My son. He's lived there for four years. He watched it all happen first-hand.Who told you thatBut China put people in cages. They sealed off victims to die. They persecuted, and prosecuted, doctors who tried to raise the alarm. And then they hid the seriousness of the disease, launching a worldwide pandemic on the rest of us.

Trump?

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wealth Tax: Yeah! Why do Warren Buffett and Bill gates need so much money in their Trust?

- Thread starter CrusaderFrank

- Start date

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

every business owner knows that better employees means more revenue.Every employer who's a capitalist knows her bottom line come first, last and always:An employer knows that to keep the best employees he has to treat them the best he possibly can

The Divine Right of Capital

"Profit = Revenue − Costs

"We might begin by making a few things visible that are invisible here. In simple terms, there are two kinds of costs: labor costs and materials. People and objects."

Capitalism conflates people and objects, and that will never change as long as a small minority of society "own" the means of production.

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

I didn't vote for Trump. I think he's an idiot.Not me.Yeah that freedom thing really sucks

You might like it better in China

You and Trump might have more in common with one party authoritarian psychopaths.

What I did was own and operate a successful property rental and management business for 25 years.

How many businesses have you owned and operated?

Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

- 1,530

the government has no business propping up colleges.Too many students or too few dollars?College in so expensive because people have bought into the everyone has to go to college mantra.

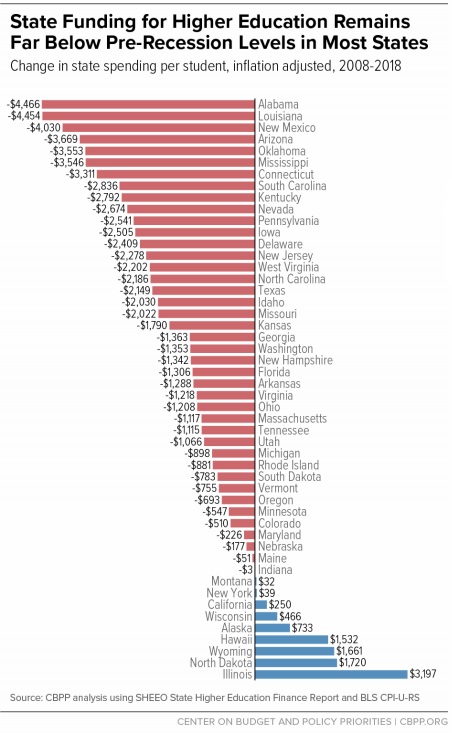

"From the 2008 school year to the 2018 school year, 41 states spent less per student, after adjusting for inflation. During that time period, states spent an average of 13% less per student — about $1,220."

The cost of college increased by more than 25% in the last 10 years—here's why

georgephillip

Diamond Member

A for-profit business has little alternative to maximizing profit in spite of any negative externalities to society as a whole.Not sure what you mean by "prey" the entire motivation of a business is to always make a profit, and to sell their service or product to a consumer.....why do you think people go in to business? To lose money???

During the 20th century mass production led to overproduction (the supply of goods growing beyond consumer demand), so business owners resorted to planned obsolescence and advertising to manipulate consumer spending:

Consumerism - Wikipedia

"In 1899, a book on consumerism published by Thorstein Veblen, called The Theory of the Leisure Class, examined the widespread values and economic institutions emerging along with the widespread 'leisure time' in the beginning of the 20th century.[2]

"In it, Veblen 'views the activities and spending habits of this leisure class in terms of conspicuous and vicarious consumption and waste. Both are related to the display of status and not to functionality or usefulness.'[3]"

He's right about the leisure class....certainly people that have access money will spend for leisure...that's a good thing....I was happy when I finally got successful enough to buy things I wanted and not just things I needed. Only in Capitalism can you get to that level of freedom.A for-profit business has little alternative to maximizing profit in spite of any negative externalities to society as a whole.Not sure what you mean by "prey" the entire motivation of a business is to always make a profit, and to sell their service or product to a consumer.....why do you think people go in to business? To lose money???

During the 20th century mass production led to overproduction (the supply of goods growing beyond consumer demand), so business owners resorted to planned obsolescence and advertising to manipulate consumer spending:

Consumerism - Wikipedia

"In 1899, a book on consumerism published by Thorstein Veblen, called The Theory of the Leisure Class, examined the widespread values and economic institutions emerging along with the widespread 'leisure time' in the beginning of the 20th century.[2]

"In it, Veblen 'views the activities and spending habits of this leisure class in terms of conspicuous and vicarious consumption and waste. Both are related to the display of status and not to functionality or usefulness.'[3]"

Also, to your first point...businesses are certainly going to advertise....but it's up to the individual to make the purchase.

as far as supply being high.....and demand low.....that just means the cost of the oversuipplied product or service, will be low....

task0778

Diamond Member

One of the founding principles of this country and our gov't is that the gov't cannot and should take away your property, i.e., what is yours is YOURS. You are required to pay taxes on what you earn every year according to the law, and whatever is left over is YOURS and you can do anything that is legal with it. And that includes leaving it to your spouse, children, or whoever upon your death. AND, you can decide to gift somebody with your wealth before you die too, again subject to the tax laws.

What the democrats are proposing changes all that. They want to spend your money for political purposes, and they don't give a flyin' fuck about your rights to your property. For them it's always open season on anybody who has a lot of money, they start out with some kind of limit, like 50 or 100 million dollars of assets, and then what? A few years down the road it drops to 30 million, then 10 million, where and when would it stop? Or they raise the wealth tax rate from 1% to 2% to 3% and up it goes; it always starts out really low and then it grows like a fuckin' weed. It's all about redistribution of wealth, do ya understand that when you do that the rich people take their wealth and go elsewhere? Who here thinks that's good for the economy? We've seen it time after time, when you try to fuck the rich the rich leave.

When the democrats tell us a wealth tax will net the US X number of addition tax dollars, it's always a linear calculation: we got this much at 35% so that means we'll get this much more if it's 40%. But they NEVER take into account the reality that those rich people you're trying to shaft will change their strategies, i.e., reduce or stop investing in businesses that they'll have to pay more taxes on. Some of them will take their wealth and leave for Ireland or somewhere else to keep what is theirs. And who can blame them for that? IT'S THEIR FUCKIN' PROPERTY! The US or any other gov't has no right to take your property from you unless it's proven that you broke the law to get it.

What the democrats are proposing changes all that. They want to spend your money for political purposes, and they don't give a flyin' fuck about your rights to your property. For them it's always open season on anybody who has a lot of money, they start out with some kind of limit, like 50 or 100 million dollars of assets, and then what? A few years down the road it drops to 30 million, then 10 million, where and when would it stop? Or they raise the wealth tax rate from 1% to 2% to 3% and up it goes; it always starts out really low and then it grows like a fuckin' weed. It's all about redistribution of wealth, do ya understand that when you do that the rich people take their wealth and go elsewhere? Who here thinks that's good for the economy? We've seen it time after time, when you try to fuck the rich the rich leave.

When the democrats tell us a wealth tax will net the US X number of addition tax dollars, it's always a linear calculation: we got this much at 35% so that means we'll get this much more if it's 40%. But they NEVER take into account the reality that those rich people you're trying to shaft will change their strategies, i.e., reduce or stop investing in businesses that they'll have to pay more taxes on. Some of them will take their wealth and leave for Ireland or somewhere else to keep what is theirs. And who can blame them for that? IT'S THEIR FUCKIN' PROPERTY! The US or any other gov't has no right to take your property from you unless it's proven that you broke the law to get it.

georgephillip

Diamond Member

I was referring to corporate balance sheets which currently optimize shareholder income over employee income, treating workers as an expense and not an asset:You reporting taxes on the money retained in your pocket?

Or, when you use it to purchase product?

"Capital Income + Retained earnings = Revenue – (Employee income + Cost of materials)

"Kelly uses some simple algebra to show that this formula could just as easily be re-written as:

"Employee income + Retained earnings = Revenue – (Capital income + Cost of materials)

"In other words, the company could just as easily be optimized to maximize employee income.

"All it takes is a perspective shift. Kelly then talks about the fact that employees don’t even show up on the corporate balance sheet.

"That’s because employees are seen as an expense, not an asset, despite the common phrase 'our employees are our greatest assets.'"

The Divine Right of Capital by Marjorie Kelly: A Summary

basquebromance

Diamond Member

- Nov 26, 2015

- 109,396

- 27,037

- 2,220

- Banned

- #590

Not all evil people are bad, but all evil people are rich

georgephillip

Diamond Member

Start defining wealth at the top of our current economic pyramid (scheme):to those who support a wealth tax: i would like to know your definition of a "wealthy" person

to those who don't: buckle up, more taxes are headed your way under Biden...guaranteed

Elizabeth Warren, Bernie Sanders propose 3% wealth tax on billionaires

"Sen. Elizabeth Warren, Sen. Bernie Sanders and other Democrats on Monday proposed a 2% annual tax on wealth over $50 million, rising to 3% for wealth over $1 billion..."

"About 100,000 Americans — or, fewer than 1 in 1,000 families — would be subject to a wealth tax in 2023, according to Emmanuel Saez and Gabriel Zucman, economists at the University of California, Berkeley.

"The policy would raise at least $3 trillion over a decade, they found."

georgephillip

Diamond Member

What affects have stock buybacks had on dividend returns since 1982?In the 1950s, you could get 9% dividend returns. Even in the 70s and 80s, you could get 3% to 5%. Today, you are lucky to get 2%.

7 Reasons Stock Buybacks Should Be Illegal

"The SEC, operating under the Reagan Republicans, passed rule 10b-18, which made stock buybacks legal. Up until the passing of this rule, the Securities Exchange Act of 1934 considered large-scale share repurchases a form of stock manipulation."

georgephillip

Diamond Member

Relative to what they earn?So under your formulate, when the company revenues fall, should all the employees take a pay cut?

7 Reasons Stock Buybacks Should Be Illegal

"In 1982, according to the Economic Policy Institute, the average CEO earned 50 times the average production worker.

"Today, the CEO Pay Ratio’s increased to 144 times the average worker with most of the gains a result of stock options and awards."

georgephillip

Diamond Member

You never tire of blaming the victims.Well that explains why everyone in Venezuela is so happy. After all those evil business people stoped preying on them, packed up their wealth, their jobs, and their businesses and left.... they are so much better off.

The History - and Hypocrisy - of US Meddling in Venezuela

"Trump’s latest moves, recognizing Venezuela’s illegitimate would-be presidential usurper Juan Guaido and appointing the neoconservative regime change hawk Elliott Abrams as special envoy, seems designed to sow seeds of subversion and revolt within the country’s government and military.

"This follows National Security Adviser John Bolton — a key neocon architect and cheerleader for the 2003 invasion of Iraq and who has also advocated regime change in Iran, Venezuela and elsewhere — calling Venezuela, Cuba and Nicaragua a 'troika of tyranny,' a hypocritical characterization reminiscent of Bush’s 'axis of evil,' and one that utterly ignores the far worse, but far more subservient, regimes backed by the Trump administration.

"The United States has almost always opposed — whether by slaughter, spies or sanctions — any government or movement that seeks to freely choose its own political and economic path if it diverges from the corporate capitalist order backed by Washington and Wall Street."

georgephillip

Diamond Member

Workers control the state in a socialist order, not the other way around.Sadly, not a joke. Socialism views labor as property of the state. Do you deny that workers are "physical and non-financial inputs used in the production of goods and services with economic value."

Workers’ Control (Socialism) | tutor2u

"Workers' control is concerned with the importance and the extent of control over the economy and/or state and how it is to be achieved.

"Democratic socialists advocate workers’ control on two grounds.

"Firstly, it will ensure a more equitable distribution of economic resources.

"Decisions will thereby be taken for the benefit of all members of the workforce rather than merely shareholders and CEO’s.

"Secondly, workers’ control will abolish class distinctions."

georgephillip

Diamond Member

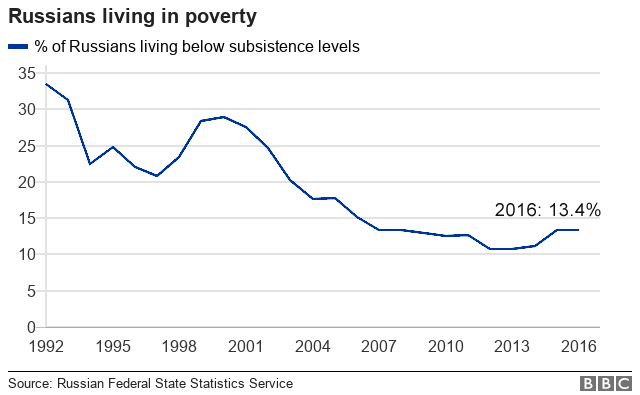

How about Russian standards of living after the fall of Communism?yeah tell me where Marxist socialism ever resulted in increased standards of living for the working class

Life in Vladimir Putin's Russia explained in 10 charts

georgephillip

Diamond Member

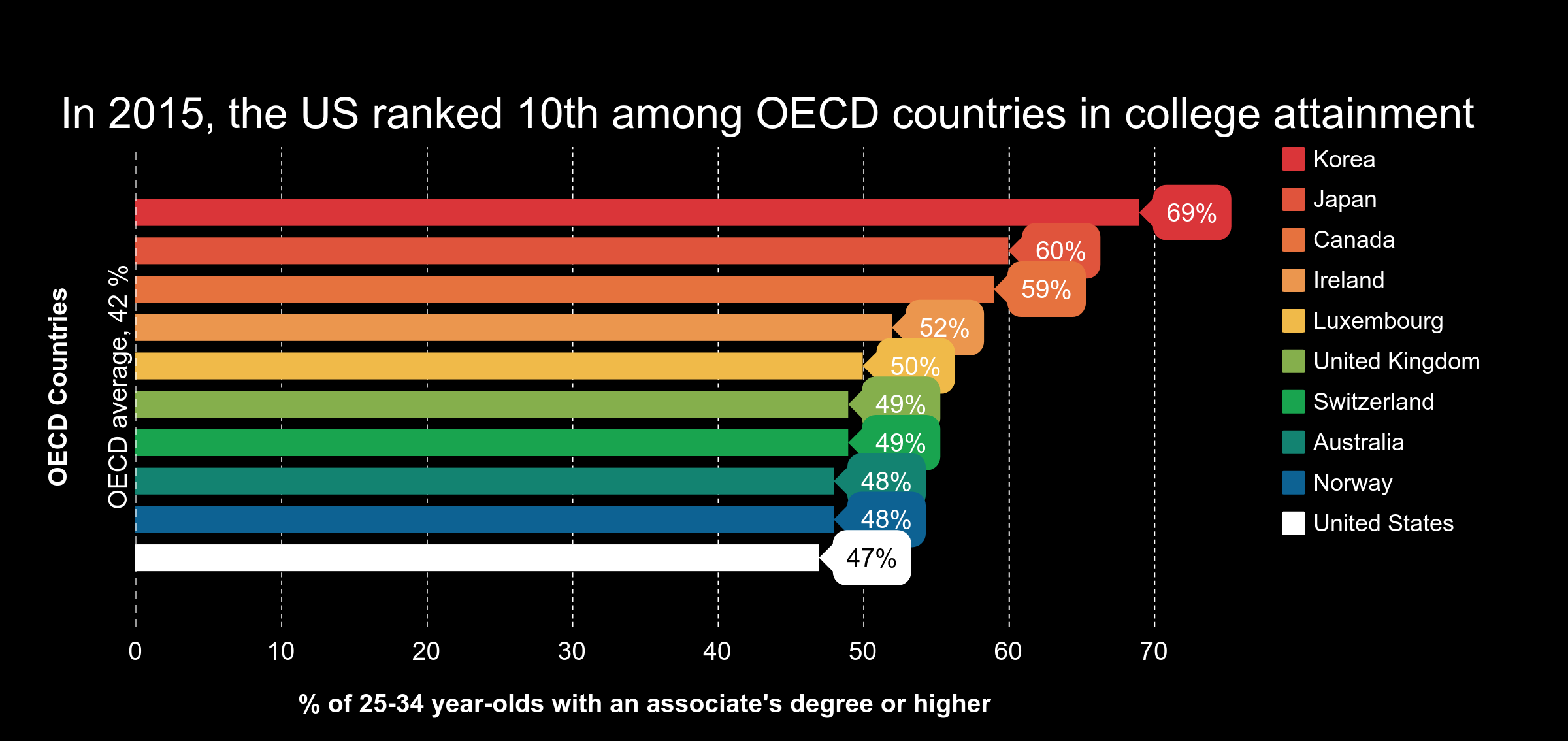

Eliminate the need for loans by using government to lower the cost of living and doing business by subsidizing higher education for all qualified applicantsGet the government out of the student loan business and tuition prices will drop

Opinion | Why We Must Make Public Higher Education Tuition Free

georgephillip

Diamond Member

A flat tax wouldn't do anything to reduce economic inequality in the US. In fact, it might make it worse.And the rate would not have to be very high to be revenue neutral.

Should The U.S. Switch To A Flat Tax?.

"In addition, a flat tax may not be as fair as one would think.

"A gradual tax system does allow for things like wealth redistribution, which many have argued is a major benefit to society.

"And a flat tax could also give middle-class families an extra burden.

"If someone making one million per year has to pay 18% of his income in taxes, he still has netted $820,000 for the year, a figure which still has great purchasing power.

"But a person making $50,000 per year is left with $41,000 per year; that difference can influence fiscal decisions, like purchasing a new car versus a used car, whether to place a down payment on a house or affording either a state school or private college, extremely tough for people who make closer to the national median income level.

"In addition, when a group of countries near each other enact a flat tax, it creates a race towards the bottom; in order to compete, nations must keep on lowering their tax rates, a problem which could lead to fiscal instability."

georgephillip

Diamond Member

Yes, the Chinese profit from war as well.....they make a lot of weapons and sell them....some of their biggest clients have been some of the most oppressive regimes as well....Iran, Iraq, North Korea, Pakistan, and Myanmar (Thailand is also a major client)

Arms sales are a global problem without any realistic solution.

Infographic: The World's Biggest Postwar Arms Exporters

That's some word salad. Worthy of danielpalos even.Corruption consists of deriving benefit from power over others in morally objectional ways such as economic gains from the inferior bargaining power of workers and from the superior political influence of those who own the means of production.You're claiming capitalism can't exist without misleading and deceptive contracts. Care to back that up? What about capitalism depends on fraud?

Anyone seriously doubting corruption's influence over capitalism should be able to explain why economic inequality continues to grow between owners and workers

THE PAINFUL TRUTH: CAPITALISM IS A ZERO-SUM GAME

"The top 20 percent of the world’s population controls 70 percent of total income while the bottom fifth account for 2 percent.

"Fifty percent of children and youth live below internationally recognized poverty rates.

"The middle income countries are the most unequal: the former Soviet Bloc, and countries in Asia experiencing the greatest increase in income inequality."

What about capitalism depends on fraud?

Similar threads

Latest Discussions

- Replies

- 77

- Views

- 560

- Replies

- 2

- Views

- 9

- Replies

- 120

- Views

- 373

- Replies

- 180

- Views

- 719

Forum List

-

-

-

-

-

Political Satire 8370

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

ObamaCare 781

-

-

-

-

-

-

-

-

-

-

-

Member Usernotes 477

-

-

-

-

-

-

-

-

-

-