All men are created equal doesn't mean equal outcome. There are so many factors that are being played in a market economy that focusing on what some don't have vs what a few do have is not a good gauge.explain this>>>

That said, tax laws and structures are meant to limit/restrict participation by all but a few. It seems that when one becomes wealthy, by whatever means, one automatically becomes despised/envied and used as tool by politicians (law/tax structure writers) to pit the less fortunate against the more fortunate- so, are we to blame those who took advantage of the imperialist/elites in DC's fucking ignorance or try to beat them at their own game, which is what the super rich do-

Yes, I call DC law/tax structure writers fucking ignorant- citizens as well. ALL rules/laws are made to be broken. Some people are paid to do just that by finding what the rule/law doesn't say and doing it- they're called accountants and lawyers. Some people come by it naturally, they're called innovative (and enemies), and some emulate the former, they are called learners and doers.

Politicians (law/tax structure writers) are sociopathic fucking idiots that are easily bought and the super wealthy recognize that flaw in their character and take advantage of it. Let's not pretend any here who envy their status (and wealth) wouldn't do the same damn thing.

NO form of gov't or economy will prevent weak immoral sociopaths from seeking to *better* their plight in life- however, capitalism "provides" an opportunity- it is up to the Individual to find it and use it to their benefit. Not everyone is cut out to be at the top, and if everyone was at the top, well, inverted triangles can't remain standing-

Want to "blame" something/somebody for all the Billionaires? Try this on for size.

The Federal Reserve is responsible for the growth of gov't, the loss of liberty, the rise in inequality, and the boom and bust cycles. All those who support peace and prosperity should join the effort to *audit and end the fed*- Ron Paul

Now, there wouldn't be Billionaires or even many millionaires if the *money* wasn't there. But, then there's be 100aries and 1000aires- but, without the money to be taxed there would be a lot less tax and a lot less graft and corruption.

Taking from one to give to another is a Robin Hood fantasy played out by sociopaths- still, taking what isn't earned is theft.

I'll agree w/ a few points that parrot your own here Gdjjr.

It isn't how rich some are here, it's that they've rigged the system to be so

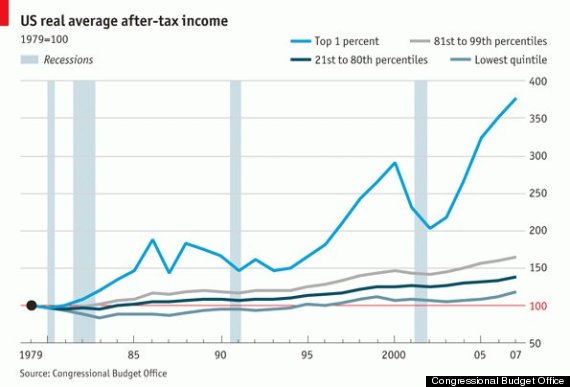

This is WHY wealth inequity exists , and has been an exponential pandemic raft with it's concentration among the very very few, w/out noteable quintile mobility

How bad is it? Well, if the rich can buy elections, by proxy they,ve bought Congress as well as our fiscal, foreign,domestic,trade, climate, policies

Ron Paul was spot on, right on back to the Jekyll island crews debute.....

It has nothing to do with envy or socialism

It has everything to do with a level playing field

~S~

There is a whole lot more at stake here than JUST a level playing field.

The live birth rate in the USA has been declining for generations, and that decline is accelerating. The live birth rate is well below the replacement rate for the US population. The right likes to blame abortion, but abortion rates are at their lowest rates since such stats were being kept. Women simply are not getting pregnant, and the reasons are strictly economic.

WORKING CLASS WOMEN CANNOT AFFORD TO GET PREGNANT. They have no medical insurance unless they work, and if they get pregnant, they can be fired and lose their insurance. They cannot afford to pay for the medical costs of a pregnancy and live birth without that insurance.

Even if their employer is enlightened and gives them time off to have a baby and keeps their job open, the costs of good childcare can run to $250 per week, per child. She might be able to afford child care for one child, but she's losing money by going out to work if she has a second child.

This is the law of unintended consequences. Low wages and lack of quality, affordable child care, which employers are consistently telling the American public they cannot afford to provide, are forcing women to choose not to have children, or to have fewer children.

https://www.cdc.gov/nchs/data/vsrr/vsrr-007-508.pdf

America’s declining birth rate is a warning sign for millions of people’s finances

Simply stated, the US government has been taken over by corporatists, who have rigged the system to keep workers needy and dependent, and stratified the classes by race and gender. These corporatists constantly decry the working poor as the source of America's problems, to distract them from the role that corporate executives are writing all of the laws, and policies of the federal government to the detriment of the general population.

You have an opiod crisis, and a declining birth rate, and declining general health for your population because of your "for profit" medical system, which has legally profitted mightily by addicting millions of people to opiods, and legally profitting again by "curing" these addicitions, and all manner of ways of keeping poor people from getting anything more than subsistence medical care, in the richest country in the world.

The USA is the only first world country whose life expectancy is declining.

So there are lots and lots of social and economic consequences for these low wage rates. Replacement rate for the population is 2.1 live births per woman. The US live birth rate is 1.73 children per woman and going down.

This is not government "of the people, by the people, and for the people", this is government of the people, by corporate interests, for the benefit of the shareholder class. 40% of Americans are not benefitting from the Trump economy. That's a lot of families for whom life is not getting any better.

WORKING CLASS WOMEN CANNOT AFFORD TO GET PREGNANT. They have no medical insurance unless they work, and if they get pregnant, they can be fired and lose their insurance. They cannot afford to pay for the medical costs of a pregnancy and live birth without that insurance.

Even if their employer is enlightened and gives them time off to have a baby and keeps their job open, the costs of good childcare can run to $250 per week, per child. She might be able to afford child care for one child, but she's losing money by going out to work if she has a second child.

This is due to the government taxing people into two job families....cut the taxes on all Americans, reduce regulations on businesses and then you can get back to a time when one parent worked, one parent stayed home to raise the children......but until you get the government to back off, and stop extracting money for every act of life, you will have this situation...

Well, you've missed the target completely, but you did hit the tree. Taxes ARE the problem but not in the way you think.

Here's the problem: Corporatists aren't giving working people tax breaks. They're off-loading the social costs of low wages workers onto the middle class. The costs of Medicaid, Food Stamps, and earned income credits are being paid by the working and middle class and not by the corporations who benefit financially from their work.

In 2014, it was being said that government benefits paid to Walmart employees cost every American taxpayer $2,000, even if you never set foot in Walmart, or bought anything in one of their stores. 2014 was the year Walmart recorded the 2nd highest profit in America. Even if Walmart had paid the $6 billion their workers received in government benefits, directly to its workers in the form of wages, Walmart's would still have paid record dividends to their shareholders.

This is just corporate greed and theft of the work of its employees.[/QUOTE]

Add to that the WOL (war on labor) that's been raging since Reagan's stint with the unions.

One might even venture as far as the WOI (war on intellect) , being a reality here as well

Bottom line?

America has created an underclass

less upward mobility, lesser lifestyles, and a whole lot of misdirected anger and angst

~S~