2aguy

Diamond Member

- Jul 19, 2014

- 112,236

- 52,459

- 2,290

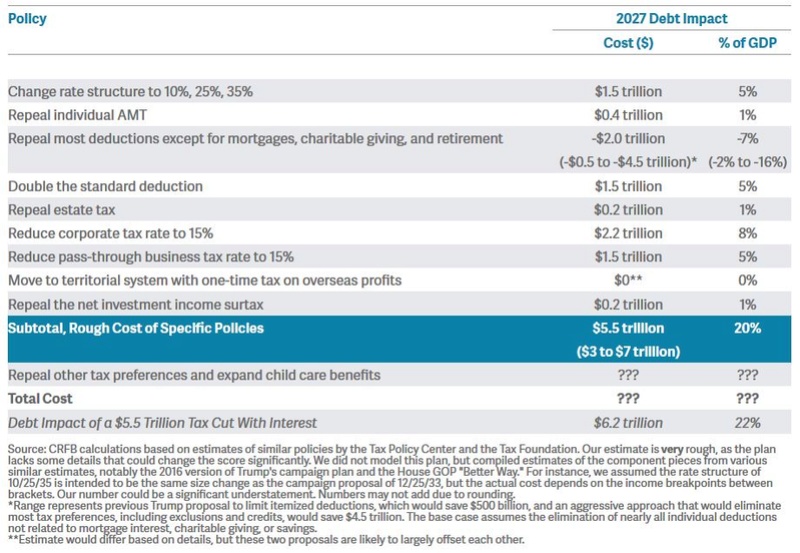

I don't know, big tax cuts at a time we're $20 Trillion in Debt and about to spend a $Trillion on 'Infrastructure.' I would think the Government needs more revenue, not less.

Tax cuts make more revenue....tax increases lower tax revenue.....Kennedy and Reagan both knew this....