Dad2three

Gold Member

"War of choice".... Lol

Always have to chuckle at that teeny bopper drivel

It wasn't? Why Dubya/.Cheney twist and turn soooo much to get the Congress to go along with them then?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

"War of choice".... Lol

Always have to chuckle at that teeny bopper drivel

Every charity has overhead, Cletus. Just ask the Clintons.That's charity, Cletus, because the church then uses the funds for charitable works. You do know how that works, right?-- which is, by the way, a lot more the 13.9 percent Mitt Romney paid in 2011.

It's nice to see Liberals finally admitting they lied when they said Romney had not paid any taxes in years. (Reid finally and shamelessly admitted that he had lied about Romney when he abused his power by attacking Romney, as American citizen, form the floor of the US Senate, justifying his lies told to help Obama win by saying, "It worked, didn't it?' BTW, Obama, Reid, and Biden also attacked Romney over 'paultry' charitable contributions...and when the truth came out it was found that Romney's contributions to charity more than doubled that of Obama and Biden COMBINED.)

Got a link to that "apology" Bubba, just ANOTHER LIE FROM YOU. Shocking, lol

You mean Romney gave money to the church he belonged too? lol

Mormons tend to do that right?

Sure Bubba, they don't fund the church building or salaries , it's used for the "charity' they do.

LOL

So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.If you simplified the tax system then there would be less IRS agents needed, less Tax Accountants, and more people on unemployment. One reason why the left doesn't want Tax simplification, is then they don't have a Lois Lerner, going after conservative pac, or other ways to stifle opposition voices. So we will continue to see an unjust tax system that punishes those that have worked hard, and reward those that sit back, in their parents basement, typing on plastic made from OIL, and bitching about the country, that they wish wasn't here.

we could really simplify the tax code for most people by eliminating the personal income tax altogether. Just tax corporations and businesses. Have a standard deduction for any full time employee.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Do everyone, especially yourself, a favor and do a little research into Morman charitable activities before you make yourself look foolish all over again.Every charity has overhead, Cletus. Just ask the Clintons.That's charity, Cletus, because the church then uses the funds for charitable works. You do know how that works, right?It's nice to see Liberals finally admitting they lied when they said Romney had not paid any taxes in years. (Reid finally and shamelessly admitted that he had lied about Romney when he abused his power by attacking Romney, as American citizen, form the floor of the US Senate, justifying his lies told to help Obama win by saying, "It worked, didn't it?' BTW, Obama, Reid, and Biden also attacked Romney over 'paultry' charitable contributions...and when the truth came out it was found that Romney's contributions to charity more than doubled that of Obama and Biden COMBINED.)

Got a link to that "apology" Bubba, just ANOTHER LIE FROM YOU. Shocking, lol

You mean Romney gave money to the church he belonged too? lol

Mormons tend to do that right?

Sure Bubba, they don't fund the church building or salaries , it's used for the "charity' they do.

LOL

Good you agree, Mittens charity didn't help the poor much, but it helped to "spread the word" on the Flying Spaghetti Monster in the Sky!

So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.If you simplified the tax system then there would be less IRS agents needed, less Tax Accountants, and more people on unemployment. One reason why the left doesn't want Tax simplification, is then they don't have a Lois Lerner, going after conservative pac, or other ways to stifle opposition voices. So we will continue to see an unjust tax system that punishes those that have worked hard, and reward those that sit back, in their parents basement, typing on plastic made from OIL, and bitching about the country, that they wish wasn't here.

we could really simplify the tax code for most people by eliminating the personal income tax altogether. Just tax corporations and businesses. Have a standard deduction for any full time employee.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.If you simplified the tax system then there would be less IRS agents needed, less Tax Accountants, and more people on unemployment. One reason why the left doesn't want Tax simplification, is then they don't have a Lois Lerner, going after conservative pac, or other ways to stifle opposition voices. So we will continue to see an unjust tax system that punishes those that have worked hard, and reward those that sit back, in their parents basement, typing on plastic made from OIL, and bitching about the country, that they wish wasn't here.

we could really simplify the tax code for most people by eliminating the personal income tax altogether. Just tax corporations and businesses. Have a standard deduction for any full time employee.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Do everyone, especially yourself, a favor and do a little research into Morman charitable activities before you make yourself look foolish all over again.Every charity has overhead, Cletus. Just ask the Clintons.That's charity, Cletus, because the church then uses the funds for charitable works. You do know how that works, right?Got a link to that "apology" Bubba, just ANOTHER LIE FROM YOU. Shocking, lol

You mean Romney gave money to the church he belonged too? lol

Mormons tend to do that right?

Sure Bubba, they don't fund the church building or salaries , it's used for the "charity' they do.

LOL

Good you agree, Mittens charity didn't help the poor much, but it helped to "spread the word" on the Flying Spaghetti Monster in the Sky!

Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.we could really simplify the tax code for most people by eliminating the personal income tax altogether. Just tax corporations and businesses. Have a standard deduction for any full time employee.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Hey, what do you know? They're highly successful.Do everyone, especially yourself, a favor and do a little research into Morman charitable activities before you make yourself look foolish all over again.Every charity has overhead, Cletus. Just ask the Clintons.That's charity, Cletus, because the church then uses the funds for charitable works. You do know how that works, right?

Sure Bubba, they don't fund the church building or salaries , it's used for the "charity' they do.

LOL

Good you agree, Mittens charity didn't help the poor much, but it helped to "spread the word" on the Flying Spaghetti Monster in the Sky!

Your projection noted Bubs

The Mormon Church is spending less than 1% of its income to help the poor.

Mormon church earns $7 billion a year from tithing, analysis indicates

Relying heavily on church records in countries that require far more disclosure than the United States, Cragun and Reuters estimate that the Church of Jesus Christ of Latter-day Saints brings in some $7 billion annually in tithes and other donations.

It owns about $35 billion worth of temples and meeting houses around the world, and controls farms, ranches, shopping malls and other commercial ventures worth many billions more.

The Mormon church has no hospitals and only a handful of primary schools. Its university system is limited to widely respected Brigham Young, which has campuses in Utah, Idaho and Hawaii, and LDS Business College. Seminaries and institutes for high school students and single adults offer religious studies for hundreds of thousands.

It counts more than 55,000 in its missionary forces, primarily youths focused on converting new members but also seniors who volunteer for its nonprofits, such as the Polynesian Cultural Center, which bills itself as Hawaii's No. 1 tourist attraction, and for-profit businesses owned by the church.

The church has plowed resources into a multi-billion-dollar global network of for-profit enterprises: it is the largest rancher in the United States

Mormon church earns $7 billion a year from tithing, analysis indicates - Investigations

Now you're starting to look foolish again, because you're still arguing the same thing and ignoring the magic money pot that apparently they use to pay taxes.Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Oh right, silly me, the Corps can't take less profit

Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.we could really simplify the tax code for most people by eliminating the personal income tax altogether. Just tax corporations and businesses. Have a standard deduction for any full time employee.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Now you're starting to look foolish again, because you're still arguing the same thing and ignoring the magic money pot that apparently they use to pay taxes.Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Oh right, silly me, the Corps can't take less profit

Hey, what do you know? They're highly successful.Do everyone, especially yourself, a favor and do a little research into Morman charitable activities before you make yourself look foolish all over again.Every charity has overhead, Cletus. Just ask the Clintons.Sure Bubba, they don't fund the church building or salaries , it's used for the "charity' they do.

LOL

Good you agree, Mittens charity didn't help the poor much, but it helped to "spread the word" on the Flying Spaghetti Monster in the Sky!

Your projection noted Bubs

The Mormon Church is spending less than 1% of its income to help the poor.

Mormon church earns $7 billion a year from tithing, analysis indicates

Relying heavily on church records in countries that require far more disclosure than the United States, Cragun and Reuters estimate that the Church of Jesus Christ of Latter-day Saints brings in some $7 billion annually in tithes and other donations.

It owns about $35 billion worth of temples and meeting houses around the world, and controls farms, ranches, shopping malls and other commercial ventures worth many billions more.

The Mormon church has no hospitals and only a handful of primary schools. Its university system is limited to widely respected Brigham Young, which has campuses in Utah, Idaho and Hawaii, and LDS Business College. Seminaries and institutes for high school students and single adults offer religious studies for hundreds of thousands.

It counts more than 55,000 in its missionary forces, primarily youths focused on converting new members but also seniors who volunteer for its nonprofits, such as the Polynesian Cultural Center, which bills itself as Hawaii's No. 1 tourist attraction, and for-profit businesses owned by the church.

The church has plowed resources into a multi-billion-dollar global network of for-profit enterprises: it is the largest rancher in the United States

Mormon church earns $7 billion a year from tithing, analysis indicates - Investigations

No, that's exactly what you tried and failed to argue in this thread.

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

BUT IF YOU MAKE $10,000,000 IN GERMANY, AND PAY THEIR TAX RATES, YOUR US BURDEN WOULD BE ZERO, BECAUSE THEY HAVE A HIGHER TAX BURDEN, YOU CAN BRING THE MONEY HOME ANYTIME, WITHOUT DOUBLE TAXATION!!!!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

Dumbass says:

"I made $5 million IN Germany... got it? I paid income taxes on it, TO Germany? Following me? The money is still IN Germany, in a German bank, collecting German interest. Each year, I have to pay Germany tax on the interest dividends."

COOL. AND YOU ARE REQUIRED TO REPORT THAT TO US TAX AUTHORITY

"It is NOT US INCOME! It doesn't ever BECOME US income unless I bring it to the US and claim it as income. If I do that, I will be taxed AGAIN."

BZZ WRONG, AGAIN, ALL INCOME FROM ANY SOURCE WHETHER YOU ARE ON US SOIL OR TEA-BAGGERSTAN OR GERMANY, IS REQUIRED TO BE REPORTED TO US TAX AUTHORITY, BUT SINCE (AGAIN) GERMANY HAS A HIGHER TAX BURDEN, THERE WOULD PROB BE NO NEW US TAX BURDEN IF YOU BRING THE MONEY TO THE US!

"My plan is to eliminate double taxation. Repatriate that wealth and create new jobs with it."

YOUR "PLAN" DO SOMETHING ABOUT SOMETHING THAT'S NOT BEING DONE??? LOL

Lot's of fun showing that YOU are not only a stupid MF but a liar too Bubs

Again... Proving that you are arguing we tax wealth assets. Bzzz,, WRONG BUBS!

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

BOSS THE DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

LOL

You can keep on spamming the board with this... do we need to contact a mod?

I've already addressed your error several times. We're not talking about income when we're talking about my wealth asset. It's not income. It won't ever be income unless I withdraw it and claim it as income. IF I DO THAT... THEN all this stuff you are posting applies. UNTIL I DO THAT, it's NOT INCOME! CAN'T BE INCOME! WON'T BE TURNED MAGICALLY INTO INCOME BECAUSE YOU WANT IT TO BE!

NOW FUCK THE HELL OFF! MORON!

Sure Bubs, sure:

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

THAT "WEALTH" YOU TALKING ABOUT LIAR? lol

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

BUT IF YOU MAKE $10,000,000 IN GERMANY, AND PAY THEIR TAX RATES, YOUR US BURDEN WOULD BE ZERO, BECAUSE THEY HAVE A HIGHER TAX BURDEN, YOU CAN BRING THE MONEY HOME ANYTIME, WITHOUT DOUBLE TAXATION!!!!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

Dumbass says:

"I made $5 million IN Germany... got it? I paid income taxes on it, TO Germany? Following me? The money is still IN Germany, in a German bank, collecting German interest. Each year, I have to pay Germany tax on the interest dividends."

COOL. AND YOU ARE REQUIRED TO REPORT THAT TO US TAX AUTHORITY

"It is NOT US INCOME! It doesn't ever BECOME US income unless I bring it to the US and claim it as income. If I do that, I will be taxed AGAIN."

BZZ WRONG, AGAIN, ALL INCOME FROM ANY SOURCE WHETHER YOU ARE ON US SOIL OR TEA-BAGGERSTAN OR GERMANY, IS REQUIRED TO BE REPORTED TO US TAX AUTHORITY, BUT SINCE (AGAIN) GERMANY HAS A HIGHER TAX BURDEN, THERE WOULD PROB BE NO NEW US TAX BURDEN IF YOU BRING THE MONEY TO THE US!

"My plan is to eliminate double taxation. Repatriate that wealth and create new jobs with it."

YOUR "PLAN" DO SOMETHING ABOUT SOMETHING THAT'S NOT BEING DONE??? LOL

Lot's of fun showing that YOU are not only a stupid MF but a liar too Bubs

Again... Proving that you are arguing we tax wealth assets. Bzzz,, WRONG BUBS!

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

BOSS THE DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

LOL

You can keep on spamming the board with this... do we need to contact a mod?

I've already addressed your error several times. We're not talking about income when we're talking about my wealth asset. It's not income. It won't ever be income unless I withdraw it and claim it as income. IF I DO THAT... THEN all this stuff you are posting applies. UNTIL I DO THAT, it's NOT INCOME! CAN'T BE INCOME! WON'T BE TURNED MAGICALLY INTO INCOME BECAUSE YOU WANT IT TO BE!

NOW FUCK THE HELL OFF! MORON!

Sure Bubs, sure:

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

THAT "WEALTH" YOU TALKING ABOUT LIAR? lol

Again... You can keep posting this spam as much as you like, it's in error because you keep talking about "income" and I don't have foreign income. I keep saying I don't have income and you keep saying "all income is taxed" and we're not making contact with your brain, apparently.

When I earned the income back in 1988, I paid Germany income taxes. I did not owe US taxes on the income. That income went into a securities investment which is now a wealth asset. It gains value each year and it rolls over into the investment, it is not claimed as income. If I ever take it out of the securities investment and bring it to the US, it counts as income... even though I already paid income tax on it in 1988. Some of it would only be subject to capital gains tax rates... but none of it is taxable in the US unless it is claimed as income. We do not tax wealth assets in America.

Look... This is the same thing as equity growth in your home. You own a home worth $200k in 2015... you do not owe income tax on your $200k home... it is an asset, not income. In 2016, the value of your home increased to $250k... you do not owe taxes on the $50k value your home gained any more than you owe tax on the home itself. We don't tax assets, we tax income. Because the value of your asset increased, doesn't make you liable for tax on the increase in value. Now... IF I SELL MY HOME... different deal! THEN the money becomes earned income from the sale of property. It's a completely different ballgame.

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

BUT IF YOU MAKE $10,000,000 IN GERMANY, AND PAY THEIR TAX RATES, YOUR US BURDEN WOULD BE ZERO, BECAUSE THEY HAVE A HIGHER TAX BURDEN, YOU CAN BRING THE MONEY HOME ANYTIME, WITHOUT DOUBLE TAXATION!!!!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

Dumbass says:

"I made $5 million IN Germany... got it? I paid income taxes on it, TO Germany? Following me? The money is still IN Germany, in a German bank, collecting German interest. Each year, I have to pay Germany tax on the interest dividends."

COOL. AND YOU ARE REQUIRED TO REPORT THAT TO US TAX AUTHORITY

"It is NOT US INCOME! It doesn't ever BECOME US income unless I bring it to the US and claim it as income. If I do that, I will be taxed AGAIN."

BZZ WRONG, AGAIN, ALL INCOME FROM ANY SOURCE WHETHER YOU ARE ON US SOIL OR TEA-BAGGERSTAN OR GERMANY, IS REQUIRED TO BE REPORTED TO US TAX AUTHORITY, BUT SINCE (AGAIN) GERMANY HAS A HIGHER TAX BURDEN, THERE WOULD PROB BE NO NEW US TAX BURDEN IF YOU BRING THE MONEY TO THE US!

"My plan is to eliminate double taxation. Repatriate that wealth and create new jobs with it."

YOUR "PLAN" DO SOMETHING ABOUT SOMETHING THAT'S NOT BEING DONE??? LOL

Lot's of fun showing that YOU are not only a stupid MF but a liar too Bubs

Again... Proving that you are arguing we tax wealth assets. Bzzz,, WRONG BUBS!

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

BOSS THE DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

LOL

You can keep on spamming the board with this... do we need to contact a mod?

I've already addressed your error several times. We're not talking about income when we're talking about my wealth asset. It's not income. It won't ever be income unless I withdraw it and claim it as income. IF I DO THAT... THEN all this stuff you are posting applies. UNTIL I DO THAT, it's NOT INCOME! CAN'T BE INCOME! WON'T BE TURNED MAGICALLY INTO INCOME BECAUSE YOU WANT IT TO BE!

NOW FUCK THE HELL OFF! MORON!

Sure Bubs, sure:

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

THAT "WEALTH" YOU TALKING ABOUT LIAR? lol

Again... You can keep posting this spam as much as you like, it's in error because you keep talking about "income" and I don't have foreign income. I keep saying I don't have income and you keep saying "all income is taxed" and we're not making contact with your brain, apparently.

When I earned the income back in 1988, I paid Germany income taxes. I did not owe US taxes on the income. That income went into a securities investment which is now a wealth asset. It gains value each year and it rolls over into the investment, it is not claimed as income. If I ever take it out of the securities investment and bring it to the US, it counts as income... even though I already paid income tax on it in 1988. Some of it would only be subject to capital gains tax rates... but none of it is taxable in the US unless it is claimed as income. We do not tax wealth assets in America.

Look... This is the same thing as equity growth in your home. You own a home worth $200k in 2015... you do not owe income tax on your $200k home... it is an asset, not income. In 2016, the value of your home increased to $250k... you do not owe taxes on the $50k value your home gained any more than you owe tax on the home itself. We don't tax assets, we tax income. Because the value of your asset increased, doesn't make you liable for tax on the increase in value. Now... IF I SELL MY HOME... different deal! THEN the money becomes earned income from the sale of property. It's a completely different ballgame.

Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?That would just hide the tax that the customers end up paying anyway through higher prices.

Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Oh right, silly me, the Corps can't take less profit

Oh, now I see why you look so foolish. You're arguing about what happens when you increase taxes on corporations, which is NOT where the money comes from to pay the taxes. You see, the inane idea of replacing individual taxes with corporate taxes simply hides the tax, which the consumer pays anyway. See, I knew you couldn't be that dense.So the money corporations have extracted from them to pay the taxes come from where, again? Where is this source of money that is NOT generated by customers purchasing their goods?Who says taxes are born by customers? Hint NOT economists

Recent economic research has improved our understanding of who bears the burden of the corporate income tax.

One key finding is that a substantial share of the return to corporate capital is from “supernormal” returns, the returns to successful risk taking, inframarginal returns, and economic rents in excess of the “normal” return (the riskless return to waiting)

.

The other key result is that international capital mobility shifts some of the corporate income tax burden on the normal return from corporate capital to labor, which is relatively immobile internationally.

Based on these recent research findings, TPC has updated its

corporate income tax incidence. For standard distributional analyses

, TPC now treats 20 percent of the corporate income tax burden

as falling on labor, 20 percent on the normal return to all

capital, and 60 percent on the supernormal returns to

corporate equity (shareholders )

.

http://www.taxpolicycenter.org/uploadedpdf/412651-tax-model-corporate-tax-incidence.pdf

OVER HALF CAP GAINS/DIVIDENDS GO TO THE TOP 1/10TH OF 1% OF US!

Generated? Oh you mean the Corps MUST make a certain amount of money, and if taxes increase their costs must also? They can't take less return on investment???

Oh right, silly me, the Corps can't take less profit

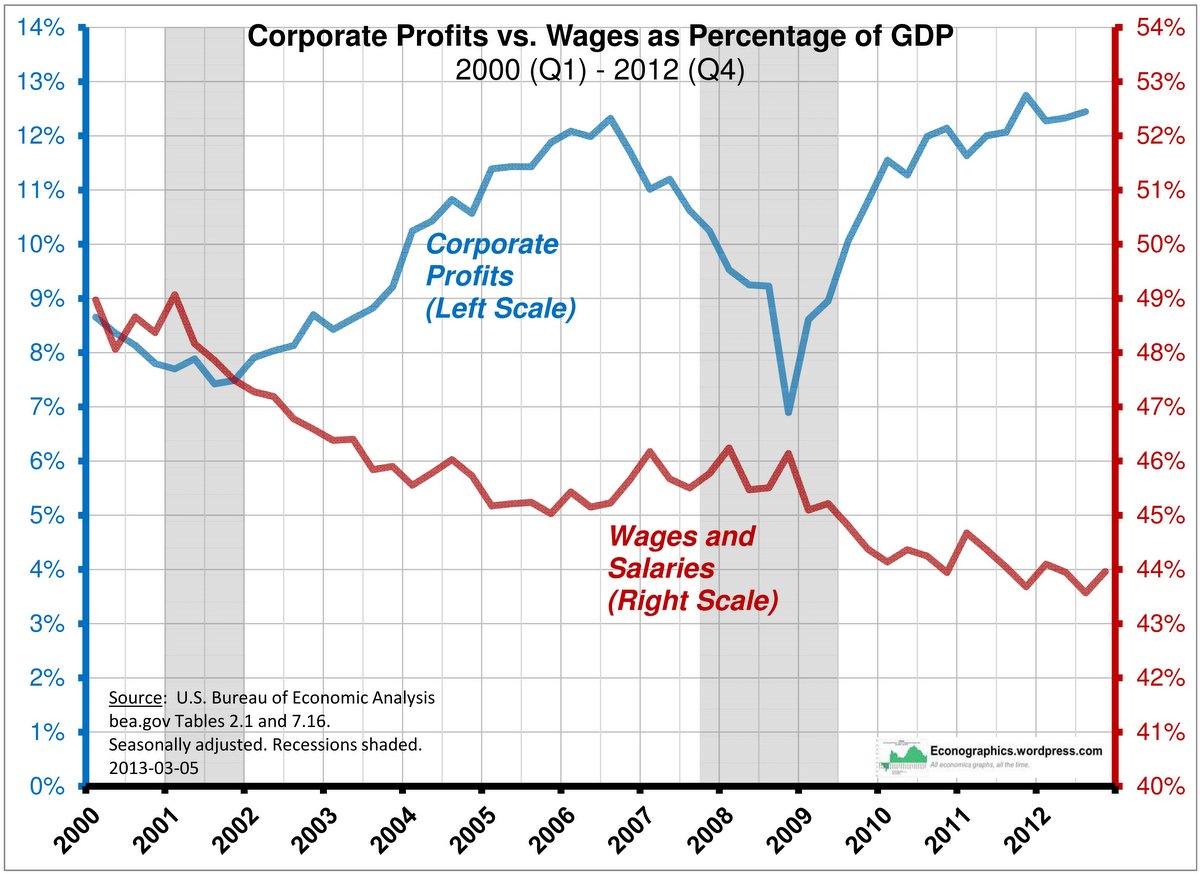

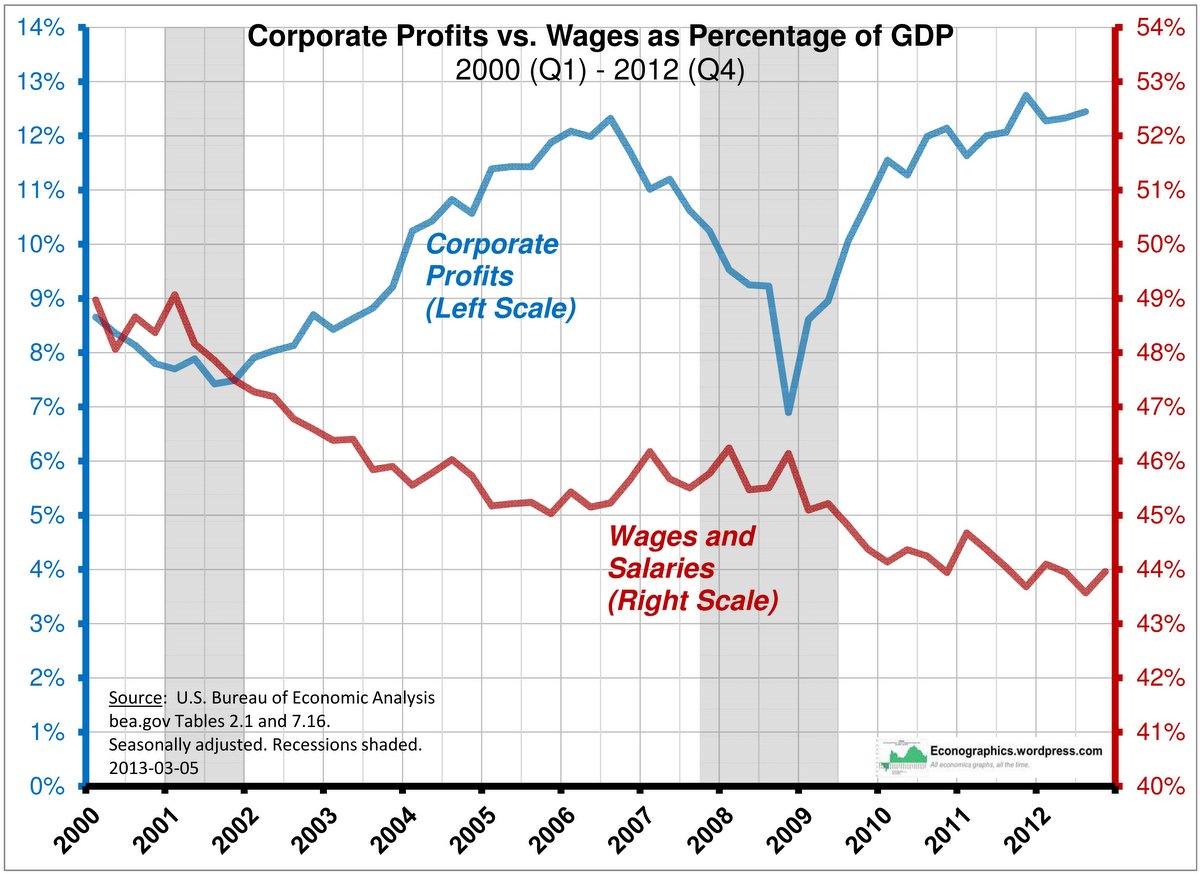

View attachment 49942

Again... Proving that you are arguing we tax wealth assets. Bzzz,, WRONG BUBS!

Sure Bubs, sure:

BOSS THE DUMBASS SAYS:

"Not true. If you reside somewhere else and earn income somewhere else, the US has no authority to tax you."

BZZ WRONG.

BOSS THE DUMBASS SAYS:

"You seem to think the US has some kind of taxing power that enables them to go all over the world taxing people in different countries because they happen to be US citizens. They don't."

BZZ WRONG. ALL US CITIZENS OWE TAXES ON ANY INCOME (OFFSET BY THOSE TAX TREATIES/TAXES PAID)

DUMBASS SAYS:

"Your taxes are paid on the income you claim in the US. If I make $10 million in Germany and claim it as income in the US, then I pay taxes on it."

BZZ WRONG. There is no double taxation, that's what the treaties do. UNLESS it's from a TAX HAVEN then YOU PROBABLY will OWE US taxes if you bring it back!

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

LOL

You can keep on spamming the board with this... do we need to contact a mod?

I've already addressed your error several times. We're not talking about income when we're talking about my wealth asset. It's not income. It won't ever be income unless I withdraw it and claim it as income. IF I DO THAT... THEN all this stuff you are posting applies. UNTIL I DO THAT, it's NOT INCOME! CAN'T BE INCOME! WON'T BE TURNED MAGICALLY INTO INCOME BECAUSE YOU WANT IT TO BE!

NOW FUCK THE HELL OFF! MORON!

Sure Bubs, sure:

DUMBASS SAYS:

"Your worldwide income (i.e.; your reported income earnings from abroad.) If you do not claim them as income they are not earnings and not taxable. "

BZZ WRONG. ALL INCOME FROM ANY SOURCE, BE IT IN THE US OR BELIZE, GERMANY OR TEA-BAGGERSTAN, ARE REQUIRED TO BE REPORTED TO US TAX AUTHORITY AND SUBJECT TO TAXATION. NOW IF YOU MADE THE INCOME IN GERMANY, PROB ZERO TAXATION ISSUE IN THE US, BUT BELIZE OR TEA-BAGGERSTAN, PROB WOULD OWE SOME FORM OF TAXES!

THAT "WEALTH" YOU TALKING ABOUT LIAR? lol

Again... You can keep posting this spam as much as you like, it's in error because you keep talking about "income" and I don't have foreign income. I keep saying I don't have income and you keep saying "all income is taxed" and we're not making contact with your brain, apparently.

When I earned the income back in 1988, I paid Germany income taxes. I did not owe US taxes on the income. That income went into a securities investment which is now a wealth asset. It gains value each year and it rolls over into the investment, it is not claimed as income. If I ever take it out of the securities investment and bring it to the US, it counts as income... even though I already paid income tax on it in 1988. Some of it would only be subject to capital gains tax rates... but none of it is taxable in the US unless it is claimed as income. We do not tax wealth assets in America.

Look... This is the same thing as equity growth in your home. You own a home worth $200k in 2015... you do not owe income tax on your $200k home... it is an asset, not income. In 2016, the value of your home increased to $250k... you do not owe taxes on the $50k value your home gained any more than you owe tax on the home itself. We don't tax assets, we tax income. Because the value of your asset increased, doesn't make you liable for tax on the increase in value. Now... IF I SELL MY HOME... different deal! THEN the money becomes earned income from the sale of property. It's a completely different ballgame.

"When I earned the income back in 1988, I paid Germany income taxes. I did not owe US taxes on the income."

Prob did not "owe" taxes BUT you were REQUIRED to report the income to the treasury, since Germany's tax rate would've been higher than the US, no taxes would've been owed in the US!

Yes GROWTH from that asset IS SUBJECT TO TAXATION FROM THE NATION EARNED WHEN CASHED OUT (or dividends are paid (which you said repeatedly happened) AND subject to US taxation IF US citizen BUT you get credit for foreign taxes paid!!).

Weird how YOU don't understand how double taxation YOU argued against earlier, doesn't really happen in the US on individuals income!

That would just hide the tax that the customers end up paying anyway through higher prices.If you simplified the tax system then there would be less IRS agents needed, less Tax Accountants, and more people on unemployment. One reason why the left doesn't want Tax simplification, is then they don't have a Lois Lerner, going after conservative pac, or other ways to stifle opposition voices. So we will continue to see an unjust tax system that punishes those that have worked hard, and reward those that sit back, in their parents basement, typing on plastic made from OIL, and bitching about the country, that they wish wasn't here.

we could really simplify the tax code for most people by eliminating the personal income tax altogether. Just tax corporations and businesses. Have a standard deduction for any full time employee.