Blues Man

Diamond Member

- Aug 28, 2016

- 35,513

- 14,899

Look at the direction deficits go. Deficits decreased under Obama and Clinton, increased under Trump and Bush . The dems inherit a mess. Biden will inherit a huge deficit thanks to trumps failure.Reagan tripled the debt. Deficits decreased during Clinton and Obama. They increased under trump and Bush. You don’t seem the dumb, are you just dishonest?irrelevantDid the deficit get bigger or smaller each year?You have google and probably remember Bush spending away the surplus he inherited. I can only answer so many stupidBush was bad. Very bad. Trump even ran on how bad Bush was.Bush inherited a balanced budget and gave it away with tax cuts and military spending.He inherited a disaster from Bush. After disaster was fixed deficits declined. Compare the last 3 years of Obama to the first 3 of Trump. Bad and worse.Yes and the giant increases came when repubs were in full control. Irresponsible tax cuts and huge military spending increase. Are you dishonest or really stupid?Spending originates in the House, Dummy.Republicans love debt. Just put it on the credit card.Nobody is listens to your bullshit,we are all laughing at your pathetic lies.But only one party has been cutting taxes and increasing spending.The last time this nation was debt free was in 1835 under Andrew Jackson. Since then both parties have run it up claiming one is worse than the other is like saying it’s better to drown in water that is 475 feet deep instead of water 500 feet deep.

Could it have said it better myself.

Dimwingers have controlled the House 55 out of the last 65 years, Brainfart.

You lose again.

Obama doubled the debt in 8 years.

Comments?

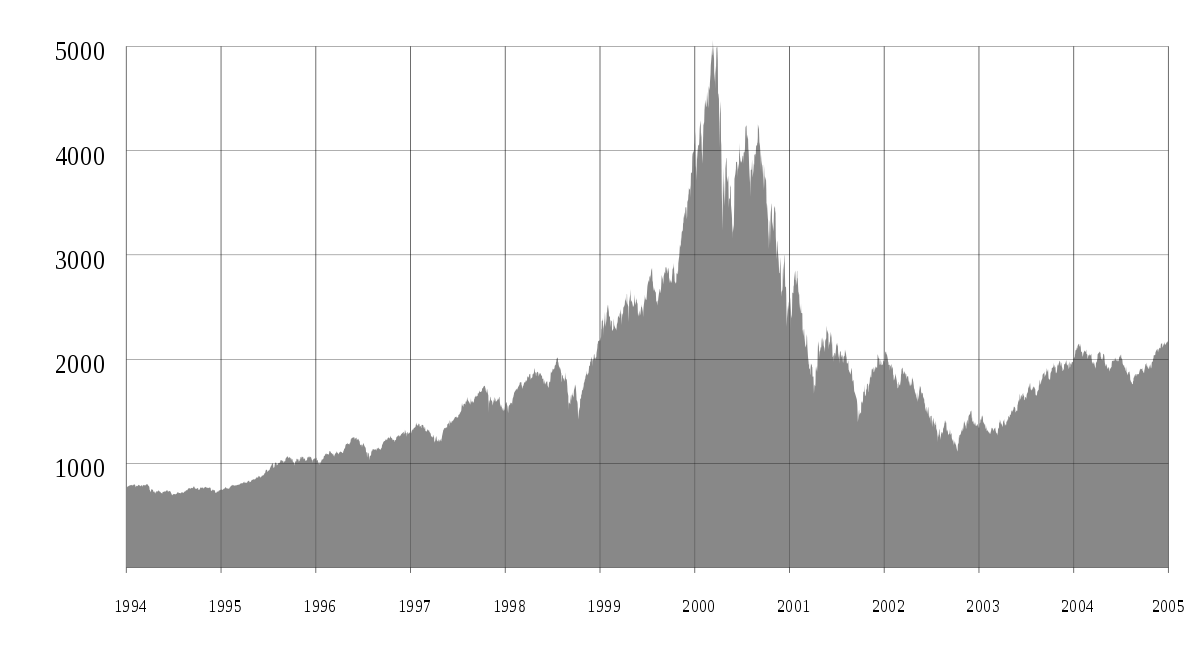

Bush inherited a dot-com disaster from Clinton. Y'all let Bush use that excuse ?

Is that what you call the dot-com bust?

Dot-com bubble - Wikipedia

en.wikipedia.org

Oh yea I know. Bush man bad, orange man bad.

Anyway, you said Clinton left a surplus and/or balanced budget. I asked you to prove it. So far you've done nothing.

questions. Republicans are either claiming newt balanced the budget or denying it. The stupidity gets tiring.

You make the claim you back it up. When I google it it shows a deficit every year, meaning you're wrong.

the debt grew

as I said the largest debt increases by percentage have mostly been under democrat administrations

look it up.

Democrats have been responsible for more of the largest percentage increases of the debt than republicans.

3 of the 5 top contributors to the national debt have been democrats

You're entire argument that only republicans increase the debt is bullshit

irrelevant.

not one administration since Coolidge actually left less debt.

your entire argument fell apart pages ago but you still cling to it.

Our debt situation has been caused by both parties and is the culmination of at least 60 years

yes, but the fact is that dems have added more debt than republicans. On that there is no question.

you might as well be arguing that the Iceberg that made the smallest hole didn't sink the titanic.

Republicans only care about the debt when democrats add to ti and democrats only care when republicans add to it.

Which is why we need to shit can the 2 party system

:max_bytes(150000):strip_icc()/deficit-57f24df95f9b586c352a2725.jpg)