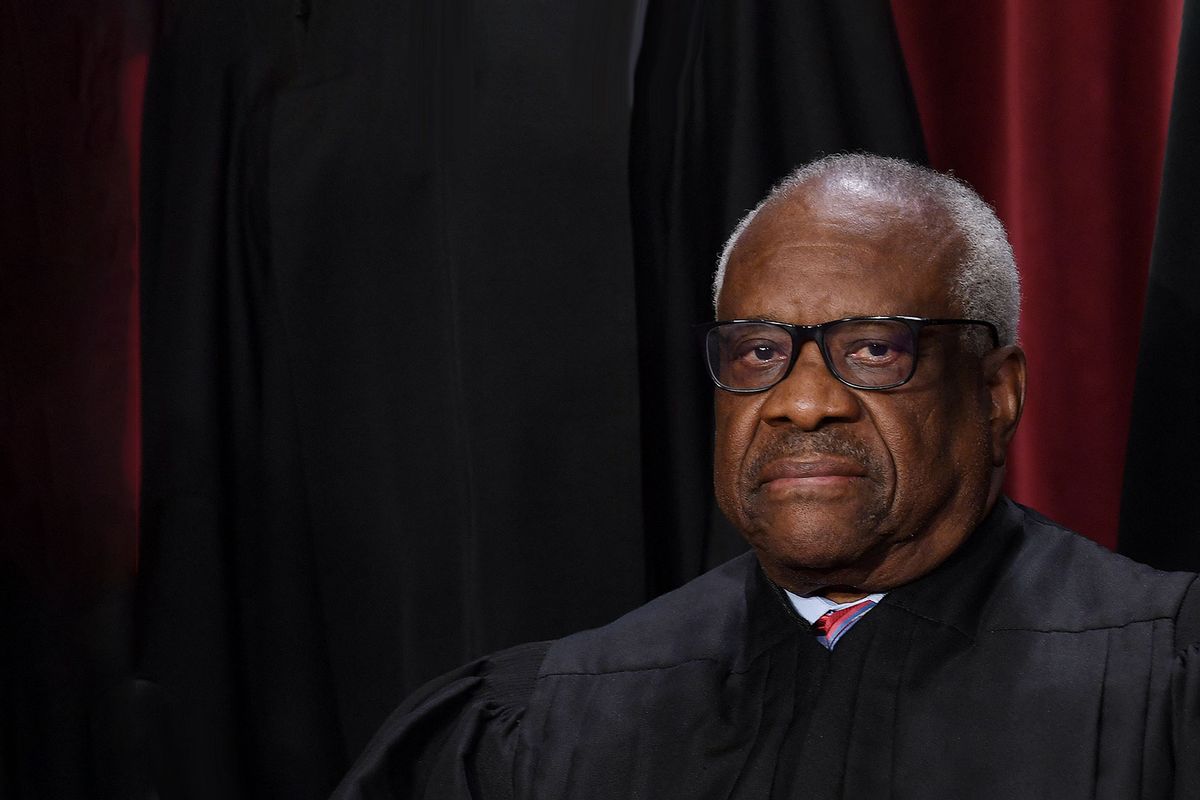

So it's okay to bribe judges? $25K to his wife, $150K to his nephew, lavish trips what else? This is acceptable to you?what law???

Then you shouldn't mind Hunter Biden getting money from special interests. What laws did Hunter break? Then stop complaining. If you don't mind what Clarence is doing then don't tell us you mind Hunter.