AntonToo

Diamond Member

- Jun 13, 2016

- 31,603

- 9,260

I think the question is what percentage does T represent? And how is that translated into a progressive taxation system?Uh, dumbass, every move to the left of the T* (aka tax cuts) results in lower revenues.

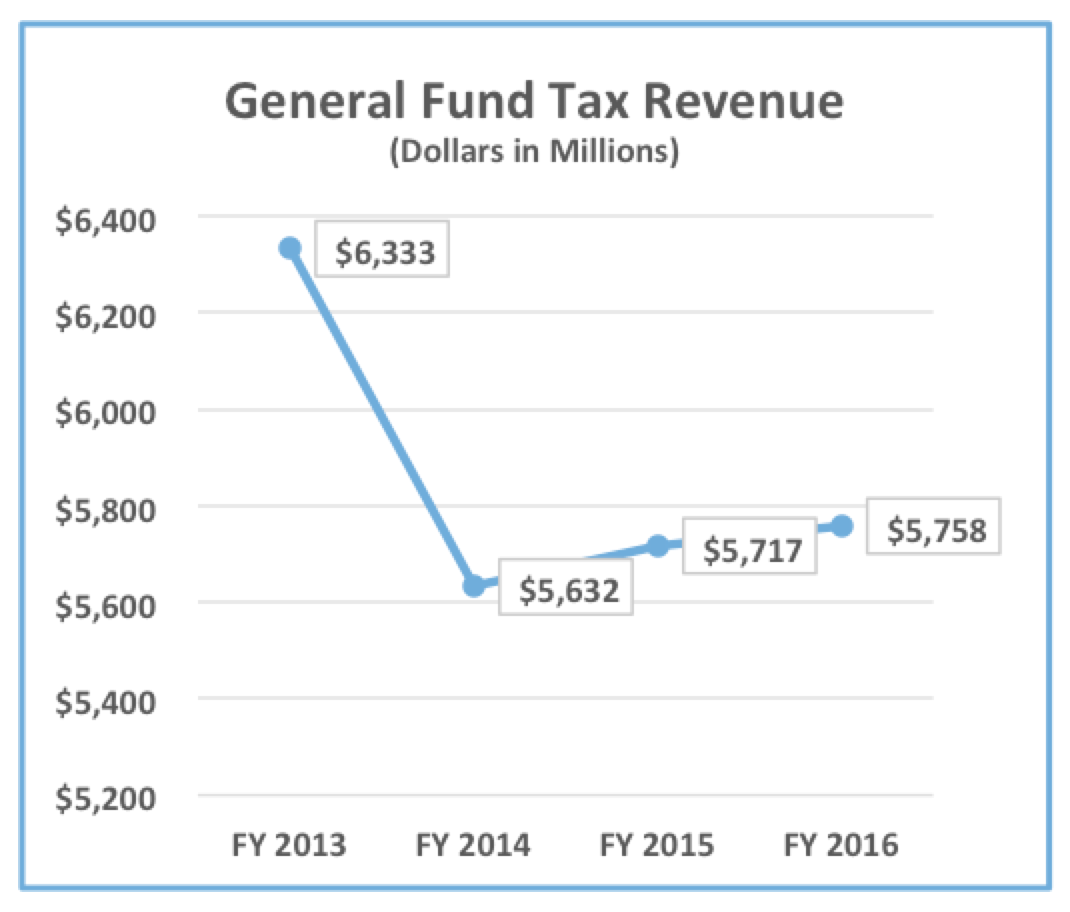

In 2014 taxes were raised when the top rate cut in the Bush tax cuts expired. Since then we've had increased revenues and lower deficits.

Without claiming as fact cause and effect, if that tax increase did in fact impact revenues, by increasing them,

that would imply that we are currently on the left side of the Laffer curve (assuming here the Laffer curve theory is legitimate in the first place).

I think T is closer to 25% for the top income rates and closer to 10% for the middle class, as the higher rates can more easily afford to pay and so T would be much higher than for people living paycheck to paycheck.

You think based on what?