Redfish

Diamond Member

- Jan 29, 2013

- 48,411

- 10,816

"Contrary to what Republicans would have you believe, super-high tax rates on rich people do not appear to hurt the economy or make people lazy: During the 1950s and early 1960s, the top bracket income tax rate was over 90%--and the economy, middle-class, and stock market boom."

THE TRUTH ABOUT TAXES: High Rates On Rich People Do Not Hurt The Economy - Business Insider

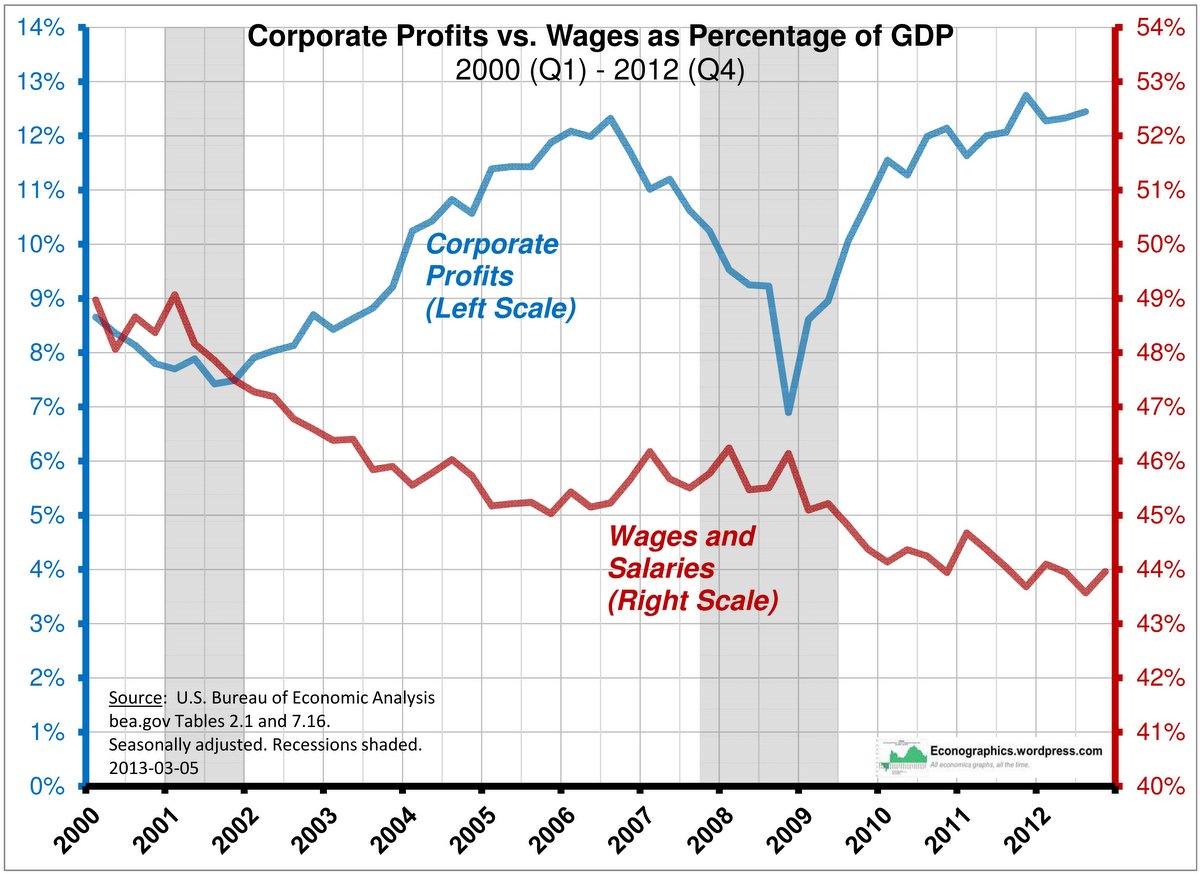

The true driving force of the economy is the middle class - not the wealthy. This economy depends on consumer spending. That is why you all should care about income inequality. Despite productivity skyrocketing over the previous decades, wages have remained mostly flat in the lower class and most of the income gains have gone to the top 1%.. The middle class is shrinking and the U.S. has the worst child poverty rate in the developed world.

Wealth And Inequality In America - Business Insider

That statistic has been debunked many times over. I'm late to this thread and I'll bet someone has already pointed it out to you.

The thing that probably no one has noted us that you could take every penny from everyone who makes $500K or more per year and you would only be able to fund the government for 6 months. And of course it would hurt the economy, it's stupid to believe otherwise.

Every penny from those making $500,000 or more only 6 months? Oh you mean WITHOUT keeping existing tax revenues TOO?

Since taxing ONLY the top 1% at DOUBLE today's EFFECTIVE rate (23%) would wipe out the current deficit?

Yep, ONLY a 46% EFFECTIVE tax rate for the top 1% and we go back to a surplus like Clinton had US at!

bullshit. you could take 100% of the income of the top 1% and it would run the govt for 6 months.

I get it Bubba, CONservatives HATE math. AGAIN, are you talking ONLY the top 1% OR the entire existing tax revenues AND the top 1%?

TOP 1% "MADE" NEARLY $2 TRILLION BUBS, PAID $451 BILLION TAXES, LEAVES $1.5 TRILLION TO WIPE OUT THE $450 BILLION DEFICIT THIS YEAR??

Summary of Latest Federal Income Tax Data

IT'S A REAL MATH THING BUBS, NOT RIGHT WING THING!

So, based on your data the evil rich paid around 25% after all the evil exemptions and deductions that the evil rich are given by the evil dems who have controlled congress for most of the last 75 years. right?

Should it be 50%? 75%? how much of a successful person's income should the govenment confiscate fromt them? Have you talked to Oprah and Beyonce about paying more?