David_42

Registered Democrat.

- Aug 9, 2015

- 3,616

- 833

- 245

How much income do they take in compared to the other 60%?They have lots of taxable income, dumbshit. Because there are lots of them. Again you confuse income and wealth, because you're an ignoramus. They dont pay ANY taxes. In fact they get back more than they pay in. If they're going to benefit from this country and all it offers shouldnt they be paying something? You scream about big corporations not paying their fair share, what about the freeloading bottom 40% of wage earners?LOL. How much taxable income do you think the bottom 40% takes in? How much wealth do you think they own? Making the bottom 40% pay more taxes is spitting on them for no reason, and it wouldn't make a difference at all.That wasnt even coherent.LOL. Sure it does.lol.A version of this article appears in print on September 11, 2015, on page A19 of the New York edition with the headline: Bush’s Plan Gives to the Poor and the Rich]

Pwned again.

A tax plan that disproportionately favors the wealthy and would cause their to have to be gutted social services to pay off the rich and their tax breaks.

Since the top 40% of taxpayers pay virtually all income tax it is no surprise that a cut in income taxes would benefit them.

We need to raise taxes on the bottom 40% so they actually pay something.

Do some basic math.

An Economic Cancer: The Top 1% Earns More Than the Bottom 50%

Income Inequality | Inequality.org

The U.S. ranks around the 30th percentile in income inequality globally, meaning 70% of countries have a more equal income distribution.[4] U.S. federal tax and transfer policies are progressive and therefore reduce income inequality measured after taxes and transfers.[5] Tax and transfer policies together reduced income inequality slightly more in 2011 than in 1979.[1]

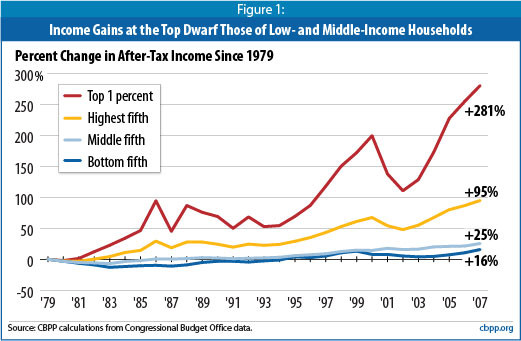

The top 1% of income earners received approximately 20% of the pre-tax income in 2013,[22] versus approximately 10% from 1950 to 1980.[2][23][24] The top 1% is not homogeneous, with the very top income households pulling away from others in the top 1%. For example, the top 0.1% of households received approximately 10% of the pre-tax income in 2013, versus approximately 3-4% between 1951-1981.[22][25] Most of the growth in income inequality has been between the middle class and top earners, with the disparity widening the further one goes up in the income distribution.[26] According to IRS data, adjusted gross income (AGI) of $388,900 was required to be in the top 1% in 2011.[27]

To put this change into perspective, if the US had the same income distribution it had in 1979, each family in the bottom 80% of the income distribution would have $11,000 more per year in income on average, or $916 per month.[28] Half of the U.S. population lives in poverty or is low-income, according to U.S. Census data.[29]

The top 1% of income earners received approximately 20% of the pre-tax income in 2013,[22] versus approximately 10% from 1950 to 1980.[2][23][24] The top 1% is not homogeneous, with the very top income households pulling away from others in the top 1%. For example, the top 0.1% of households received approximately 10% of the pre-tax income in 2013, versus approximately 3-4% between 1951-1981.[22][25] Most of the growth in income inequality has been between the middle class and top earners, with the disparity widening the further one goes up in the income distribution.[26] According to IRS data, adjusted gross income (AGI) of $388,900 was required to be in the top 1% in 2011.[27]

To put this change into perspective, if the US had the same income distribution it had in 1979, each family in the bottom 80% of the income distribution would have $11,000 more per year in income on average, or $916 per month.[28] Half of the U.S. population lives in poverty or is low-income, according to U.S. Census data.[29]

U.S. income inequality, on rise for decades, is now highest since 1928

"

In 1928, the top 1% of families received 23.9% of all pretax income, while the bottom 90% received 50.7%. But the Depression and World War II dramatically reshaped the nation’s income distribution: By 1944 the top 1%’s share was down to 11.3%, while the bottom 90% were receiving 67.5%, levels that would remain more or less constant for the next three decades.

But starting in the mid- to late 1970s, the uppermost tier’s income share began rising dramatically, while that of the bottom 90% started to fall. The top 1% took heavy hits from the dot-com crash and the Great Recession but recovered fairly quickly: Saez’s preliminary estimates for 2012 (which will be updated next month) have that group receiving nearly 22.5% of all pretax income, while the bottom 90%’s share is below 50% for the first time ever (49.6%, to be precise).

"