Dad2three

Gold Member

Democrat's should be required to pay higher taxes since they feel we're not taxed enough....

They want higher taxes....Then they should cut a check to the IRS when they file their tax returns...

Yeah, because that's how Gov't is funded, by voluntary contributions *shaking head*

GOP Prez policy since 1981 HAS created about 90% of current US debt but CONservatives/GOP think they shouldn't have to pay iy back!

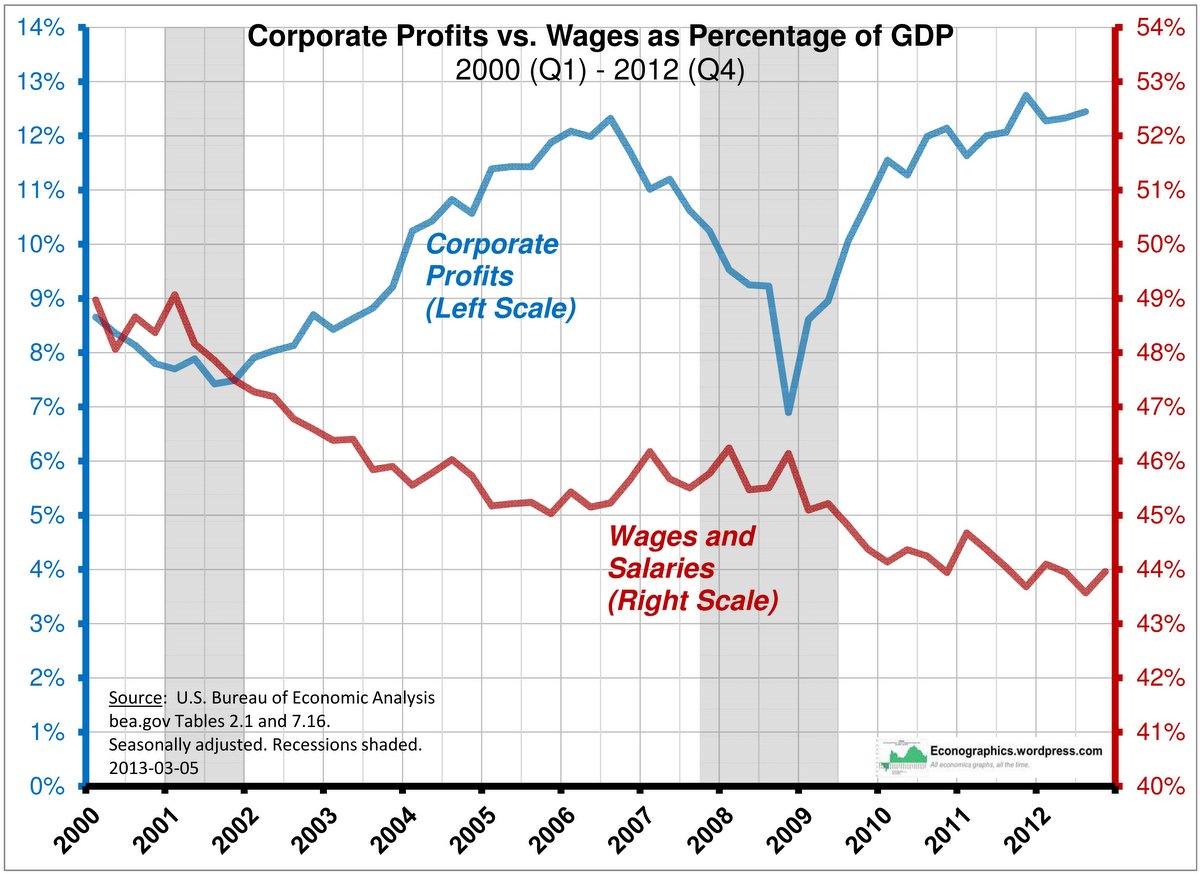

For 34 years, CONservatives "supply side" BS has not only GUTTED revenues, rewarded the top 1/10th of 1% by HUGE increases in the piece of the pie they held 1945-1980 (while the tax "burden" on that piece of the pie has shrunk by 40%!!!), but they ALSO gutted infrastructure spending, safety nets and continue their war on the poor/middle class

Congrats you right wing loons, the US will look like a 3rd world nation your Klown policies create!