Avorysuds

Gold Member

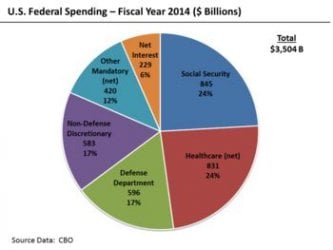

US revenues = aprox 2.5 trillion. Government spending = aprox 3.5 trillion. his does not include FR stimulus or non stop historic low interstate rates, otherwise we would be bear 2 trillion a year in deficit spending.

We currently have a Government 40% or so bigger than we can afford... So obviously the answer is to expand deficit spending. No need to compare Government debt and spending to a house hold or a business, just compare it to other countries that have done similar and you can see the inevitable collapse awaiting us.

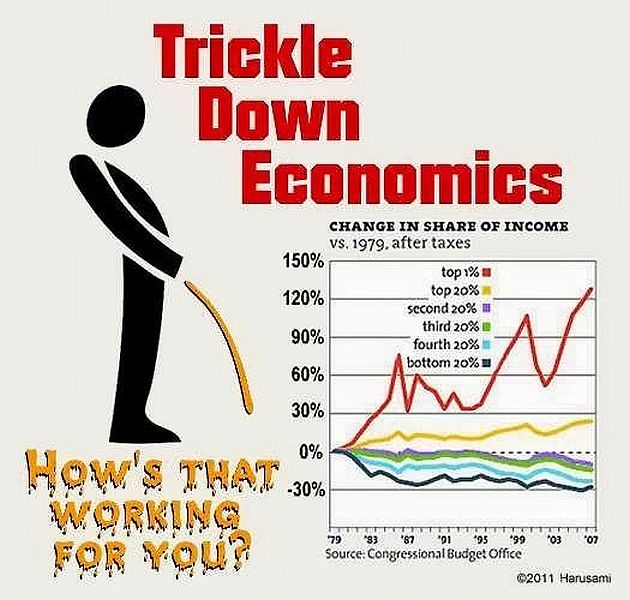

The Republic died when the electorate found they could vote themselves money, as was predicted. There is no going back, only learning from the failed system and applying it to the next country created in it's stead.

We currently have a Government 40% or so bigger than we can afford... So obviously the answer is to expand deficit spending. No need to compare Government debt and spending to a house hold or a business, just compare it to other countries that have done similar and you can see the inevitable collapse awaiting us.

The Republic died when the electorate found they could vote themselves money, as was predicted. There is no going back, only learning from the failed system and applying it to the next country created in it's stead.