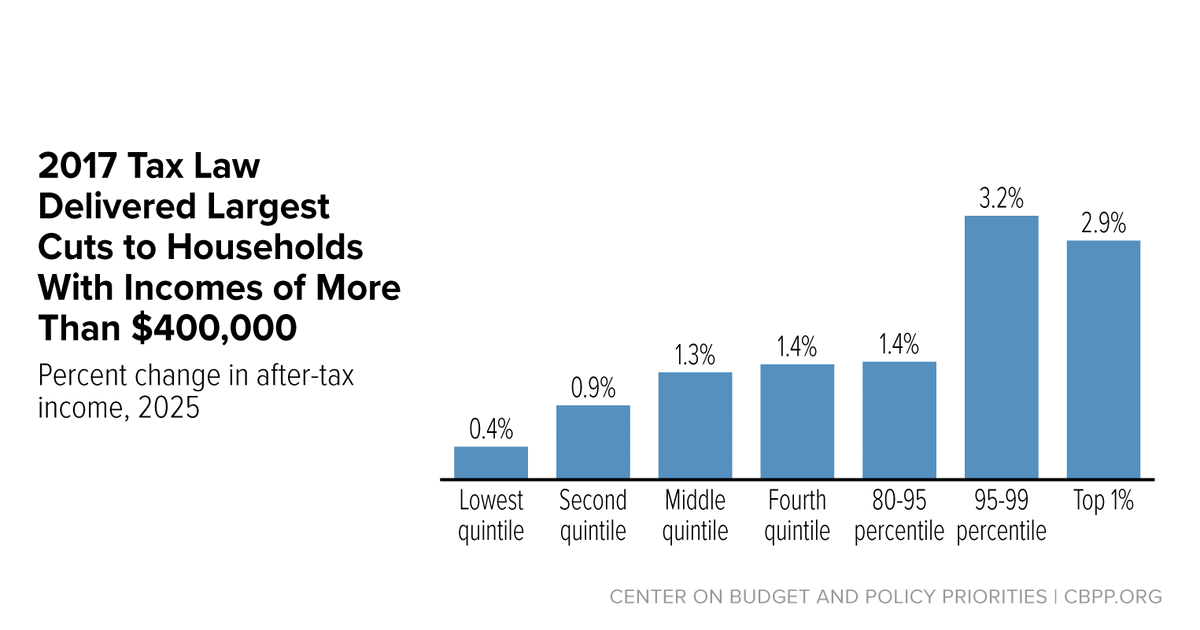

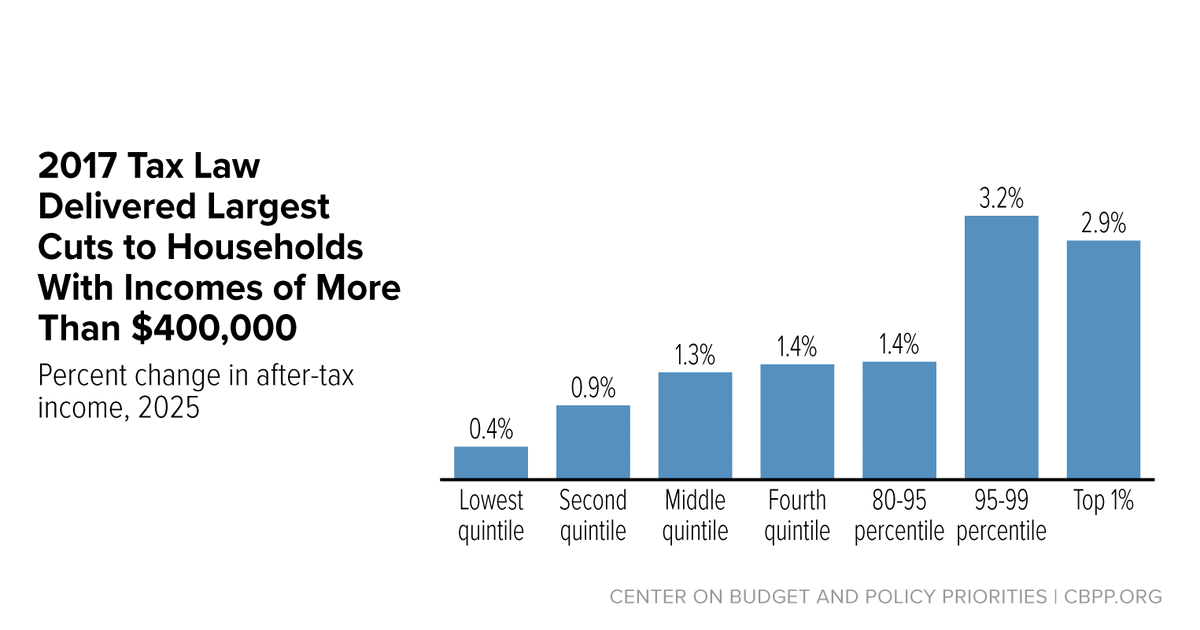

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises | Center on Budget and Policy Priorities

Policymakers and the public should understand that the 2017 Trump tax law was skewed to the rich, was expensive and eroded the U.S. revenue base, and failed to deliver promised economic benefits. A 2025 course correction is needed.www.cbpp.org

View attachment 938524

Last edited:

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

I ain't a billionaire.Your income is other than wages .. so the same / similar scenario as the "ultra rich" who aren't paying their fair share.

Not even a millionaire.

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

it's not "extra".Why do I need to give the fed .gov a extra near $1800.00?

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

You make $90K and have no deductions.I'm my own tax preparer, and I have no write-offs except the standard deduction.

Sure, that's likely.

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

Sunsetting the tax cut will not add $2k to you tax bill.Adjusted gross income for the year in question was $96,000. Taxable after deductions was $89,000.

Andylusion

Platinum Member

You mean the people who pay all the taxes, might benefit from a tax cut the most?The whole cut amounted to half that for your income.

The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises | Center on Budget and Policy Priorities

Policymakers and the public should understand that the 2017 Trump tax law was skewed to the rich, was expensive and eroded the U.S. revenue base, and failed to deliver promised economic benefits. A 2025 course correction is needed.www.cbpp.org

View attachment 938524

The top 25% pay 90% of all taxes, and you act shocked they benefit more than people who pay almost no taxes? Crazy! CRAZY I say....

Woodznutz

Platinum Member

- Dec 9, 2021

- 19,156

- 9,106

- 473

- Thread starter

- #28

I now make $110,000/yr. and still no 'loophole' or business deductions. The only tax-deferred income is from some annuities. I hope to be retired when they mature so I'll be in a much lower tax bracket. But if not, I'll just have to pay the taxes.You make $90K and have no deductions.

Sure, that's likely.

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

YOu need a new accountant.I now make $110,000/yr. and still no 'loophole' or business deductions. The only tax-deferred income is from some annuities. I hope to be retired when they mature so I'll be in a much lower tax bracket. But if not, I'll just have to pay the taxes.

task0778

Diamond Member

Most people take the standard deduction, right? So, if the increase in the standard deduction goes away then my taxes will go up when the Trump tax cuts die, right? I'm a retiree with an income around $40k, so I'm gonna be paying more income tax, right? Thank you Joe Biden, you SOB.

- Feb 22, 2017

- 109,326

- 38,022

- 2,290

You make $90K and have no deductions.

Sure, that's likely.

Pretty common i would bet.

My wife and I made more than 250k last year and took the standard deduction

Andylusion

Platinum Member

That's not uncommon at all. My parents had the same thing. No deductions at all.You make $90K and have no deductions.

Sure, that's likely.

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

So I guess you like paying taxes?Pretty common i would bet.

My wife and I made more than 250k last year and took the standard deduction

Andylusion

Platinum Member

No, if we could take more deductions we would.So I guess you like paying taxes?

- Feb 22, 2017

- 109,326

- 38,022

- 2,290

So I guess you like paying taxes?

Not at all, but I am not one prone to breaking the law by cheating on my taxes, I had enough trouble with the IRS when I did everything correctly.

- Feb 22, 2017

- 109,326

- 38,022

- 2,290

No, if we could take more deductions we would.

Exactly. My kids are grown, I do not pay that much in interest on my mortgage and pretty much have no other deductions. Or at least none that add up to more than 27,700

Woodznutz

Platinum Member

- Dec 9, 2021

- 19,156

- 9,106

- 473

- Thread starter

- #37

I have enough money. I don't need to chase after more. In fact, I stopped renting the 2nd floor flat because I got tired of advertising, showing, cleaning, the place every year (I'm in a student area). The rental value is $700/month.YOu need a new accountant.

Last edited:

Crepitus

Diamond Member

- Mar 28, 2018

- 76,148

- 74,068

- 3,615

Then why were you complaining to start with?I have enough money. I don't need to chase after more.

- Feb 22, 2017

- 109,326

- 38,022

- 2,290

Not complaining, just stating a fact. A small tax increase is chickenfeed compared to the money I've lost in other ways.

Still trying to figure out how he conclusion I like to pay taxes

Similar threads

- Poll

- Replies

- 184

- Views

- 2K

Latest Discussions

- Replies

- 107

- Views

- 433

- Replies

- 52

- Views

- 214

- Replies

- 16

- Views

- 59

- Replies

- 191K

- Views

- 2M

Forum List

-

-

-

-

-

Political Satire 8512

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 483

-

-

-

-

-

-

-

-

-

-