Arianrhod

Gold Member

- Jul 24, 2015

- 11,060

- 1,076

- 255

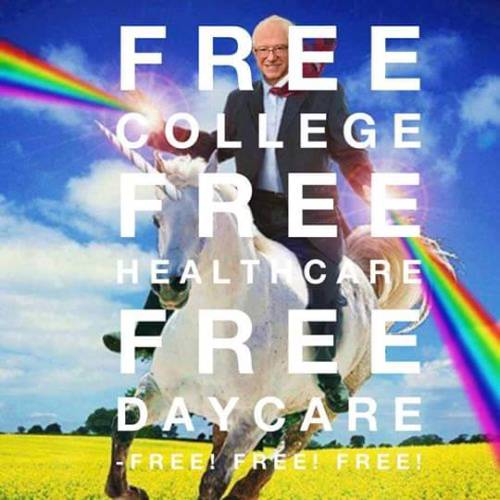

Great news! I can't wait to get my free college!Already have a degree but want another.

An undergrad degree at a state university? Let us know if the Sanders plan includes people who already have degrees. Now, if you have outstanding student loans for the first degree, even Hillary's promising refi rates.

Maybe we should of bailed out the student loans instead of the banks in 08. they are once again TOOO Big to Fail, yep.

"Should have" bailed out student loans? How would you do that?