danielpalos

Diamond Member

- Banned

- #41

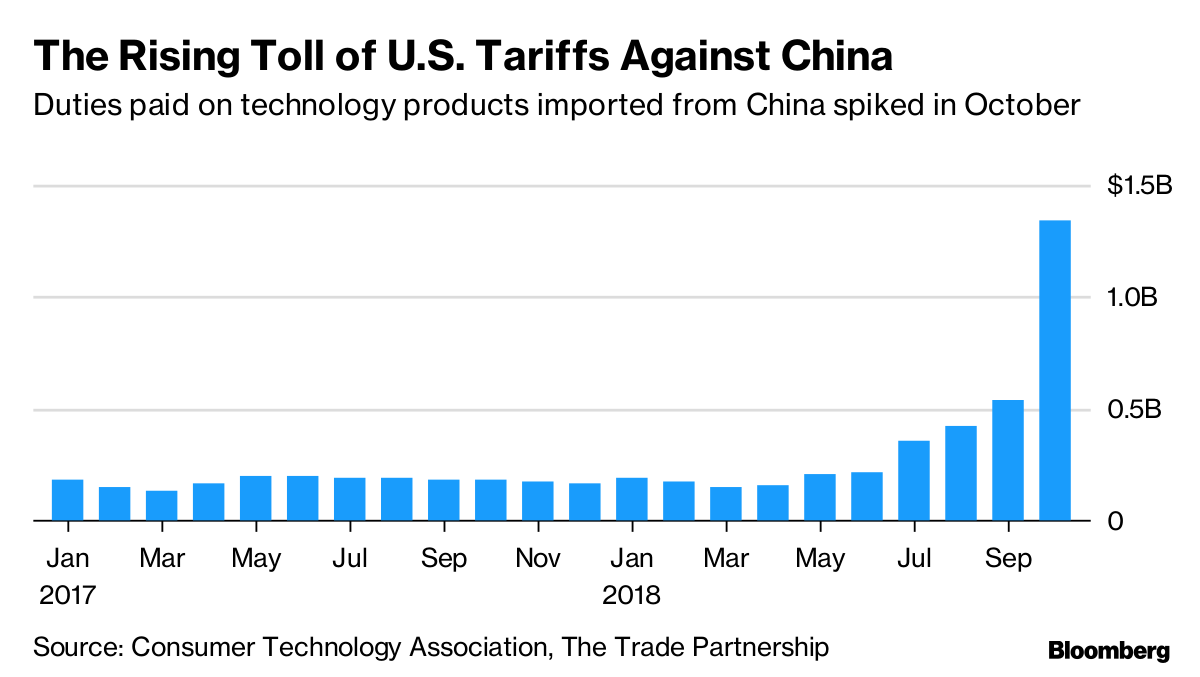

Helping them raise their Standard of Living to achieve that sort of equilibrium, should be standard, Commerce Clause practice.all i saw was the price increases.Trump's failure to reduce the US trade deficit has actually produced an increase of 7.9% over the previous year at the same time his tax giveaway to his 1% base has increased the budget deficit.

How could tariffs partially solve that problem, and who would pay?

Trump's New Tariffs on China Help Pay for his Corporate Tax Cut

"And that is that the American budget, government budget is running up deeper and deeper debt as a result of Trump’s tax giveaway to the 1%.

"And so he says, how am I going to shrink the budget deficit?

"He says, I know I’ll make my constituency pay.

"That is, the people that voted for me.

"I’ll make labor pay.

"If I can raise taxes on 300 billion of Chinese imports by another 10%, that’ll be all together I think a 20%.

"That’ll yield $60 billion to help us solve the budget deficit that I might give away to Wall Street and the wealthy corporations he’s created.

"So it’s all a diversion so that people won’t look at what’s really happening."

What's really happening is that Trump is isolating the US by driving China, Russia, Europe, and Iran into trade pacts that might well end the dollar's role as a global reserve currency.

Are you tired of winning yet?Hopefully, your job hasn't been exported to China.all i saw was the price increases.

/u-s-china-trade-deficit-causes-effects-and-solutions-3306277-v4-HL-c7c2d2f39bc748c29acdaed43bfb52df.png)

"Causes

"China can produce many consumer goods at lower costs than other countries can. Americans, of course, want these goods for the lowest prices. How does China keep prices so low? Most economists agree that China's competitive pricing is a result of two factors:

- A lower standard of living, which allows companies in China to pay lower wages to workers.

- An exchange rate that is partially fixed to the dollar.

"If the United States implemented trade protectionism, U.S. consumers would have to pay high prices for their 'Made in America' goods.

"It’s unlikely that the trade deficit will change. Most people would rather pay as little as possible for computers, electronics, and clothing, even if it means other Americans lose their jobs."

The Real Reason American Jobs Are Going to China