francoHFW

Diamond Member

No I don't. I follow everything.Try it, dupeI don't subscribe to the Washington post. I see that you do. Maybe that is one of your problems.

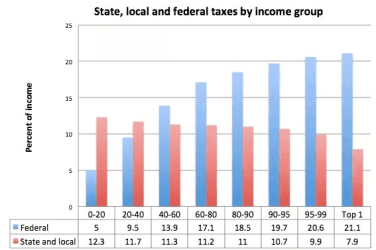

And when government controls the money flow, more money in people's pockets is more government has our nuts in a vice. Yes, we need massive tax cuts, not more revenue redistribution. Tax cuts and redistribution are in no way the same