The Original Tree

Diamond Member

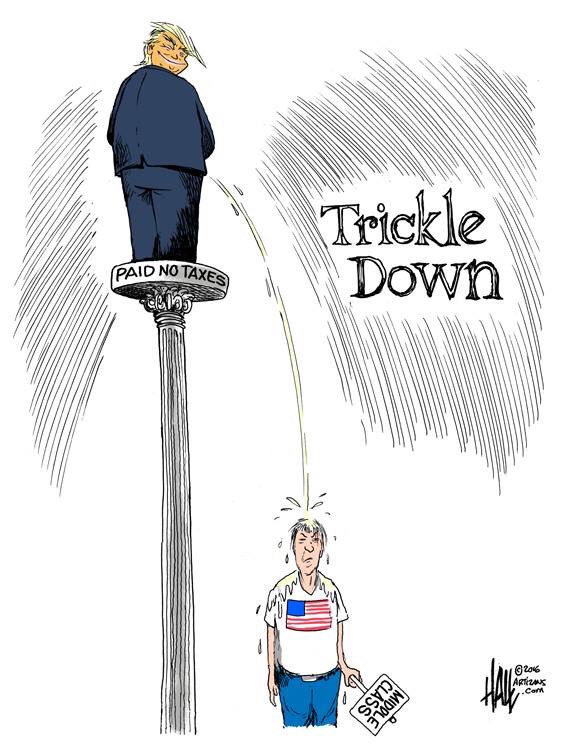

Waiting for you to explain why a huge tax cut for corporations lead to decreased gdp growth.Thank you for actually giving an answer to the question. I think it's definitely on the right track. With so many of our corporations being near monopolies I think they already had tons of cash.Those of us living in reality can now say that the corporate tax cuts were a failure that hurt revenue and did nothing for the economy. So the question is why? I think it likely has to do with the fact so many of our corporations are near monopolies. Curious what others think.

Trump handed big business a massive tax cut, and all he got in return was embarrassment

Two years after his administration passed a massive tax cut for corporations meant to spur economic growth, the verdict is in, and the results are embarrassing. The tax cuts did not "unleash animal spirits" (as the business media is so fond of saying). And it did not usher in a period of 3% GDP growth(as Trump's administration was so fond of echoing).

The plan did not — by any stretch of the imagination — "pay for itself with growth and reduced deductions," as Treasury Secretary Steve Mnuchin said it would back in 2017. In fact, the US budget deficit has grown by 50% since Trump took office.

Corporations didn’t need the cash. Tax cuts work if corporations need capital to pay for equipment or expansion. Corporations have awash with cash since W was in office. Profits from offshoring production.

A capitalist economy exists on supply and demand. There is a lot of pent up demand due to stagnant wages and a shrinking middle class. But not cash amongst workers and middle class to act on it.

Do you even know what a corporation is?