iamwhatiseem

Diamond Member

- Aug 19, 2010

- 42,630

- 27,178

Why do you reply in these threads - you know nothing. And it is super obvious.You missed the point entirely, as usual.The most corrupt politician in history is President and he has appointed the most corrupt cabinet, etc., hiring crooks who should be in prison. Hedge funds, the most corrupt market manipulators in history get pwnd by a website of some folks working as a free market hedge fund and the "democrat" hedge funds get fucked as they should. In response certain trading platforms stop trading to protect the corrupt hedge funds.

Okay, let's get real here. Gamestop is a dying company. Nobody goes to the game store anymore when they can play games on line. So a few amateurs playing games with their stock wasn't going to end well, but leave it to stupid people to do stupid, like they are "sticking it to the man" by artificially propping up their stock.

And then what? Yeah, all these day traders buy Gamestop and they have stock in a company that is still dying.

1. Some investors believe that gamestop (GME) is a viable "brick and mortar" store that owns property and hires real people to work in the store. They bought the stock as an investment.

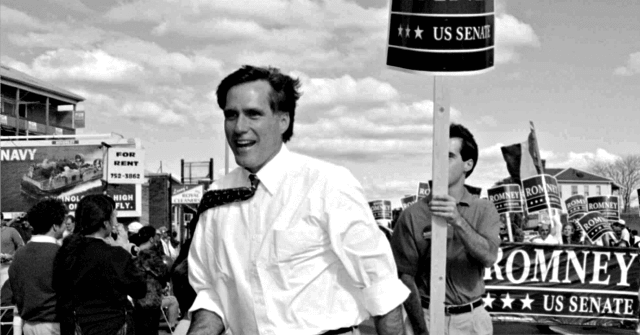

2. Some hedge funds believe, like you, that GME is a dying company and want to help it die by selling their stock short, without actually owning the stock, making lots of money by killing GME, kinda like Mitt Romney and Bane Capital did.

3. A small band of RobinHood investors linked up on Reddit to buy GME to drive the stock up to fuck the hedge funds. Surprise, it worked. The hedge funds had to buy GME at any price to close their shorts. FANTASTIC!!

Romney's Bain Capital Profited Billions by Bankrupting American Workers

Mitt Romney's investment firm Bain Capital profited billions between 1992 and 1997 that resulted in layoffs for thousands of American workers.www.breitbart.com

4. The small investors may not all get their money out, but they don't care. They beat the hedge funds! David beat Goliath and their bought and paid for crooked politicans.

5. When Ted Cruz and AOC both support the Reddit Raiders, this could be good! But you are clueless and on the wrong side as usual.

And you're dangerously uninformed. Gamestock is NOT a viable bricks and mortar store. People download games now, just like they download music, movies. My grandkids haven't been to the game store in years. No waiting for Mom and Dad to drive them, just use those gift cards Gramma and Grandpa give them to purchase at the Microsoft Store, or the Apple Store. X-Boxes now come with built in WIFI capability. My SIL complained that his 3 year old spent $120 at the Microsoft Store while playing video games.

Digital media companies are making it ever easier to part us from our money without every leaving the house. ALL bricks and mortor stores are suffering. Vacancies in shopping malls

Robinhood executives should be arrested immediately.

Robinhood executive have done nothing wrong. It was the Reddit Chat Room that hatched the scheme. Robinhood, and other small investor platforms were simply the vehicles the investors used.

When a stock become this volatile, halts in trading are frequent so brokerage houses can "settle their positions". Trading on GameStock was halted to "settle the trades" because there were buy orders for more stocks in this company, than there were stocks available for sale. Everybody had to settle up so they could know where they're at.

Robinhood is now in grave danger of having a LOT of getting destroyed when the bubble bursts.

Your "response", such that it is, has nothing to do with my post on the viability of the stores, or settling the trade. Why do YOU think they halted trading?

Obvious. You don't even need to ask. The result of the move is like a shining beacon.

One of the hedge funds that was losing BIG - OWNS Robin Hood. Did you know that?

Robin Hood did not halt trading, they halted buying only. They still allowed selling.... now gee...why do you think that is?

Thye halted buying only, which gave the Hedge funds the opportunity to bid down the shares while there was no one buying. If people were still buying - they couldn't do that. So the result? The shares fell I believe it ended up being 34%. GREAT for the funds.

Robin Hoods move saved the hedge funds... one of which owns them.

There is literally not one single market player that agrees with you. Not one. No one is falling for Robin Hood's ridiculous excuse of following procedures. No one.

Define "no one". Do you mean "no one in the chat rooms"? "No one pushing conspiracy theories" is falling for this. "No one ginning up the outrage machine" is falling for this. Because I haven't talked to any of my Bay Street friends who agrees with you at all.

Because in the world of people who understand how the stock market works, and what WILL happen to Robinhood when GameStock crashes, are saying something entirely different.

Other than parrotting what these people are telling you, tell me about your portfolio. How long have YOU been in the market. I worked on Bay Street for more than 20 years. I worked in banking, finance and law for 40 years. Explain to me what it is that I got WRONG. Because other than your ranting about Robinhood's ownership, you haven't backed up your post at all.

No.

Traders

I have Twitter, and besides a few family and friends - all of the people I follow are traders and funds. Most are nationally recognized and celebrated - highly successful traders. A couple are $billionaires.

I pay attention to them.

You are paying attention to MSNBC, HuffPo and other corporate parrots that are trying to convince you this is a bad thing. HuffPo and CNN especially telling people this "hurts the working people"... an absolute lie.

Course - you will fall for all of it.