Kondor3

Cafeteria Centrist

Ooooooohhhh, look, Mumsie... a LibTard "cupcake", copy-catting Conservatives' use of the word... so few LibTards have even the tiniest sliver of originality.Each individual company has to determine when taxes are too high… It's not up to the federal government. The federal government knows nothing of business… Try and keep up festerTry to keep up fester, those companies would not be moving if they were not overtaxed… Taxation without representation

Sure Cupcake, sure

Warren Buffett: ‘It Is A Myth’ That U.S. Corporate Taxes Are High

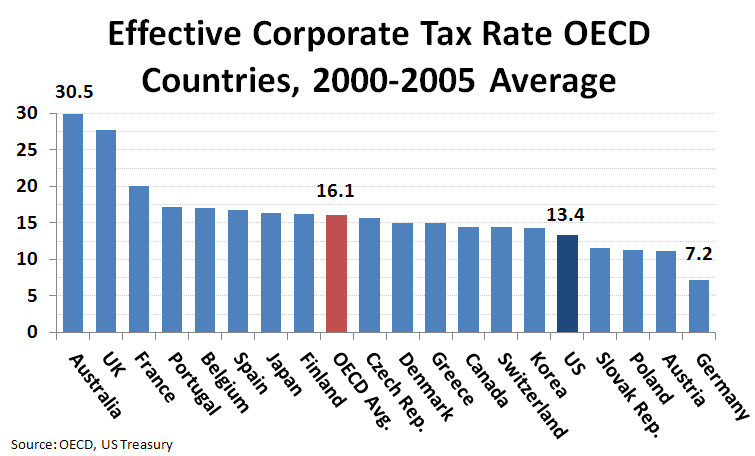

The interesting thing about the corporate rate is that corporate profits, as a percentage of GDP last year were the highest or just about the highest in the last 50 years. They were ten and a fraction percent of GDP. That’s higher than we’ve seen in 50 years. The corporate taxes as a percentage of GDP were 1.2 percent, $180 billion. That’s just about the lowest we’ve seen. So our corporate tax rate last year, effectively, in terms of taxes paid for the United States, was around 12 percent, which is well below those existing in most of the industrialized countries around the world. So it is a myth that American corporations are paying 35 percent or anything like it…Corporate taxes are not strangling American competitiveness.

Warren Buffett: ‘It Is A Myth’ That U.S. Corporate Taxes Are High

Yes Cupcake, Gov't can't just decide to tell the Corps who don't want to play by RULES we set up to go fuck themselves if they don't want to create jobs in the US and instead off shore the jobs WHILE deducting those expenses (which Dems tried to stop and the GOP blocked)?

Grow a brain Cupcake

Yeah... Dems tried to stop all that... NAFTA... TPP... that kind of effort by the Dems... trying to stop jobs from going off-shore, right? Ssuuuurrree !!! Not.

Maybe... one day... a long time from now... when you finally get to put on your Big Boy Pants... you'll figure out that Dems are just as full of $hit as Pubs...

It's just a different smell and a different flavor coming from a different angle...

Donkey $hit is, indeed, different from Elephant $hit...

But it's still $hit..

=======================================================

Meanwhile...

When the Pubs pull the plug on SNAP, or, at least, when they shave it down to within an inch of its life...

6.9% of the White population will be impacted...

28.29% of the Black population will be impacted...

http://www.usmessageboard.com/posts/17419822/

Sounds like great fun...

Enjoy...

NAFTA? Oh right thew CONservative Heritage Foundations thing that Ronnie Reagan introduced to US the day he ran for Prez in 1979.

It was proposed by Ronnie, negotiated by HW, and pushed through with GOP SUPPORTERS by BJ Bill, the best conservative Prez since Ike.

60% of Dems have opposed EVERY free trade agreement Know how math works Cupcake? Want to guess the percentage of GOPers supporting them"

Ronald Reagan calls for an open border with Mexico, 1980

Doesn't matter.

The subject-at-hand is SNAP, and related welfare programming, such as Medicaid...

With SNAP being the most ubiquitous form of such programming...

And Red State consumption of SNAP vs. Blue State consumption of SNAP.

For that, read... White Folk on SNAP vs. Black Folk on SNAP... as a macro-level observation.

On that level, as SNAP gets cut to the bare bone...

6.9% of White Folk will be impacted...

28.29% of Black Folk will be impacted...

Broadly speaking, I don't think White America really gives a good rat's ass about SNAP any longer...

They just wanna keep more money in their wallets...

Times changed, on November 8, 2016...

Fun time, and the Free Ride, are over...

You're on your own... as it should have been, all along...

Enjoy...